British Muslims growing impatient for government to fulfil Islamic student loan promise

The British government continues to kick the can down the road amid renewed calls to introduce a Shariah-compliant alternative to interest-bearing loans for university students.

Eight years after the then prime minister, David Cameron, pledged to introduce a means for students to source money for college fees and living expenses without paying interest on their borrowings, ministers are still unable to commit to the timing of its introduction.

This is despite there being a ready-made mechanism commissioned some time ago by the Department for Education (DfE) that is said by its modeller to be fully Shariah-compliant, equivalent in every way to the established system and straightforward to implement.

“Never again should a Muslim in Britain feel unable to go to university because they cannot get a student loan simply because of their religion,” said Cameron at the World Islamic Economic Forum in 2013 in a bid to tackle the financial exclusion of Muslims in Britain by encouraging the growth of Islamic finance.

The previous year, university fees in England and Wales trebled to £9,000 a year, which meant that most students were required to take a loan from the Student Loans Company (SLC), a government-owned non-profit, to fund their education.

Headline interest paid on these loans is calculated according to the prevailing retail price index plus a fixed percentage. The rate of interest is currently set at 5.6% for graduates earning over £49,000 annually.

Interest begins to accrue after graduates reach a threshold of £27,295 per year and applies for 30 years from the time the loan is taken. The loan is cancelled in the event of the graduate’s death and often in the case of disability.

Speaking in the House of Commons on Thursday (July 15), Opposition member of parliament Stephen Timms called on the DfE to commit to a timetable for the implementation of alternative student loans so they can be delivered by the 2022-23 academic year.

“It is very hurtful that the government simply cannot be bothered to keep the promises made eight years ago to so many people in that community,” he told the house during an adjournment debate.

“Young Muslims have waited patiently. How much longer must they wait?”

Adjournment debates give members the opportunity to raise an issue and receive a response from the relevant minister.

“Some young Muslim people defer university until they have saved to pay their fees outright,” said Timms. “Some with a heavy heart take out a loan and feel bad about it ever after. Others don’t take it out at all. That’s the reality for young British Muslims today.”

Michelle Donelan, the minister of state for education, responded by saying that the government intends to address the matter of student finance when it concludes a major review of education funding that was published in 2019, although she did not confirm when this would be.

The 200-page review by Dr. Philip Augar contained a paragraph stating: “Students should be able to access finance support that is compatible with their religious beliefs. The government will need to consider carefully how the changes we are proposing affect plans to introduce a system of alternative student finance for students who feel unable to access interest-bearing student loans for reasons of faith.”

Donelan said it had been the government’s intention to respond earlier to the Augar review in full, but it had been forced to defer this due to the pandemic.

“We decided to align a decision on the implementation of alternative student finance with the outcome of the [Augar] review. We did this to ensure that the terms of any package under the terms of alternative student finance are the same as those for mainstream student support. We will provide an update on a Shariah-compliant student finance product when we conclude the post-18 review of education and funding.

“More broadly, I can assure that this government is committed to ensuring that higher education is accessible to all, no matter where they come from, their religion or their race,” she added.

|

TIMELINE: UK GOV'T AND ISLAMIC STUDENT LOANS 2013: David Cameron announces government will introduce Shariah-compliant student loans. 2015: Green paper acknowledging government will develop a takaful loan product more fully. 2016: White paper said there was a real need to support students who feel unable to use interest-bearing loans, and that “we will introduce an alternative student finance product for the first time that will avoid the payment of interest”. 2017: Higher Education and Research Act gains royal assent. Campaigners hope it will pave the way for implementation of the takaful loan model. 2019: Publication of Review of Post-18 Education and Funding (Augar review), which sets out the key attraction factors of alternative student finance. 2020: Ministers delay response to Augar review, citing new priorities due to pandemic. |

While the machinery of government is expected to grind slowly, it is surprising that the DfE’s gears have been spinning for so long, given that an alternative student funding mechanism was proposed in 2014 and greeted with overwhelming approval in a consultation that attracted a record number of responses at the time.

