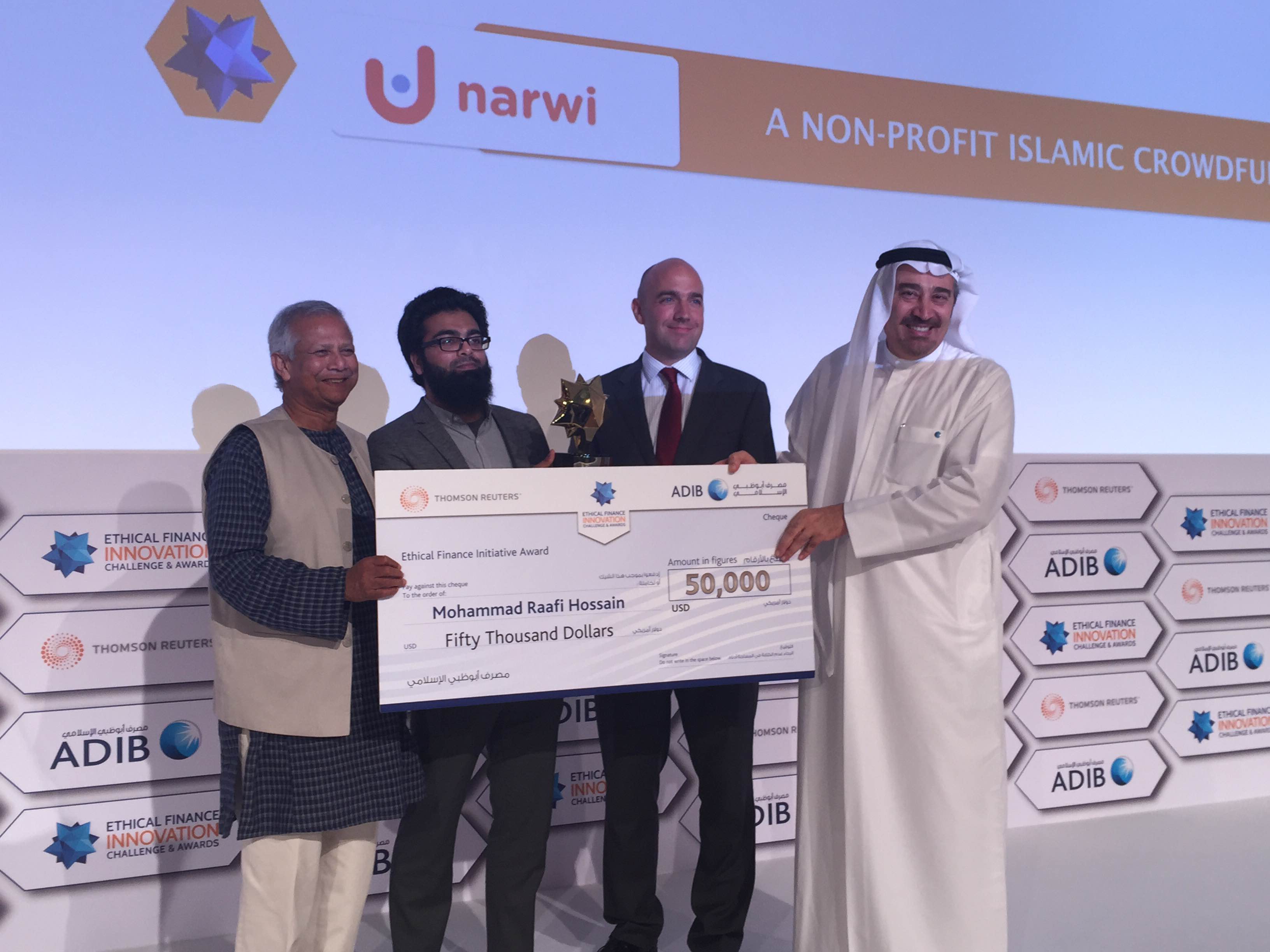

EFICA: Islamic crowdfunding platform Narwi wins Ethical Finance Initiative Award 2015

Islamic crowdfunding platform Narwi.org has won the 2015 Ethical Finance Initiative Award, beating Community Sourced Capital and Wahed Invest.

The Ethical Finance Initiative Award is part of the Ethical Finance Innovation Challenge and Awards (EFICA) organized by Thomson Reuters and Abu Dhabi Islamic Bank.

The three finalists made their formal presentations of their initiatives at a dinner and award ceremony event in Dubai on October 4th where audience voting determined the winner.

This is the third consecutive EFICA.

Nobel Peace Prize winner Muhammad Yunus, former CEO of Grameen Bank, was the keynote speaker at this year’s EFICA ceremony.

ABOUT THE AWARD

The Ethical Finance Initiative Award looks for new or existing ethical financial solutions that can be implemented within the financial sector. There is a single prize of $50,000 for the winner.

ABOUT THE WINNER – NARWI

Narwi is a non-profit Islamic crowdfunding platform. It was set up in June 2015 by Silatech, a MENA regional initiative focued on youth employment and enterprise development, and is enabled by Kiva.org, the world’s largest online microlending platform.

Narwi allows donors to support microentrepreneurs of their choice by establishing an endowment, or “Narwi-Waqf” with as little as $25. Through Narwi, donors provide no-cost capital to a network of field partners (primarily microfinance institutions), lowering their risk and enabling them to serve marginalised, higher risk and higher social impact beneficiaries.

Narwi currently finances projects in Yemen, Palestine, Jordan, Iraq, Lebanon, Egypt and Somalia. It has plans to expand to Morocco and Tunisia.

ABOUT THE OTHER FINALISTS

COMMUNITY SOURCED CAPITAL

Community Sourced Capital (CSC) is an Internet-based platform for use in the United States where small businesses can access between $5,000 and $50,000 in capital directly from members of their own communities in the form of zero-interest loans. It is a crowd-sourced lending platform. CSC charges businesses that raise funds flat fees for the use of the platform.

Since CSC launched its first campaigns in early 2013, it has helped 80 neighbourhood businesses access $1.4 million in zero-interest loans from over 5,000 people.

WAHED INVEST

Wahed Invest is an automated Shariah-compliant savings platform. It targets middle-income investors and keeps the minimum requirement for investment at $12,500. Investors pay one all-inclusive management fee that starts at 0.29 percent.

Wahed selects low-cost ETFs (Exchange Traded Funds) and securities for investment according to investors’ risk profiles.

Wahed Invest is an SEC-registered Investment Advisory.

© Copyright SalaamGateway.com 2015