How halal economy is unlocking the power of frontier technologies

Frontier technologies are transforming every industry worldwide, and the Islamic economy is no exception.

Businesses are already seeing the benefits, with investments in technologies such as artificial intelligence (AI), the Internet of Things (IOT), and blockchain paying big dividends.

Like other sectors, Islamic economy companies have much to gain from adopting innovative, emerging technologies. Not only is this empowering them to address global challenges and seize opportunities, but it’s also ushering in new levels of assurance and personalization and in some cases, bringing Muslims closer to their faith.

Halal food consumer confidence

Blockchain, for one, is transforming the halal food sector, giving consumers the confidence that their food is ethical and true to its claims.

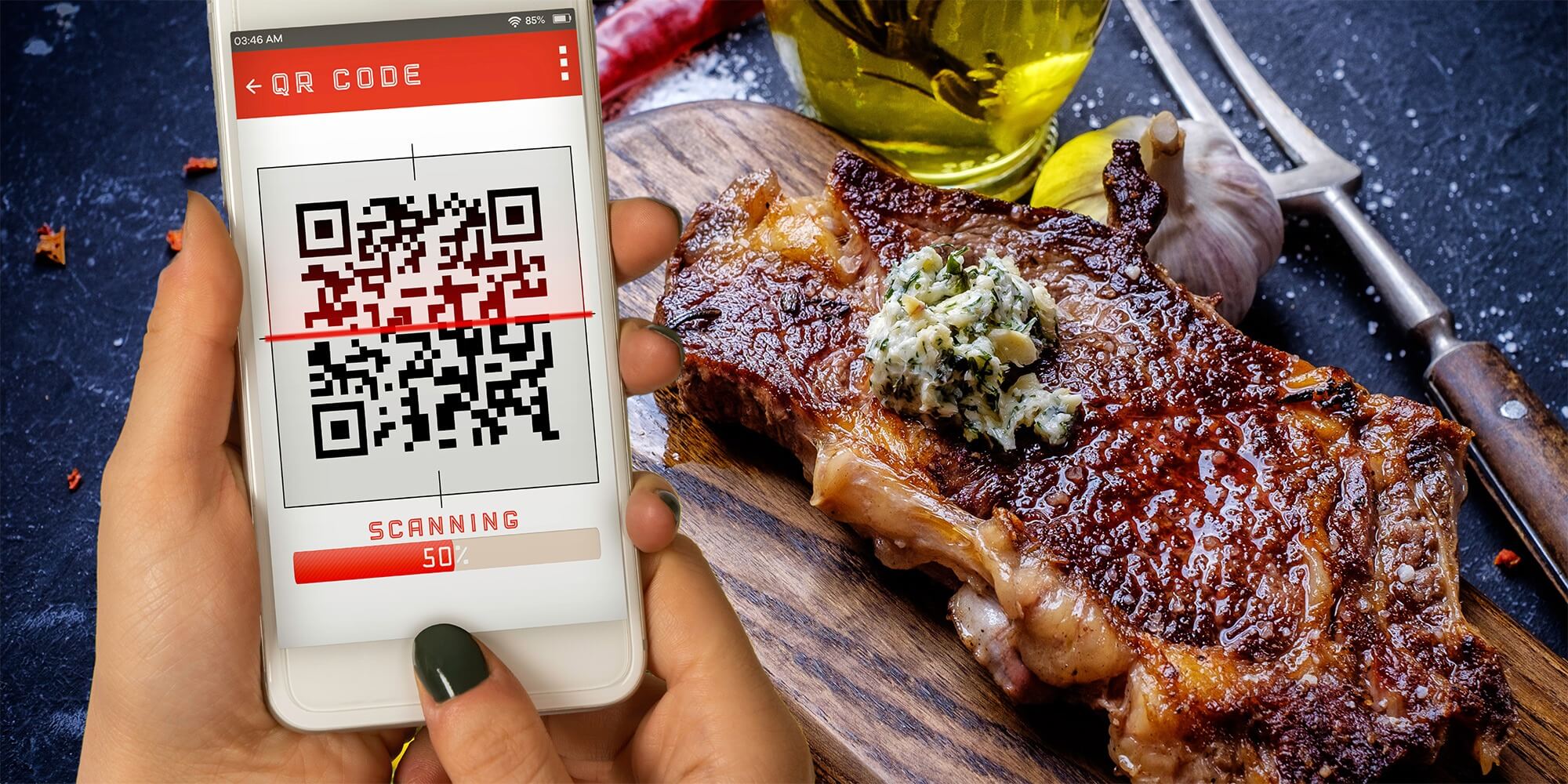

Switzerland-Singapore based OneAgrix has been at the forefront of this revolution. The B2B e-commerce platform recently launched a farm-to-retail solution, which enables halal food consumers to verify the origin of their food with their smartphones.