The consultation attracted almost 20,000 comments, with 94% stating their belief there would be “demand among students and potential students for an alternative finance product which was Shariah-compliant” and 81% would find the takaful-based mechanism “acceptable”.

The model proposed was a takaful system in which students paid into the system to guarantee each other against loss through a co-operative. Repayments, debt levels and the cost to the government would be the same as for conventional student loans.

The UK Islamic Finance Council (UKIFC) was commissioned by the DfE to create a detailed structure for the scheme using a mechanism that could be implemented within the conventional student loans structure.

“What we have successfully done over the two years we worked with the DfE is to develop a workable, comparable structure that is implementable by Government without any material obstacle to doing so,” Omar Shaikh, UKIFC’s Advisory Board Member, told Salaam Gateway.

“There will be an operational process that the SLC will have to consider when implementing this, but none of that is insurmountable or beyond their capabilities. We did walk-through tests with the SLC to ensure it can be implemented within existing processes.”

Legislative additions could be required, however, to introduce alternative student financing, but this can have a legislative cycle up to 18 months, said Shaikh, enabling it to be finalised in time for the 2022-23 university year.

“The delay since we presented our findings has been for the reasons that the government has publicly stated that they are doing a full review on the student loans process the Post-18 review.

“That’s why there remains this perceived hiatus. We remain optimistic that the government will follow through with it, but it is disappointing that it has taken this long. The government needs to prioritise this better,” Shaikh added.

