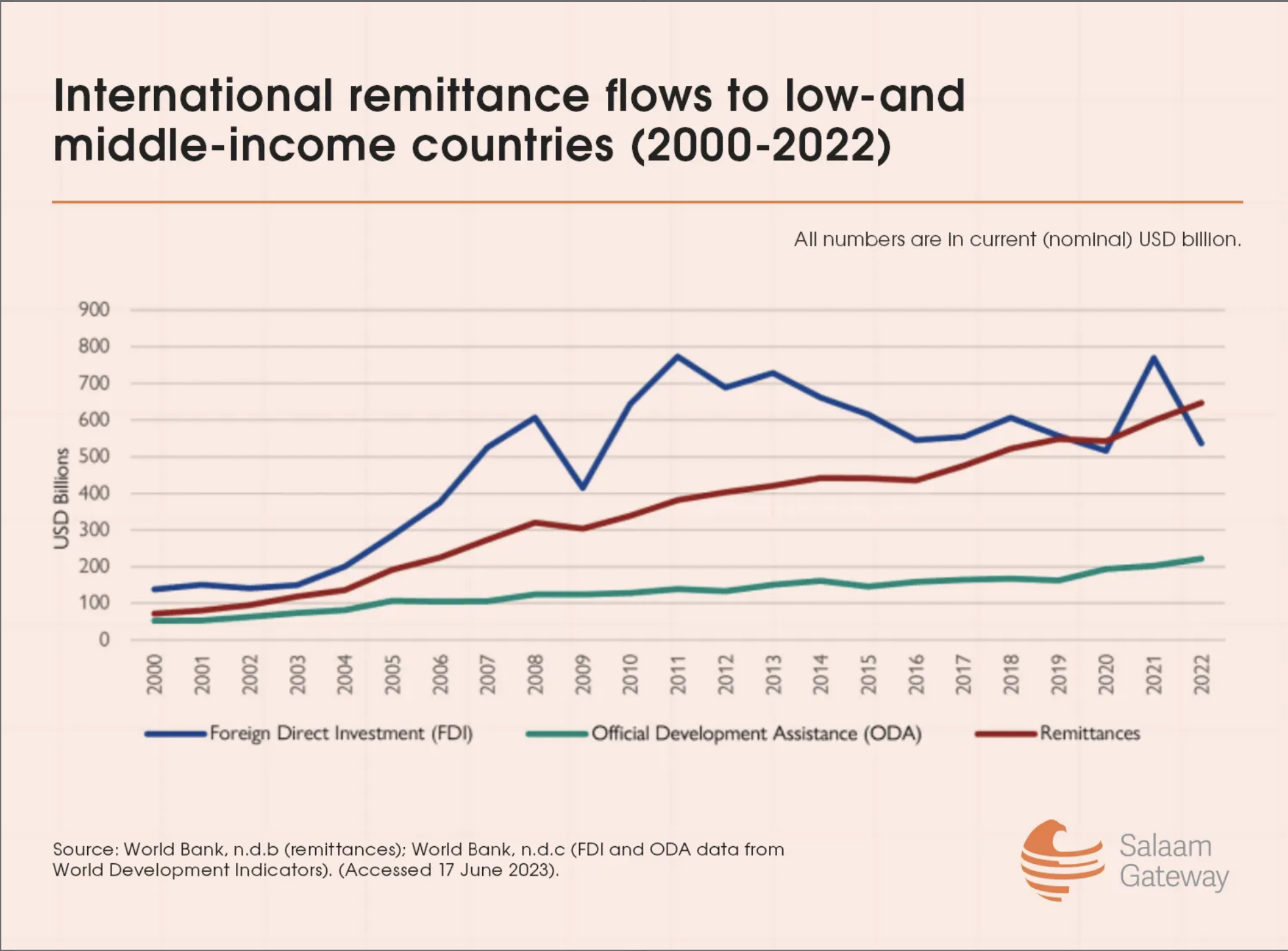

Remittances are among the most important financial lifelines for developing economies. Not only are they vital for household incomes, but also for macro-economic stability, serving as a major source of foreign exchange and often outweighing foreign direct investment or development aid. According to the World Bank’s Migration & Development Brief (June 2024), remittance flows to low- and middle-income countries reached $647 billion in 2023 and as per the most recent estimates, increased to $685 billion in 2024.

