How Saudi Arabia is turning religious tourism into a growth engine

Like millions of Muslims worldwide, when 72-year-old Ahmad traveled to Saudi Arabia to perform Hajj with his son and grandchildren, he was struck by how much had changed since his first pilgrimage in 1987.

Recalling his parents’ experiences, who had sailed from Pakistan and relied on acquaintances and makeshift shelters back in the 1960s, the change was even more startling.

From e-visa registrations to climate-controlled tents and real-time crowd monitoring, everything was more coordinated and streamlined as Saudi Arabia continues its attempt to strengthen its tourism sector, backed by the rising number of religious devotees.

Religious tourism as a core growth engine

When Saudi Arabia launched its Vision 2030 plan in 2016, tourism was positioned as a key pillar of economic diversification, with religious travel viewed as the kingdom's most scalable and dependable asset. Nearly a decade later, the results are surpassing initial benchmarks.

In 2024, over 18.5 million pilgrims visited the kingdom - 16.9 million for Umrah and 1.61 million for Hajj, according to data reported by Skift and the Ministry of Hajj and Umrah. The goal is to welcome 30 million Umrah pilgrims annually by 2030.

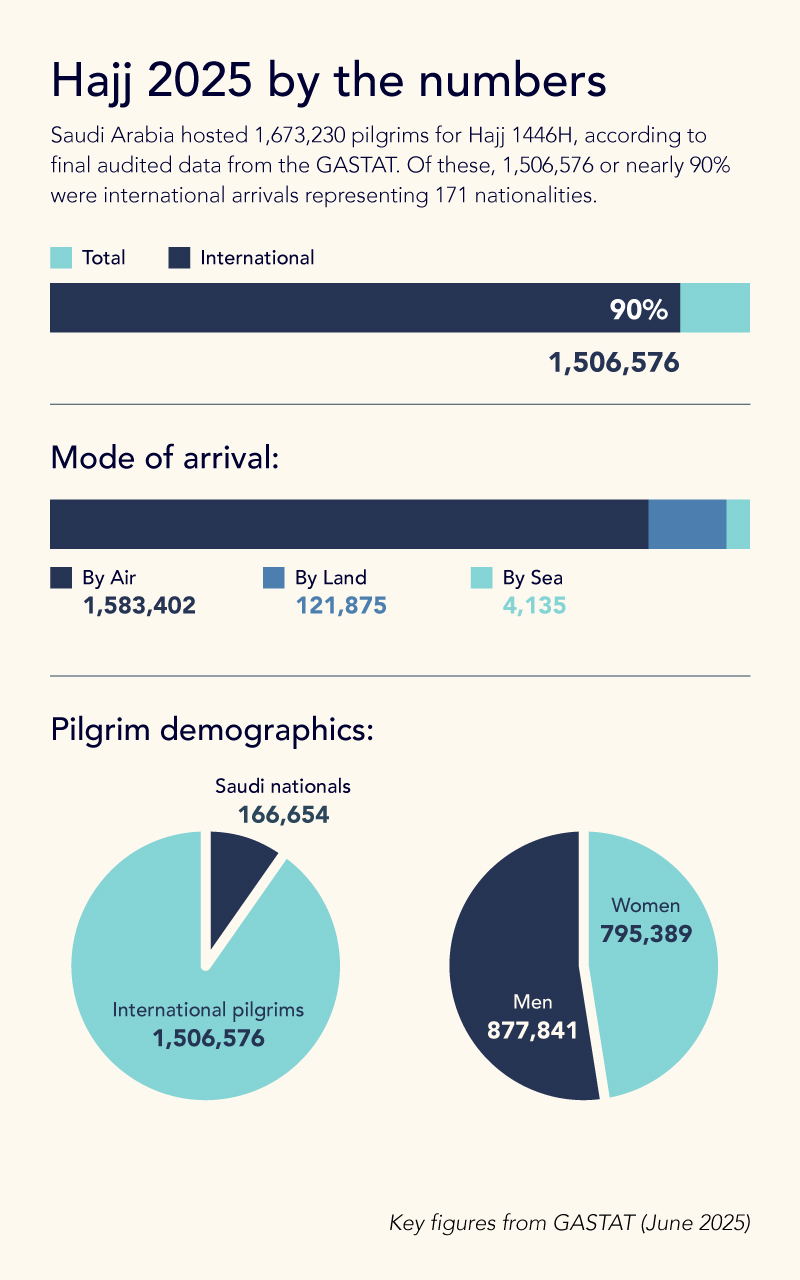

According to the kingdom's General Authority for Statistics (GASTAT), 1.67 million pilgrims performed Hajj in 2025, with the vast majority - 1.51 million people from 171 countries - arriving from abroad.

