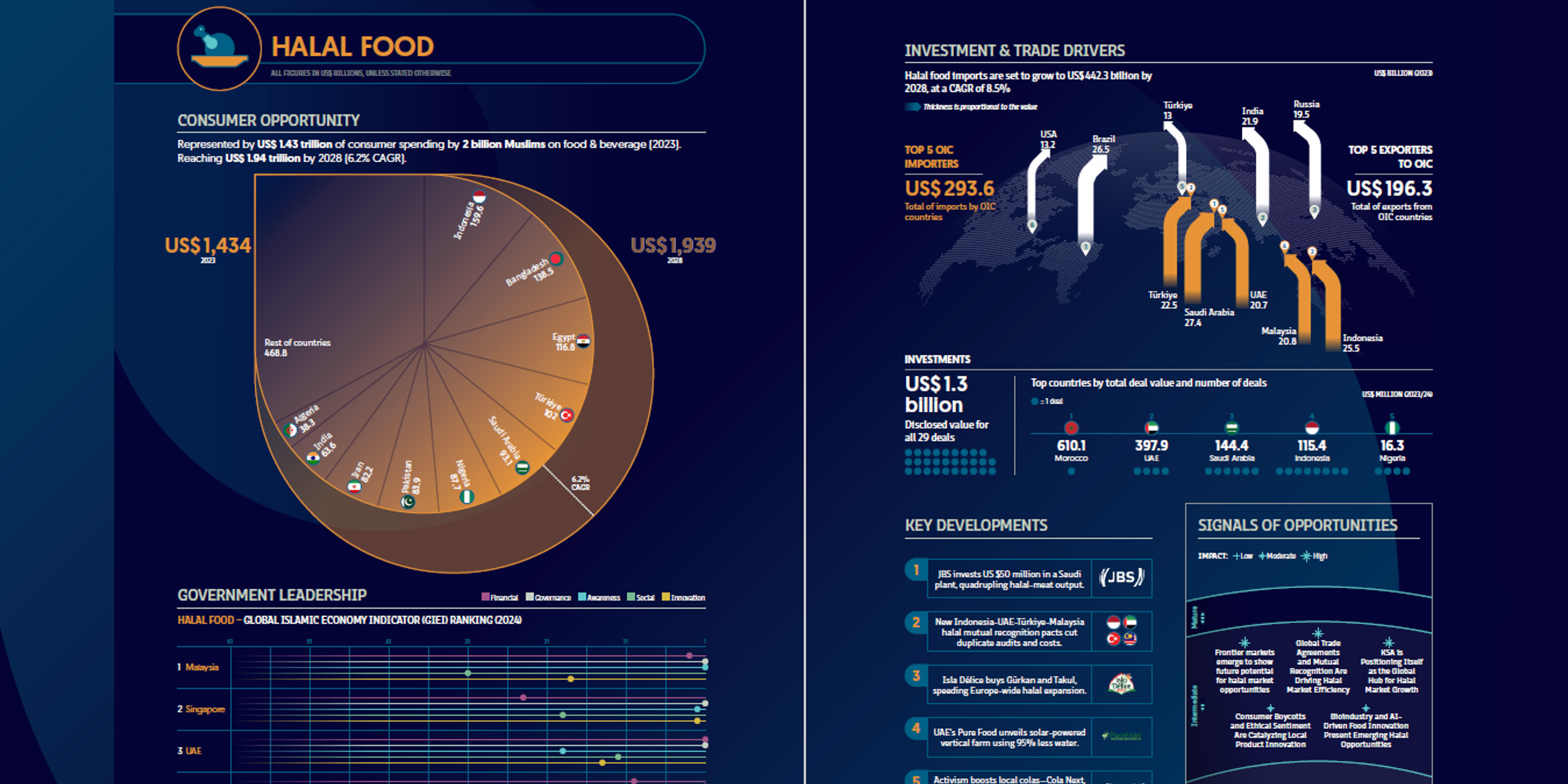

The halal-food market continues to anchor the wider Islamic economy. Muslim consumers spent US $1.43 trillion on food and beverages in 2023; buoyed by population growth, localisation of production and stronger certification regimes, spending is expected to reach US $1.94 trillion by 2028, a healthy 6.2% CAGR. Indonesia remains the single largest national market by expenditure, followed by Bangladesh and Egypt.

Trade flows are accelerating even faster than consumption. OIC members imported US $293.6 billion of halal-related food in 2023 and are set to lift that bill to US $442.3 billion by 2028, implying 8.5% annual growth. Saudi Arabia, Türkiye, Indonesia, Malaysia and the UAE are the five biggest buyers inside the bloc, while Brazil, India, Russia, Türkiye and the United States supply the largest export volumes into OIC markets. Government-to-government mutual-recognition agreements (such as the new Indonesia–UAE–Türkiye–Malaysia pact) are shaving certification costs and widening market access.

Investor appetite cooled in value terms last year, yet remained significant: 29 disclosed halal-food deals totalled US $1.3 billion. Morocco topped the league by ticket size thanks to a US $610 million sugar acquisition, followed by the UAE (US $398 million), Saudi Arabia (US $144 million), Indonesia (US $115 million) and Nigeria (US $16 million). Activity centred on capacity expansion—Brazil’s JBS poured US $50 million into a Saudi processing plant to quadruple output, while UAE conglomerates are investing in vertical farming to slash water use.

Policy leadership is concentrated in South-East Asia and the Gulf. The Global Islamic Economy Indicator ranks Malaysia first for halal food governance and ecosystem depth, ahead of Singapore, the UAE, Indonesia and Jordan. These frontrunners combine robust certification systems with active export strategies and innovation incentives.

Five headline developments in 2023/24 illustrate the sector’s direction of travel:

- JBS’s Saudi plant points to Gulf self-sufficiency goals;

- The four-nation mutual-recognition deal streamlines cross-border trade;

- French brand Isla Délice’s European acquisitions signal market consolidation;

- Pure Food’s solar-powered vertical farm highlights resource-efficient production;

- Consumer movements are propelling local cola brands—from Cola Next to Gaza Cola—into the mainstream, proving the power of values-driven demand.

Looking forward, the report flags opportunity signals ranging from AI-enabled traceability solutions and alt-protein fermentation to localisation plays in frontier markets and the uptick of activist-led brand preferences—each poised to reshape supply chains and product innovation over the next five years