“The faith-based sector is a highly sensitive sector whereby consumers are bound by religious laws or personal moral and ethical preferences as to how and what they eat. It is often overlooked that it is indeed a food security issue in many countries,” Diana Sabrain, co-founder and CEO of OneAgrix tells Salaam Gateway.

“What we’ve done to tackle these challenges is to approach them in a holistic manner by [establishing an] ecosystem platform where we consolidate and simplify these challenges for buyers and suppliers, in partnership with shipping aggregators, trade specialists, reliable payment methods, and best-in-class traceability technologies.”

Enabling such traceability helps stakeholders in the food supply chain by shortening the time taken to trade in the export market. Agrifood and FMCG manufacturers also benefit from having a traceability system that helps them prepare their manufacturing facilities to become compliant as they export. This is especially important due to the increasing regulatory requirements in many countries.

“The main purpose here is to ensure that faith-based foods distribution is not disconnected in the global food supply-chain and that we can ship halal, kosher, and vegan food products globally,” says Sabrain.

OneAgrix showcased its traceability solution in Dubai, UAE in December 2022. In partnership with Switzerland’s Inexto, a provider of track and trace solutions, and Slovenia’s OriginTrail, a blockchain-based protocol designed for supply chain management, the company demonstrated the journey of Hill Farm Finest beef from their farm in Bedfordshire, UK, all the way to the distributor Longino & Cardenal in the UAE, and to the restaurant IL Borro in Dubai.

Using OneAgrix platform, diners could confirm the halal certification of Hill Farm Finest and of the slaughtering process, the integrity of the supply chain via serialization, as well as DNA analysis, showing the product was authentic.

“Given the complexities of today’s food supply chains, OneAgrix leverages and integrates AI, blockchain, serialization, anti-counterfeiting, and DNA analysis technologies to bridge the gap between food producers and suppliers, thereby enhancing connectivity, transparency, and traceability in the food industry,” says Sabrain.

Blockchain is known to provide an immutable, timestamped record of any data it stores. In OneAgrix’s case, certifications such as those for the farm and for the slaughtering process are placed on the blockchain at the time they’re declared, and it's impossible to go back in time to forge any declaration.

With traceability proving to be one of blockchain’s most powerful applications, other companies are now betting on the technology to ensure halal food conformance.

Among them is British blockchain solutions provider iov42 and Cardiff-based compliance services provider Prime UK. Together, the companies are developing a blockchain-facilitated data-sharing platform that would improve the traceability of halal meat specifically.

The project is being funded by the Welsh Government through Blockchain Connected, a network for the blockchain community in Wales. It is expected to improve trust in the halal market’s accreditation and certification schemes and to strengthen transparency in the local Welsh meat industry.

Bringing Muslims closer to their faith

Government agencies, too, are investing in emerging technologies, with the UAE’s General Authority for Islamic Affairs and Endowments, also known as Awqaf, planning to offer preaching lessons using 3D hologram technology.

The service would see a virtual, life-size preacher giving lessons from a website to an unlimited number of distant audiences and interacting with them. These lessons would be broadcast to multiple locations across the UAE, Awqaf said during GITEX 2022, without specifying a timeline for the project.

As the UAE’s reference for Islamic affairs, Awqaf is also gearing up to provide services via Amazon Alexa devices. Users would be able to ask the AI-powered voice assistant questions about Awqaf, set prayer times, listen to Friday sermons and to morning and evening Adkar (remembrances of Allah).

Hyper-personalized Islamic banking

In Islamic banking, the benefits of frontier technologies are particularly attractive. For example, the integration of AI has created extraordinary prospects for the sector in recent years, making it easier to screen investments for Shariah compliance and provide hyper-personalized experiences.

Hyper-personalization - a process that uses AI in conjunction with real-time data to create products, services or content that is highly tailored to individual customers - has become a business imperative.

Abu Dhabi Islamic Bank (ADIB) is one institution that has made AI central to its operations through the launch of its digital command center, ACE, in 2022. The AI hub incorporates big data and predictive analytics and transforms these into hyper-personalized insights. With this intelligence, ADIB can go to market with campaigns focused on customer needs.

Another institution harnessing AI to deliver personalized Islamic investment solutions is Maybank Asset Management. The Malaysia-headquartered fund manager launched a Shariah-compliant hyper-customized portfolio solution in November 2023 for high-net-worth investors in the country.

Built in partnership with UK investment advisory and tech firm Arabesque AI, the new platform leverages the power of AI and data analytics to construct portfolios that align with Shariah principles and investors’ objectives.

“We firmly believe in the convergence of sustainability and technology as the driving force for a more sustainable future. It's no longer sufficient for investments to yield returns; we must scrutinize how they're generated,” says Omar Selim, CEO of Arabesque Group.

“In a world where investors prioritize societal impact and values, the true power of AI lies in crafting highly personalized portfolios down to the individual stock level. This values-driven shift reshapes finance for a more sustainable future.”

As businesses in Muslim markets continue to embrace digitalization and reap the benefits of tech advancements, the use of frontier technologies in the Islamic economy will most likely expand in the years to come.