A new effort to harmonize halal standards for medicines, vaccines, and nutraceuticals could build trust and transform the future of pharmaceutical trade

The world’s first international halal standards for biopharmaceuticals, vaccines, and nutraceuticals are in the works - and they could reshape how medicines are traded, certified, and trusted worldwide.

Led by the Istanbul-based Standards and Metrology Institute for Islamic Countries (SMIIC), the initiative offers an opportunity to unify a fragmented system. If successful, experts say, it will cut costs, boost innovation, and open new markets well beyond Muslim-majority countries.

“By ensuring the production of safe, high-quality halal-certified medicines, a unified standard can strengthen patients’ confidence in the products they use,” Dr. Tariq Ali, professor and chair of pharmaceutics at Dow University of Health Sciences in Pakistan tells Salaam Gateway.

Such a global standard, he argues, could even pave the way for a free-trade model among Muslim nations - streamlining supply chains and encouraging collaboration in drug development.

“This, in turn, will foster stronger research and development efforts - not only in pharmaceuticals but also in the production of biological products,” explains Ali.

A fragmented landscape

For now, the global halal pharmaceutical sector remains fragmented.

“Exporting medicines between countries is already much more complex than other products,” says Dr. Mohammed Ali Alsheikh Wace, Specialist and Technical Assistant at SMIIC, which operates under the Organisation of Islamic Cooperation (OIC) and has 45 member states.

“Pharmaceuticals require special registration with ministries of health or food and drug authorities to prove their safety, quality, and efficacy. This process involves extensive documentation and, in many cases, factory inspections.”

Halal certification adds an extra layer of difficulty. “If multiple national or regional halal standards exist, this creates confusion, higher costs, and additional inspections for producers. We already see this problem in halal food, where different national standards exist alongside the OIC/SMIIC standard,” Wace says.

Strategic opportunity

Unlike halal food, however, pharmaceuticals present a rare chance for early alignment. So far, only Malaysia and Pakistan have introduced national halal pharmaceutical standards.

That gives the OIC/SMIIC 50 standard a head start, Wace explains. The framework consists of three parts: General Requirements for Halal Pharmaceuticals (50-1), Biopharmaceuticals/Vaccines (50-2), and Nutraceuticals and Related Products (50-3).

The general requirements (50-1) were published in 2022. The remaining two standards are now under development - and, crucially, will be global benchmarks in their categories.

“Notably, SMIIC 50-2 and 50-3 will be the first international standards in their fields, with no existing national equivalents. This provides a unique opportunity for global harmonization,” says Wace.

Companies that comply with these standards, he adds, will find their products more readily accepted across borders. This will cut costs and encourage innovation as firms will focus on developing new products, without worrying about conflicting national requirements.

Barriers on the ground

Yet uptake of OIC/SMIIC 50-1 has been slow.

“An OIC-member accreditation body must accredit halal certification bodies (HCBs). This requires registering halal pharmaceuticals as a new field and paying additional evaluation fees. The high costs discourage many HCBs from applying, especially as the number of companies requesting certification remains small,” says Wace.

Most firms active so far are dietary supplement producers, which are usually certified under OIC/SMIIC 1 - the general halal food standard - given its less complex regulatory requirements.

“Regulations for dietary supplements are much simpler compared to full pharmaceutical products, so companies often choose that route instead of adopting OIC/SMIIC 50,” Wace explains.

Another major obstacle is the requirement for dedicated halal-only production lines. “For many manufacturers, this is a major barrier to certification,” he says.

Silver lining

Despite these hurdles, momentum in the halal pharmaceutical sector is building.

Egypt, Nigeria, the UAE, Saudi Arabia, and Pakistan are among the OIC members strengthening regulatory frameworks for halal pharmaceuticals. Azerbaijan has adopted the OIC/SMIIC 50-1:2023 standard, while Indonesia has introduced comprehensive halal manufacturing guidelines for drugs, biological products, and medical equipment.

“Each year more companies are showing interest, and the trend indicates gradual but stable expansion in the application of OIC/SMIIC 50-1,” says Wace.

Transportation is not covered under this standard but rather in the halal supply chain series (OIC/SMIIC 17), he notes.

The role of partnerships

Industry partnerships are also driving momentum. In 2024, Duopharma Biotech teamed up with Universiti Kebangsaan Malaysia to advance halal healthcare standards, producing the first halal-certified oncology drugs and the world’s first halal-certified biosimilar.

Dr. Ali stresses that long-term progress will depend on global cooperation. “Establishing a truly globally accepted framework for the halal pharmaceutical industry requires mutual understanding, collaboration, and standardization among countries,” he says.

“Continued research and innovation will also play a vital role in advancing the sector. Achieving this vision will demand sustained effort, time, and strong commitment from all global stakeholders.”

