Analysis: Most Active VCs in the Islamic Digital Economy

The global Islamic digital economy has seen significant growth in recent years, driven by increasing demand for Sharia-compliant financial services, halal products, and Islamic fintech solutions.

The Islamic digital economy—defined as digital-native, consumer-facing services driven by Islamic requirements and delivered wholly or partially—is rising in prominence due to growing consumer consciousness, ethical considerations, and a young, tech-savvy Muslim consumer base.

Venture capital (VC) firms have played a pivotal role in fueling this expansion, supporting innovative startups that cater to the needs of Muslim consumers globally.

In our analysis of the top 15 most active VCs in this space, we identified key investment trends that highlight the scale and focus of their activities. In 2024, 169 deals worth US$733.6 million were recorded in the global Islamic digital economy, with 15 VCs contributing to over one-fourth of these transactions.

.jpg)

Wahed Ventures leads, followed by Core Vision and Hasan VC

UK-headquartered Wahed Ventures leads the pack with an aggregate score of 95.71, driven by an investment score of 85.71 and Muslim consumer-centric portfolio score of 100.00, reflecting its strong focus on Islamic digital economy investments. Originally launched as an Islamic fintech company, Wahed has expanded to become one of the most active venture capital firms in the digital Islamic economy. It targets early-stage, emerging Islamic economy startups across multiple categories, including fintech, e-commerce, AI, edtech, and SaaS. Notable deals in 2024 include Durioo, SalaamBooking, and GoBarakah. We also observed that Wahed is actively expanding its reach into Malaysia and Qatar.

Behind Wahed Ventures, Saudi-based Core Vision Investments follows with an investment score of 100.00 and a Muslim consumer-centric portfolio score of 72.22, reflecting a diversified investment approach across Islamic digital ventures. Kuala Lumpur-based Hasan VC ranks third with a score of 55.63, supported by an investment score of 42.86 and a Muslim consumer-centric portfolio score of 61.11.

In addition to our primary list, we highlight five notable VCs for their active role in building the global digital Islamic economy. These include Saudi Arabia’s STV, US-based Innate Capital, UAE-based Shorooq Partners and US-based Collective Continuum.