The difficulty of measuring remittances

Measuring remittances remains a major challenge because much of the money moves through informal or hard-to-track channels. Official data typically record only a fraction of total transfers, as reliable and timely reporting systems are still limited. In most countries, the responsibility for collecting and publishing official remittance data is defined by national law and typically lies with the central bank. These figures are compiled as part of the Balance of Payments (BoP), with the central bank’s statistics division setting reporting rules for individuals, businesses, and financial institutions. To ensure accuracy and consistency, central banks collaborate closely with other government bodies involved in economic data, including national statistics offices, ministries of finance, and other relevant agencies and stakeholders.

However, central banks struggle to keep pace with rapid changes in financial markets — from new money transfer operators to digital platforms like mobile wallets, which complicate the process of updating reporting frameworks and harmonizing them with anti–money laundering and transaction reporting rules.

Adding to this complexity is the diversity of transfer methods: funds can move through formal systems, such as banks and licensed money transfer operators, or informal networks, including hawala, personal cash deliveries, and in-kind exchanges. This patchwork makes it difficult to accurately capture the true scale of remittance flows, especially in the least developed countries, where limited resources hinder the development of advanced monitoring systems.

Methodology behind using 2023 data

In compiling the list, we kept our ranking firmly anchored in the 2023 calendar-year figures for a few important reasons. First, the World Bank provides a consistent and comparable dataset for that year, allowing apples-to-apples comparison across OIC nations. Second, while many countries now publish year-to-date or fiscal-year-to-date data for 2024, full-year 2024 figures are still being finalised, meaning there is potential for revision or inconsistency. Third, in some regions—such as the Middle East and North Africa—the World Bank itself has flagged that 2023 flows were under-recorded due to parallel foreign exchange markets and informal channels, meaning 2023 remains the latest robust benchmark.

When presenting the ranking, keep in mind that the figures provided are estimates and represent a trend. According to the World Bank brief, remittances to South Asia are expected to grow by 11.8% in 2024, driven by countries such as Pakistan and Bangladesh.