What’s next

Wace expects demand to rise initially across specialized areas.

“Based on studies and experience, I expect the first significant demand to emerge for heparin and low molecular weight heparins, followed by certain vaccines,” he says. “These areas will likely drive a wave of innovation and certification within the next three to five years.”

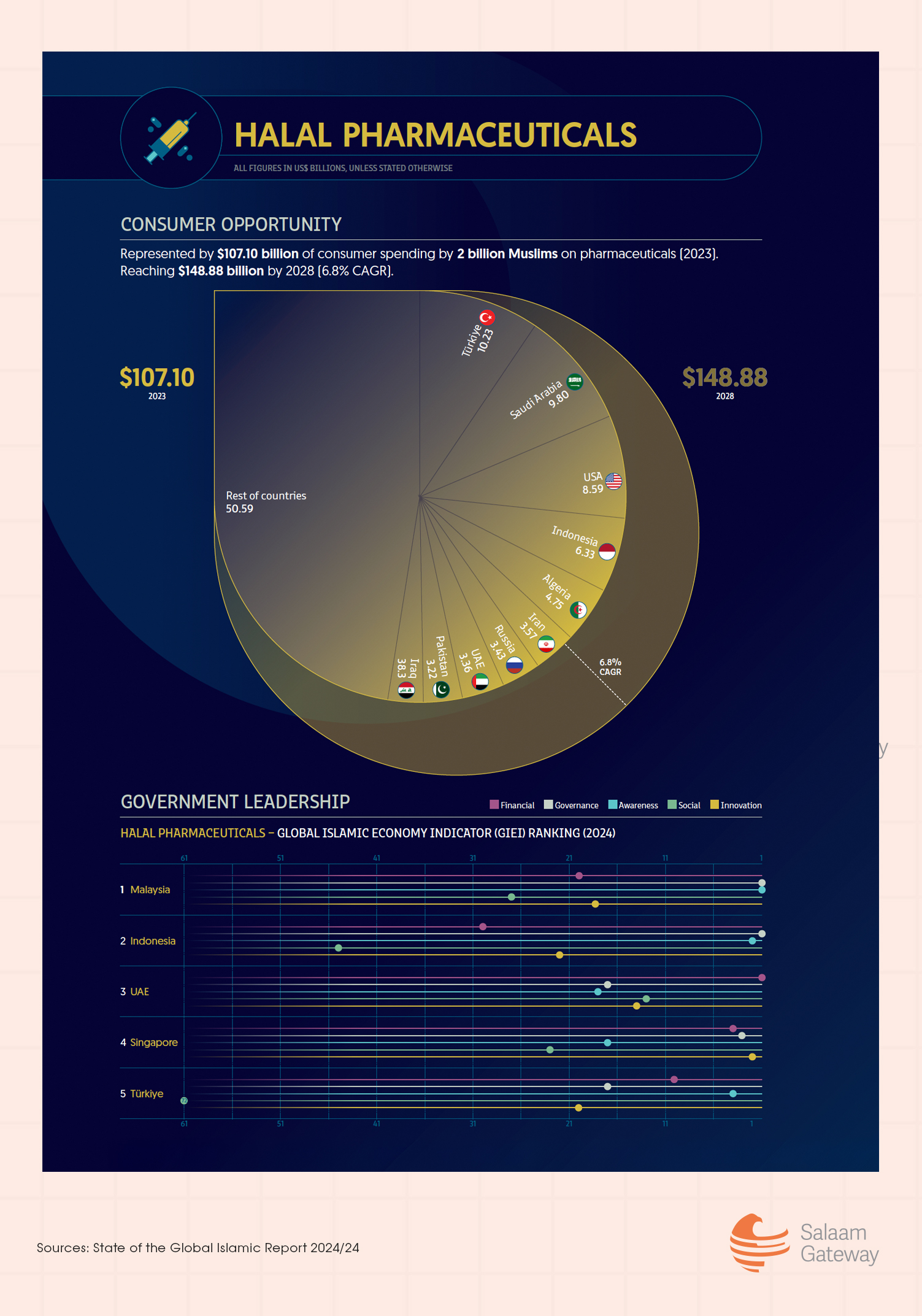

According to the State of the Global Islamic Economy Report 2024/2025, Muslim consumer spending on pharmaceuticals rose to $107.1 billion in 2023, up slightly from $106.9 billion in 2022. The market is projected to climb to $149 billion by 2028.

With the Muslim population growing and awareness of halal compliance rising, the question isn’t whether global standards will take hold - but when.

“The Muslim population represents a large and growing market, and as awareness increases, demand for halal-compliant medicines will naturally expand,” Wace adds. “It’s therefore only a matter of time before a global framework is established.”