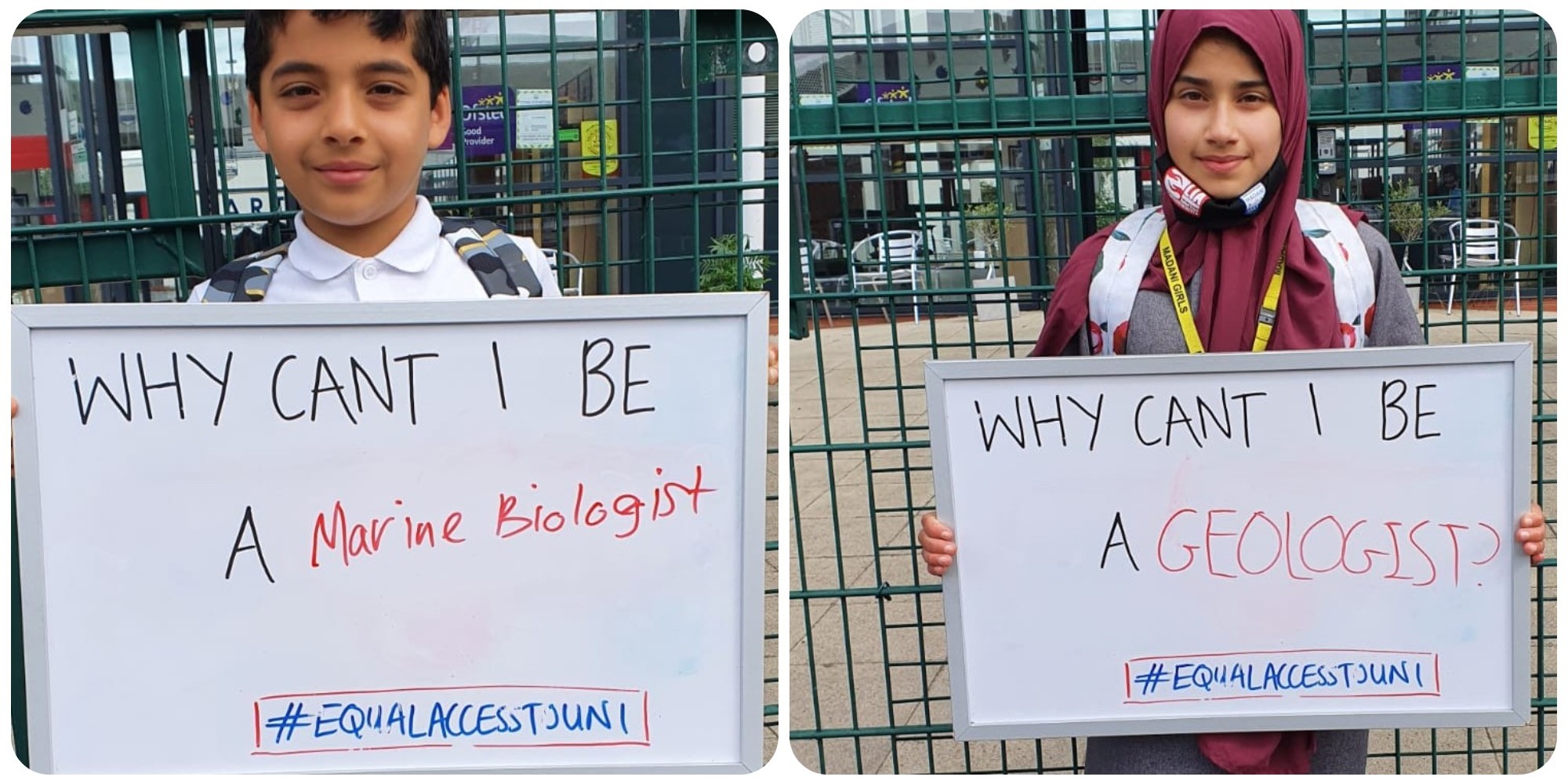

STUDENTS DEMONSTRATE

On Friday (July 16), school and university students will gather outside the DfE offices in London in a demonstration to raise awareness of the issue.

“We are trying to encourage anyone who cares and thinks this should not be a problem to gather and bring a book and just read it or just study,” said Asha Hassan, a final-year medical student at Exeter University who has taken a year off her studies to campaign for the government to realise their promise.

“We just want to show that we want access to our right to learn in a country that is tolerant and progressive. Who knows who will turn up, but even if it’s only five or 10 people, the image will be there.”

Hassan, who has relied on scholarships and grants to fund her studies, said the matter has been overlooked for too long, and few people are aware of Cameron’s promise in 2013.

“There is no reason whatsoever why [the government] should delay this. The experts who have designed the system say it can be made available. What is left is political will, but they have shown there is no will; they will happily drag it out for another 10 years unless we act,” Hassan told Salaam Gateway.

“The key thing is that no one knows about this. Muslims have suffered in silence.”

DIFFERENT VIEWS

Perhaps one of the reasons why the issue has remained under the carpet is differing viewpoints over whether conventional student loans fall under riba.

Various scholars and fatwa organisations of the UK and Europe, including the European Council for Fatwa and Research, have ruled it is permissible for Muslim students to take out university fee loans, and that there is no interest involved when one does so.

The arguments are that the loan is not actually paid to the student, so there is no ownership of the money, nor is there the choice to do with it as the student wishes. In addition, the loan is written off after a set period of time, or if the student is disabled or dies.

Many Muslim students will accept such guidance and happily take out a conventional student loan.

Nevertheless, there will still be many who follow their own understanding of riba.

While UKIFC’s Omar Shaikh believes student loans fall under riba, he asserts that this is a moot point because a Shariah-based alternative had been promised, even if it is important to “five, 50, 500 or 5 million students”.

The agenda for Islamic students follows the principle of financial inclusion and it’s about ensuring that every part of society has access and is now way beyond an issue of measuring up demand,” he said.

“We know the consultation for this issue done by the government attracted a significant response, and from that we know clearly that this is an issue. If it was a non-issue, the prime minister would not have made that promise in 2013. The issue has become about the government coming through with its promises to minority communities.”

© SalaamGateway.com 2021 All Rights Reserved