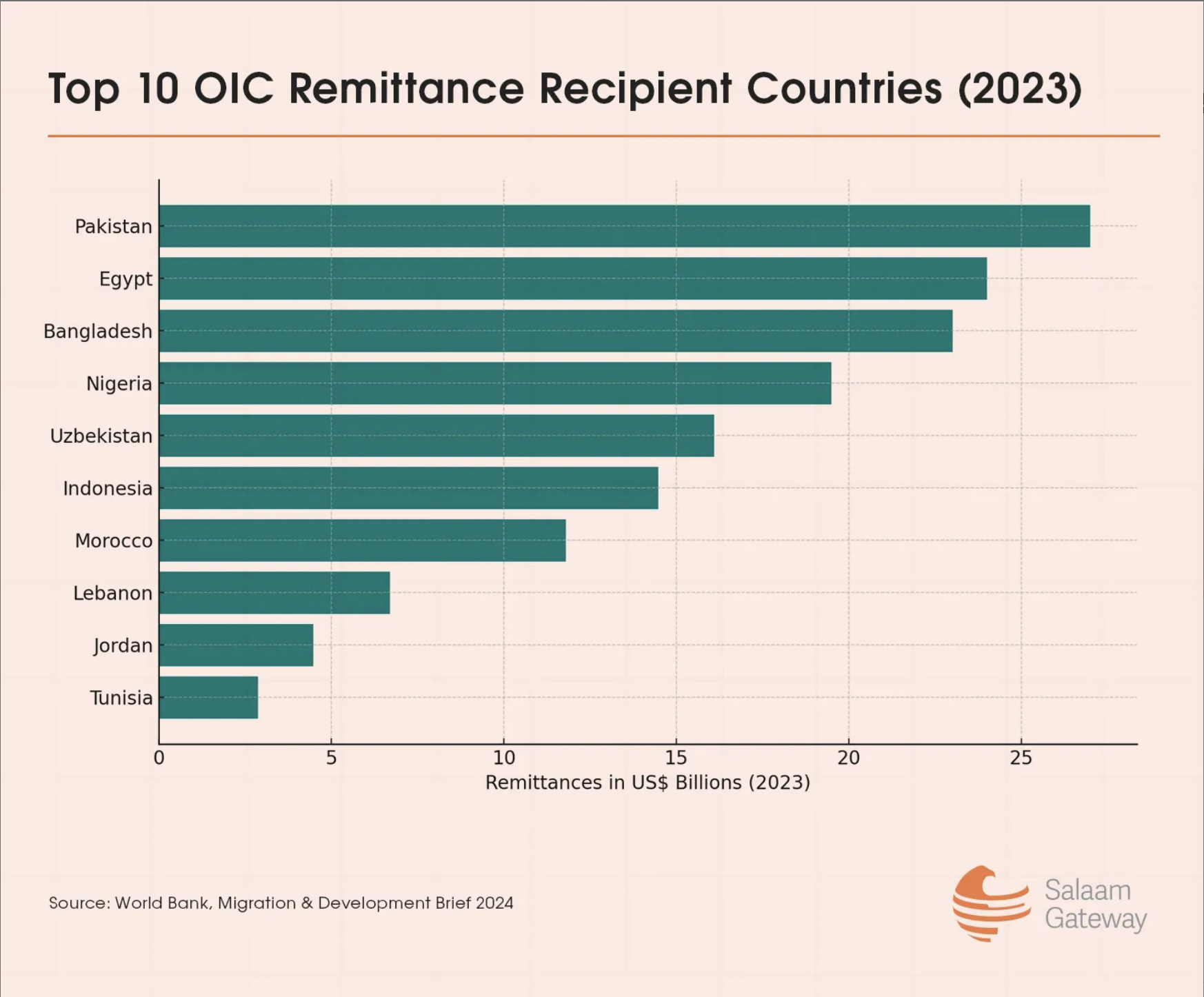

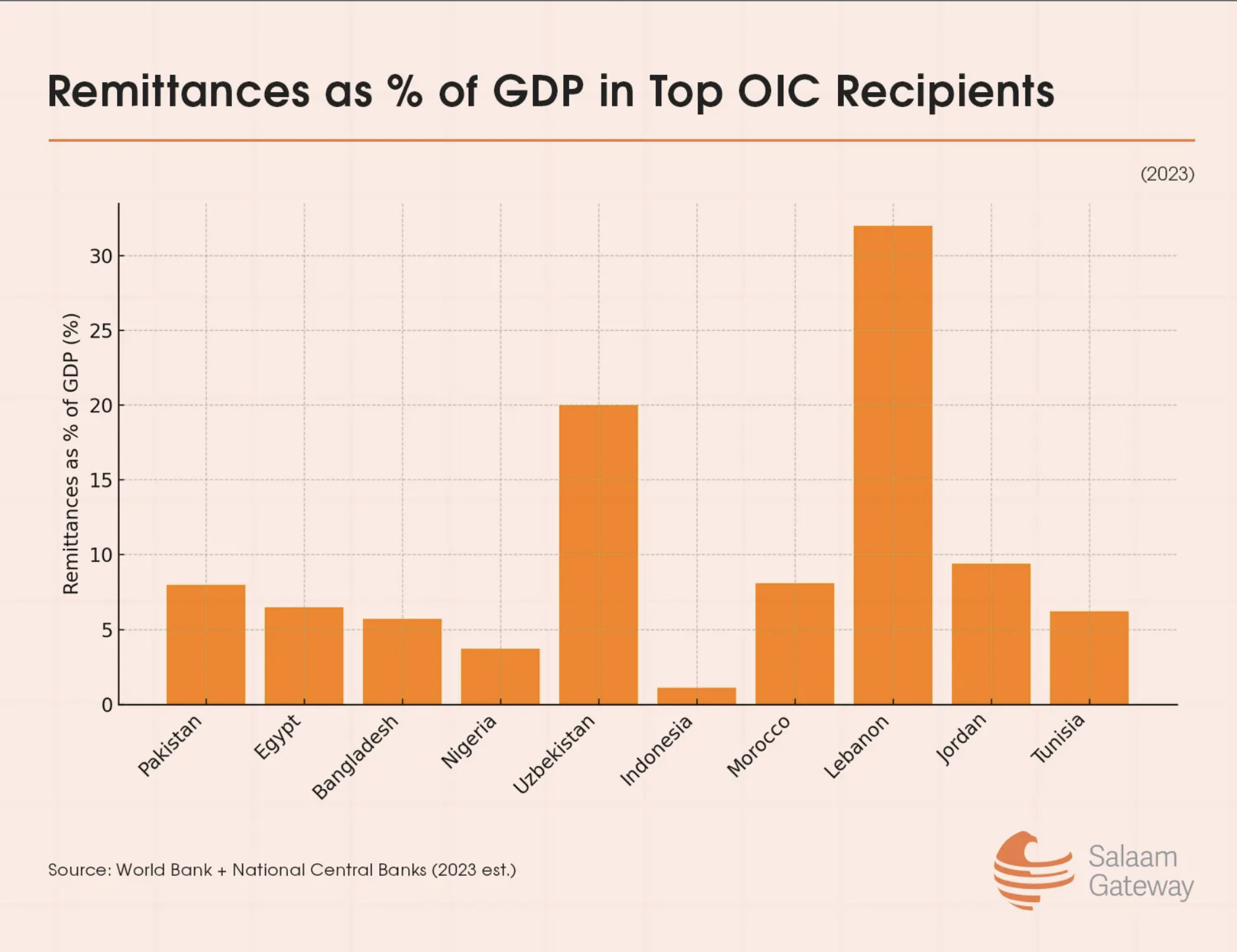

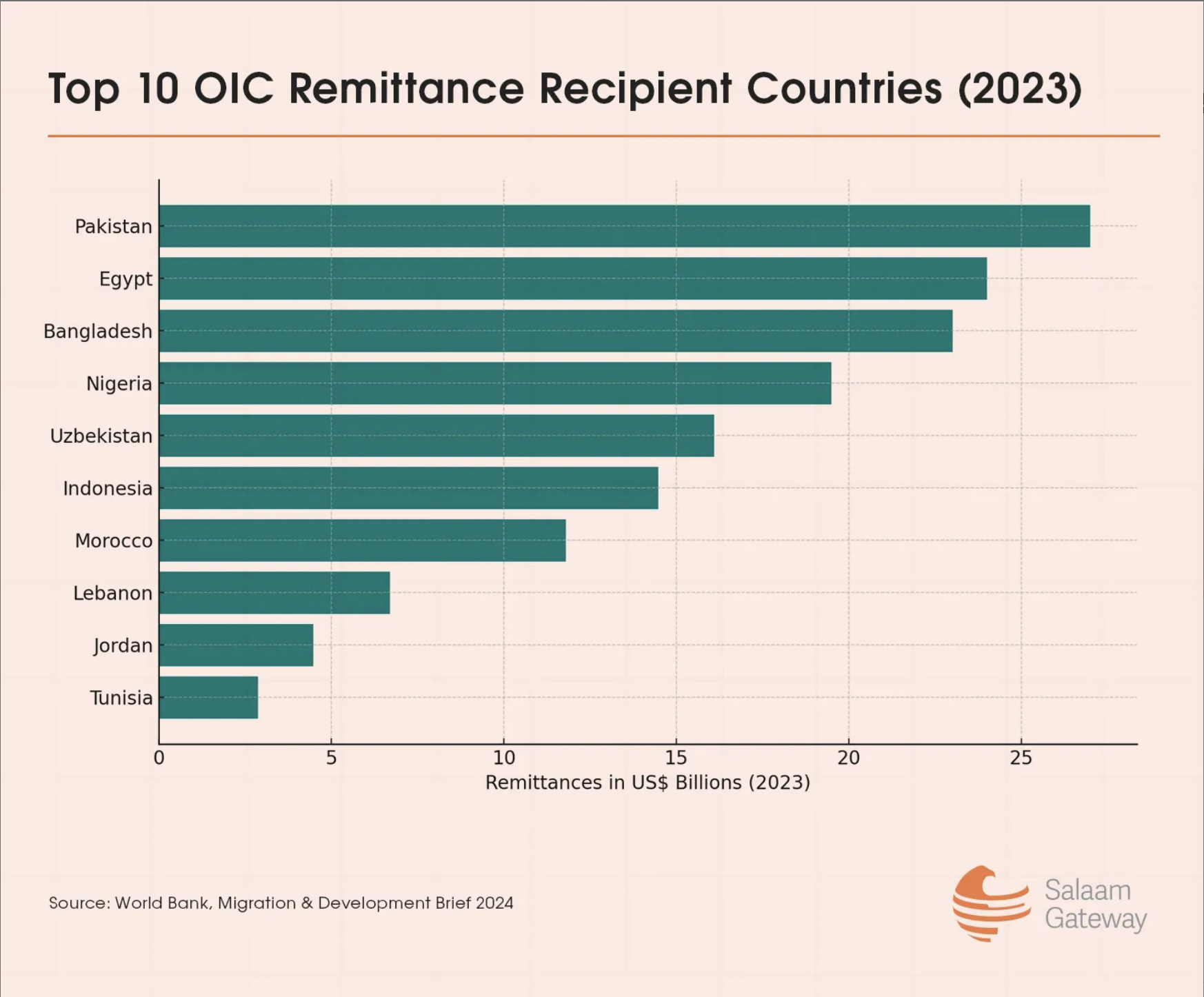

The following ranking identifies the Top 10 OIC remittance-recipient countries by volume, based on the most reliable data for the calendar year 2023, and it also shows the emerging trend for 2024.