Saudi Arabia becomes the most vibrant VC investment hub, followed by the UAE

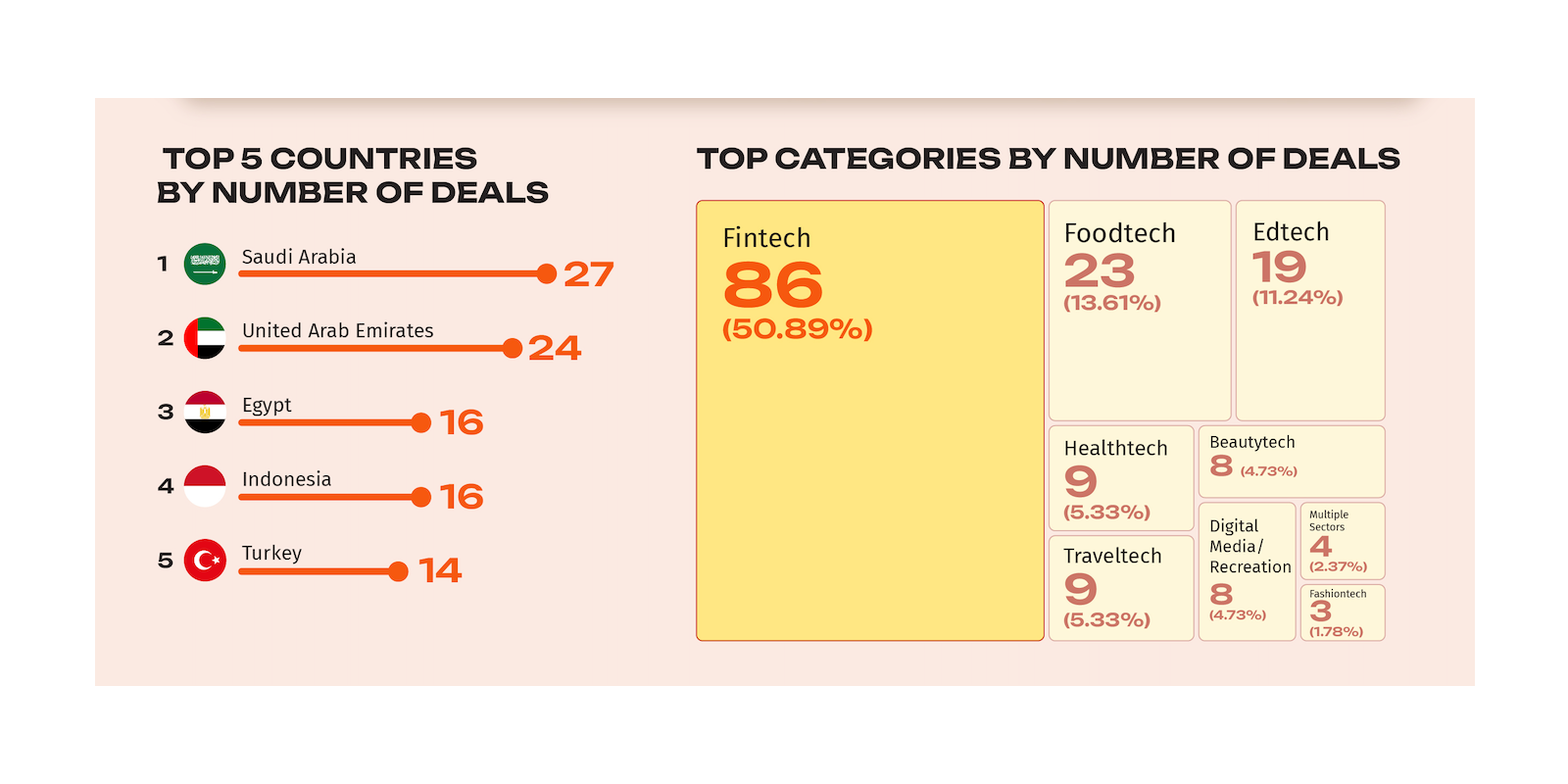

Venture capital activity in the digital Islamic economy spans a diverse global landscape, with Saudi Arabia emerging as the most active hub, recording 27 deals, followed by the United Arab Emirates with 24 deals. Egypt and Indonesia each recorded 16 deals

Saudi Arabia’s investment approach has shifted toward strengthening its local economy, aligning with its Vision 2030. This has impacted the funding ecosystem from early-stage startups to IPO. Five of the top 15 VCs in our list are Saudi-based. In 2024, more than half of the Kingdom’s Islamic digital economy deals are directed toward Islamic fintech. The largest deal was a US$18 million Series A round for Islamic robo-advisory firm Abyan Capital, led by STV with participation from RZM and Wa’ed Ventures. It's also worth noting that in early 2025, STV launched a US$100 million Sharia-compliant fund called NICE (Non-dilutive Investment in Callable Equity) to capture high-growth opportunities while generating income in line with Sharia compliance.

Islamic fintech remains the most attractive sector, with a focus on early-stage deals

Venture capital investments are predominantly concentrated in Islamic fintech, which comprises 50.89% of total investment allocation, reflecting the rapid development and adoption of Sharia-compliant financial technologies.

Halal Foodtech ranks second at 13.61%, followed by Muslim-friendly edutech at 11.24%, indicating a growing market for halal food products and digital Islamic learning. Healthtech and traveltech sectors each captured 5.33%, while beautytech and digital media/recreation each accounted for 4.73%. Fashiontech (1.78%) and multiple-sector plays (2.37%) also reflect increasing diversity in venture capital allocations.

The distribution of venture capital investments in the digital Islamic economy shows a clear emphasis on early-stage funding. Seed rounds accounted for 56 deals, highlighting strong support for nascent startups in Islamic fintech and halal industries. Pre-seed funding followed with 35 deals, indicating a robust pipeline of new ventures, particularly in thriving markets like Saudi Arabia and the UAE.

Series A came in third with 18 deals, followed by Series B (6), corporate rounds (5), Series C (2), and Series D (1)—a distribution that suggests a cautious approach to later-stage funding. Additionally, 46 transactions were recorded with undisclosed funding stages.

To view the list of 15 Most Active VCs in the Islamic Digital Economy, click here.

Read also: Global Islamic Fintech Report 2024/25, click here