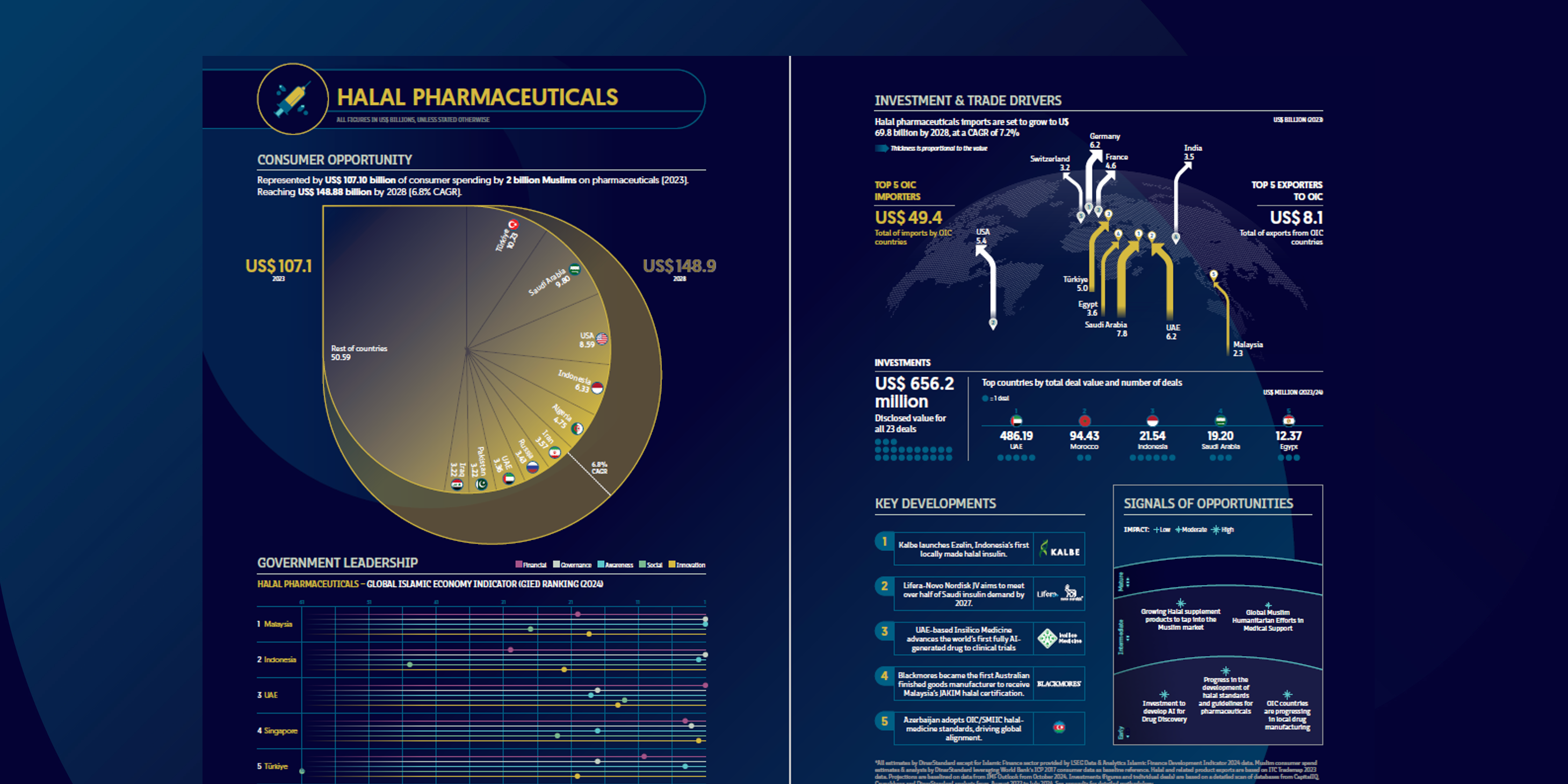

Muslims spent an estimated US $107 billion on medicines and health-related products in 2023. As certification frameworks mature and frontier markets localise production, outlays are projected to reach US $149 billion by 2028, equivalent to a 6.8 % compound annual growth rate. Turkey, Saudi Arabia and Iran remain the three largest end-markets, while Indonesia, Malaysia and Egypt are the fastest climbers in absolute demand.

Trade & investment pulse

- Imports. OIC members purchased US $49.4 billion in pharmaceutical goods in 2023; the bill is forecast to rise to US $69.8 billion by 2028 (7.2 % CAGR). Saudi Arabia (US $7.8 bn), the UAE (US $6.2 bn) and Egypt (US $3.6 bn) headed the import league, sourcing mainly from Switzerland, Germany and India.

- Deals. Twenty-three disclosed transactions totalled US $656 million. The UAE contributed the bulk of value (≈ US $486 m) via a single precision-medicine acquisition; Saudi Arabia, Egypt and Indonesia followed at a distance.

Five headline developments (2023 – mid-2024)

- Kalbe Farma introduced Ezelin, Indonesia’s first locally produced halal-certified insulin, marking a milestone in Southeast-Asian biopharma.

- Lifera–Novo Nordisk formed a JV to supply more than half of Saudi insulin demand by 2027, signalling GCC self-sufficiency drives.

- Insilico Medicine (UAE) advanced the world’s first fully AI-generated drug into Phase-I trials, underscoring the sector’s tech pivot.

- Blackmores became the first Australian finished-goods manufacturer to secure Malaysia’s JAKIM halal certification, widening non-OIC participation.

- Azerbaijan formally adopted the OIC/SMIIC halal-medicine standard, accelerating global regulatory convergence.

Ecosystem leadership

The pharmaceutical sub-index of the Global Islamic Economy Indicator (GIEI) ranks Malaysia #1, thanks to integrated halal-park infrastructure and strong inspection capacity. Indonesia moves up to #2 on the back of BPOM’s halal-process regulation and insulin production, while the UAE, Singapore and Tunisia fill out the top five with active R&D incentives and export gateways.

Signals of opportunity

- AI-driven drug discovery platforms are shortening R&D cycles for halal-compliant biologics.

- Nutraceutical and supplement demand is rising sharply among Gen-Z Muslims seeking preventative wellness.

- Green pharmaceutical manufacturing—solar-powered plants, water-efficient processes—aligns with both ESG and tayyib (wholesome) principles.

- Humanitarian health corridors, from Gaza to Sudan, are spurring emergency procurement of certified medicines.

- OIC investment in domestic API (active pharmaceutical ingredient) capacity promises to ease reliance on conventional supply chains and cut certification costs.