1. Pakistan — $27.0 billion

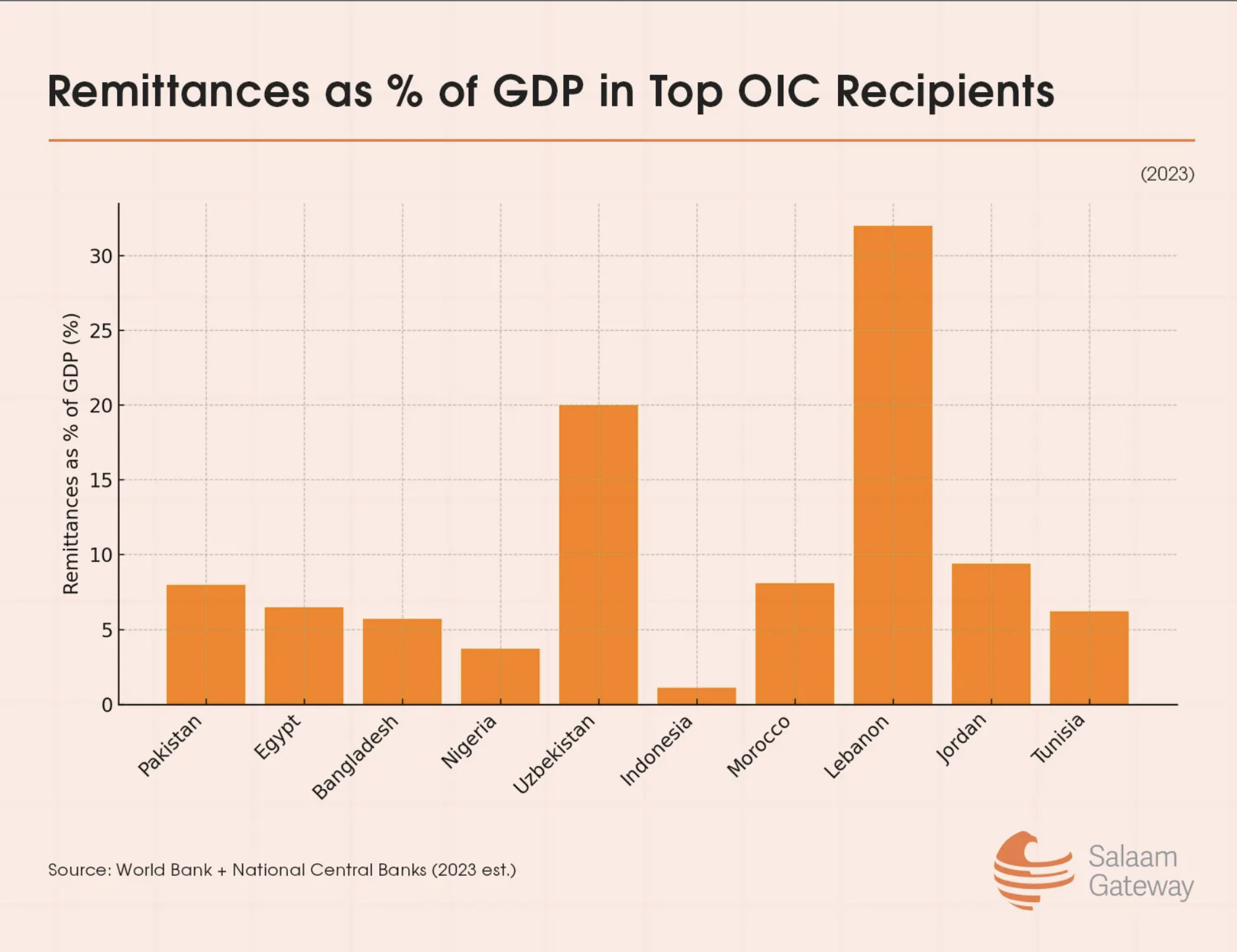

Pakistan remains the largest remittance recipient among OIC nations in terms of volume, as highlighted in the World Bank’s Migration & Development Brief 40. Flows mainly originate from Pakistani workers in the Gulf region, the UK, and North America. The remittances were further expected to increase to $28 billion in 2024.

2. Egypt — $24.0 billion

Egypt remains the top recipient in the Arab region, according to the World Bank’s December 2023 brief. However, the Bank warned that official 2023 inflows may be underreported due to informal foreign exchange channels. The 2024 estimate/partial data places expected remittances for 2024 at approximately $22.7 billion, according to World Bank data published in June 2025.

3. Bangladesh — $23.0 billion

While Bangladesh’s final 2023 figure is still subject to revision, the World Bank projected around $23 billion in remittances for that year. The flows are driven largely by Bangladeshi workers in the Gulf and Southeast Asia.

4. Nigeria — $19.5 billion

Nigeria tops remittance inflows in Sub-Saharan Africa, according to the country press, citing the World Bank. The Nigerian diaspora in Europe and North America provides a substantial share of foreign receipts. The 2024 estimate/partial data places expected remittances for 2024, show a modest growth forecast for expected remittances in 2024, aligning with global trends. However, no full-year national figure has been published yet.

5. Uzbekistan — $16.1 billion

Remittances to Uzbekistan remain high, largely from workers in Russia and Central Asia. The 2023 estimate was about $16.1 billion. The 2024 estimate/partial data suggest that expected remittances for 2024 are expected to stabilize or mildly recover; however, full-year data have not yet been published.

6. Indonesia — $14.47 billion

Indonesia’s remittance inflows reflect millions of migrant workers across Malaysia, Saudi Arabia, and Taiwan. The World Bank’s WDI dataset shows approximately $14.5 billion for 2023; some sources project more than $16 billion for 2024.

7. Morocco — $11.8 billion

Morocco remains the second-largest remittance recipient in North Africa after Egypt, with major flows from Moroccans working in France, Spain, and Belgium. There is no 2024 estimate/partial data as a complete full-year figure has not been made public yet.

8. Lebanon — $6.7 billion

Despite its economic crisis, Lebanon’s remittances remain substantial, representing more than 30% of its GDP. For 2024, anecdotal data suggest strong flows via the Lebanese diaspora, but no consistent national full-year figure has yet been published.

9. Jordan — $4.48 billion

Jordan receives significant remittances from its citizens abroad, particularly in the Gulf and the United States. However, no full-year 2024 figure has been published yet.

10. Tunisia — $2.87 billion

Rounding out the top ten is Tunisia, with remittances largely from Tunisians in France, Italy, and Germany. These flows often exceed tourism receipts in years of economic instability.