Halal Cosmetics Sector Snapshot 2024/25

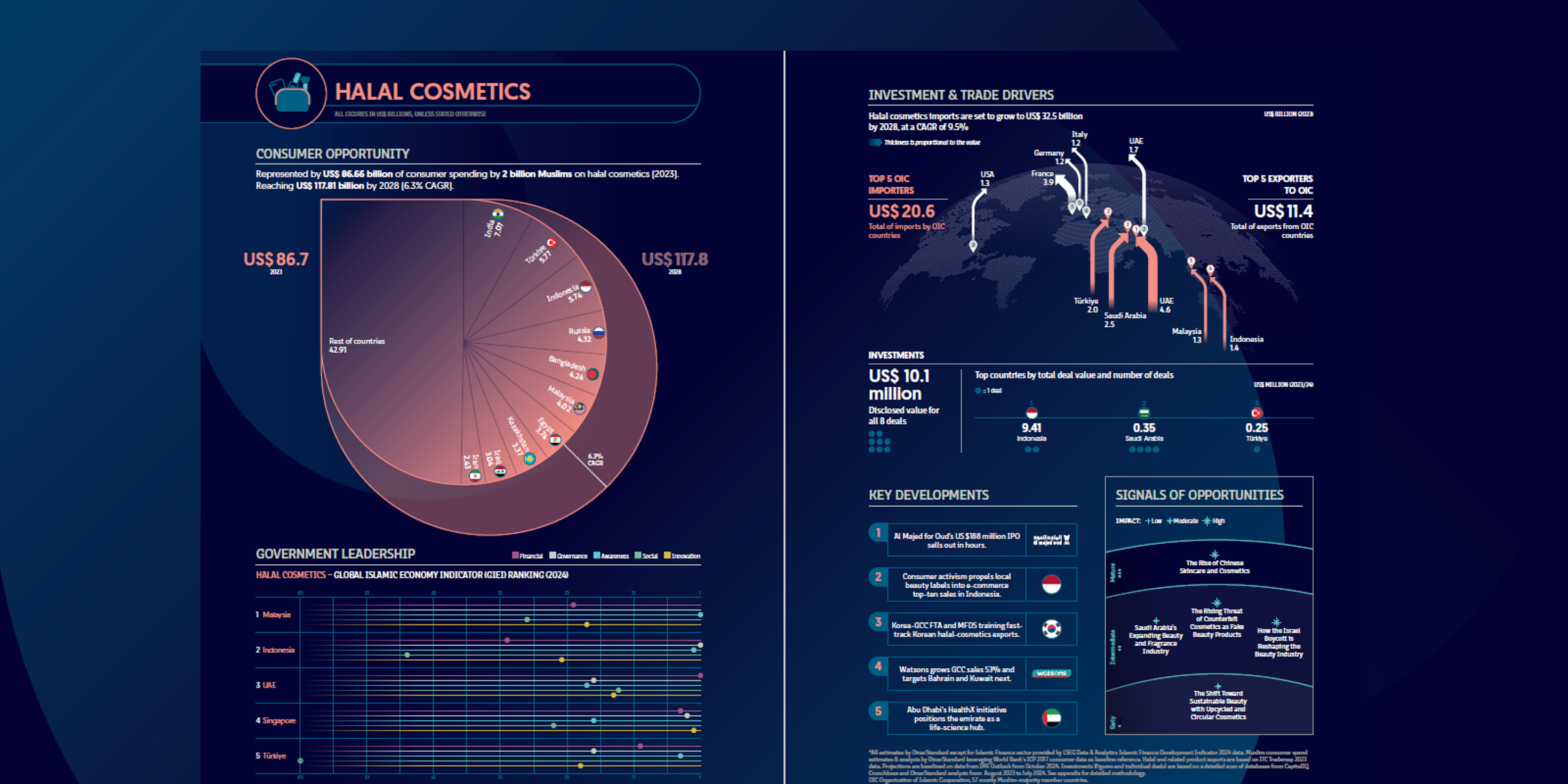

Spending on beauty and personal-care products that meet Islamic requirements is accelerating. Muslim consumers laid out US $ 86.7 billion on halal cosmetics in 2023; momentum is expected to lift the market to US $ 117.8 billion by 2028, a healthy 6.3 % compound annual growth rate. Turkey and Iran remain the largest single-country spenders, while Indonesia, Bangladesh and Egypt are the fastest-rising markets as local brands scale online.

Trade and investment dynamics

- Imports. OIC countries purchased US $ 20.6 billion in cosmetics from abroad last year; the import bill is projected to reach US $ 32.5 billion by 2028 (9.5 % CAGR), driven by rising disposable incomes and demand for cruelty-free, alcohol-free formulations.

- Exports. OIC suppliers collectively shipped US $ 11.4 billion in halal-certified cosmetics, with Indonesia, Malaysia and the UAE emerging as outward-looking production hubs.

- Deals. Eight disclosed transactions totalled US $ 10.1 million in 2023/24. Indonesia alone attracted US $ 9.4 million, underscoring investor confidence in Southeast Asia’s digital-beauty landscape.

Five headline developments (2023 – mid-2024)

- Al Majed for Oud raised US $ 188 million in an IPO that sold out within hours, signalling strong demand for heritage fragrance brands.

- A wave of consumer activism in Indonesia propelled local labels to the top tier of e-commerce beauty sales during the Gaza-related boycott season.

- Korea’s halal-export push accelerated after the GCC-FTA and MFDS training programmes fast-tracked certification.

- Watsons reported a 54 % jump in GCC sales and announced entry into Bahrain and Kuwait, showing mainstream retailers’ commitment to halal shelves.

- Abu Dhabi’s HealthX life-science initiative courted international cosmeceutical R&D, positioning the emirate as a regional formulation hub.

Policy leadership

On the cosmetics pillar of the Global Islamic Economy Indicator, Malaysia tops the table for the consecutive year thanks to JAKIM’s rigorous standards and incentives for ingredient traceability. Indonesia climbs to second, reflecting BPOM’s new halal-process rulebook and aggressive SME on-boarding, while the UAE, Singapore and Türkiye round out the top five with innovation sandboxes and export rebate schemes.

Signals of opportunity

- China’s OEM ecosystem is racing to capture contract-manufacturing mandates for halal-skincare brands.

- British “clean beauty” labels see Gulf and ASEAN halal certification as a door to fast growth.

- Saudi Arabia’s fragrance investments dovetail with plans to expand premium perfume capacity.

- Boycott-driven brand switching is reshaping demand curves, rewarding locally owned players that emphasise ethical sourcing.

- Up-cycled, circular-beauty formats—from refill stations to compostable packaging—are converging with halal purity expectations.