Drought, not bushfires, will force drop in supplies from Australia as second biggest halal meat exporter

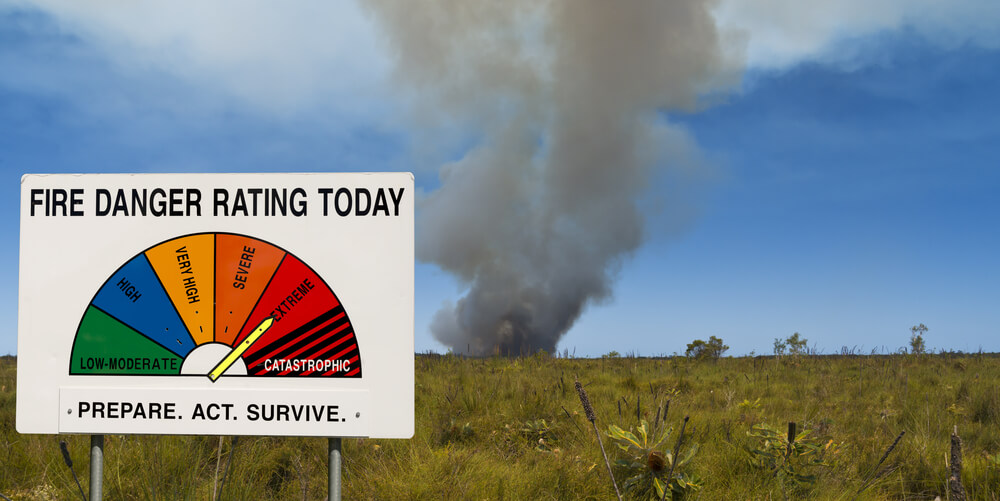

Bushfires currently raging in Australia are yet to have an impact on supplies from the world’s second-biggest halal meat exporter.

It is a three-year drought, however, that stands to have the biggest effect on Australia’s $2.4 billion of meat and livestock exports to Muslim-majority countries.

The way it currently stands, dairy cattle exports are most likely to be affected by the fires, which are concentrated in the south and east of the country, while beef production has largely been spared.

“A lot of areas that have been affected are predominantly dairy producing areas and we have a significant live dairy heifer export trade. We are waiting to see what that impact will be,” Mark Harvey-Sutton, chief executive of the Australian Livestock Exporters Council, told Salaam Gateway.

“It’s not a very good situation and I would expect some impact on the export of those animals, but we aren’t sure yet,” he added.

Australia’s latest drought, which began in 2017 and recently saw the driest November in the country’s history, will have more impact on beef supplies to Muslim markets, though it will take time to reflect on shipments.

Farmers typically “turn off” stock by selling surplus cattle during droughts, rather than holding onto them and paying for their upkeep. Farmers have now turned off much of their stock and the government anticipates a 14% fall in livestock exports during the year ending June 2020.

“We have been expecting a drop-off in supply, but that hasn’t happened yet. That forecast is quite reasonable but there are still a lot of factors to see it come to pass,” said Harvey-Sutton.

Australia’s main competitors come from South America, including Brazil, the world’s biggest halal poultry and meat exporter that sold some $5.5 billion to Muslim-majority markets in 2018.

“We have been seeing some of our markets starting to investigate the import of live cattle from Brazil,” added Harvey-Sutton.

Australia is a relatively small player in terms of beef production, accounting for about 3% of global supply, but it is a major player when it comes to exports. According to Meat and Livestock Australia, increased production from Brazil and India have been putting pressure on Australian beef and live cattle exports to China, Southeast Asia, the Middle East and North Africa.

Most of Australia’s beef exports come from northern regions that have suffered from drought but are largely unaffected by the bushfires.

Despite a prolonged shortage of rainfall, OBE Organic in Queensland, a large exporter of halal beef, has been thriving.

OBE has seen exports to the Middle East, Asia and North America grow “significantly” in the last six months in the face of drought. Its meat producing areas are used to just 150mm of annual precipitation, though they have had less rain recently.

“Our animals graze in the heart of Australia, which is very remote and dry most of the time. Our supply chain is used to functioning in a harsh environment,” Dalene Wray, OBE’s managing director, told Salaam Gateway.

“The producers that we source from have chosen breeds of animals that are able to perform well in these sorts of environments: mainly British breeds, like a Hereford cross or an Angus. They drink from boreholes in the Outback."

With halal certification “for all markets around the world”, OBE has most recently taken strides into Saudi Arabia and Kuwait and does not foresee any drop in its supply.

This is in contrast to Australian lamb exports, which have seen disruption caused by the drought.

LAMB EXPORTS DISRUPTED

The national sheep flock will have dropped in size to an estimated 66.8 million by the end of the current financial year that ends June 30, from 72.1 million in 2017, according to Abares, the government’s agricultural research department. This is expected to fall further to 64.9 million next year.

"Production and exports are forecast to fall because fewer animals are available for slaughter,” Abares said in its December quarter 2019 agricultural commodities report.

The smaller sheep flock has already impacted buyers abroad.

Kuala Lumpur wholesale meat supplier Wira Food has been watching Australian prices for lamb shoulder, the most popular cut, nearly double, from 17 Malaysian ringgit ($4.11) per kilo three years ago to 32 ringgit today. Its owner, Salena Abdul Rahim, now frets that supplies will be maintained.

“Australian lamb is a hot item over here and there has been a shortage over the last few months. It’s not good for us,” she told Salaam Gateway.

In response, suppliers are forced to source lamb from New Zealand.

Though Kiwi lamb is more expensive than its Australian counterpart, it is not as well-loved by consumers.

“Consumers prefer Australian, definitely. But since there are no supplies, there are no other options like lamb from India or other countries. We are still waiting for Australian stocks to Malaysia,” said Salena.

The Australian name is a strong selling point for beef and lamb in Malaysia and other Islamic markets.

“If we experience a shortage of beef supply, we have to look at options from different countries. The market will be very reluctant to change from Australian stock,” she added.

(Reporting by Richard Whitehead; Editing by Emmy Abdul Alim emmy.abdulalim@salaamgateway.com)

|

READ ALSO |

© SalaamGateway.com 2020 All Rights Reserved