Breaking the numbers down further, in 2025, air travel dominated arrivals (1.58 million), while land and sea routes together accounted for 8%.

The demographic split between men and women was almost down the middle, with 878,000 and 795,000, respectively. There were only 10% Saudi nationals for Hajj, which illustrates that the annual pilgrimage remains, first and foremost, a global gathering.

While the total attendance dropped 8.5% from 1,833,164 pilgrims recorded in 2024, Hajj 2025 remained the world's largest coordinated religious convention.

While the total attendance dropped 8.5% from 1,833,164 pilgrims recorded in 2024, Hajj 2025 remained the world's largest coordinated religious convention.

The other main pilgrimage is Umrah, which, unlike Hajj, operates year-round and continues to drive volume growth.

According to GASTAT and the Ministry of Hajj, 6.5 million international visitors performed Umrah in the first quarter of 2025 alone, an 11% jump on the previous year.

This was owed to an expanded e-visa scheme that now covers more than 60 countries and to an airline network rapidly stitching new routes across Asia and Africa.

Vital contribution

Religious tourism contributes roughly $12 billion annually to Saudi Arabia's economy, making up nearly 20% of the non-oil economy and around 7% of the total GDP, according to Astrolabs Insights 2024.

Spending data from Visa's Travel Pulse Index for Ramadan 2025 showed a 162% year-on-year surge in Makkah during the holy month, with food and beverage comprising 27% of transactions, followed by accommodation and transport.

In Madinah, spending rose 64% during the same period, with official data suggesting pilgrims typically spend between $1,300 - $4,000 per trip, depending on the package and duration.

The sector also delivers employment opportunities. In 2023, religious tourism supported over 936,000 jobs, with projections rising to 1.6 million by 2030 as Umrah capacity and infrastructure grow.

Megaprojects building a pilgrim metropolis

Saudi Arabia's infrastructure investments under its Vision 2030 transformation agenda are reshaping the physical landscape of pilgrimage.

From hotel expansions to rail upgrades and enhanced airport capacity, these megaprojects are designed to scale the volume and quality of religious tourism.

In Makkah, the Masar Destination project on King Abdulaziz Road, is a $26.6 billion mixed-use corridor, which will host 24,000 hotel rooms and 13,000 residential units, accommodating up to 158,000 pilgrims annually.

The Rua Al Madinah redevelopment in Madinah reportedly spans 1.5 million square meters and will add 47,000 keys, host 149,000 visitors, and create 93,000 jobs across hospitality, transport, and retail.

Radisson Hotel Group also announced two new properties in Madinah with further expansion planned, citing the city's more stable, year-round demand. Wyndham Hotels & Resorts plans to open 100 Super 8 hotels by 2030, many in Makkah and Madinah's mid-market segment.

In addition to this, major upgrades in air and rail are also underway. For instance, the King Salman International Airport in Riyadh will feature six runways and handle up to 120 million passengers annually by 2030, with a capacity set to reach 185 million by 2050.

The Haramain High-Speed Railway added two million seats in 2025, and transported nearly 70% of international Umrah pilgrims this year between Jeddah, Makkah, and Madinah in under 45 minutes.

During Hajj, the Mashair Metro supported last-mile transport, moving up to 72,000 passengers per hour across key ritual sites, including Mina, Arafat, Muzdalifah, Jamarat, and the Grand Mosque.

Digital pilgrim and smart Hajj

Saudi Arabia's Smart Hajj initiative is transforming the pilgrimage experience through AI, mobile platforms, and real-time data systems.

At the center of this digital transformation is Nusuk, the official Hajj and Umrah "super-app," which offers e-visa processing, itinerary updates, cashless payments, and access to transport and emergency services.

As of early 2025, Nusuk had surpassed 12 million downloads and is now available in 14 languages. Pilgrims are also issued RFID-enabled smart cards that store personal, medical, and logistical data.

The Ministry of Interior deployed over 2,000 drones and smart surveillance cameras across the holy sites during this year's annual pilgrimage. These AI-powered systems feed into a central control room that uses satellite imagery and predictive analytics to detect and resolve crowd bottlenecks in real-time.

Transit systems have also been upgraded. The Mashair Metro now adjusts train dispatch frequencies based on crowd density. In 2025, train intervals were reduced by up to 60% during peak congestion to ease platform pressure.

Inclusivity is also improving. In 2024, the Ministry of Hajj and Umrah introduced VR orientation modules for elderly and first-time pilgrims. Offered in over 10 languages, the program helps users become familiar with the rituals before arrival.

From Hajj-only to Umrah plus

To extend stay durations and increase visitor spending, the Ministry of Tourism has launched a program encouraging pilgrims to combine religious rites with visits to destinations such as Jeddah's Al-Balad, Taif, or the Red Sea coast.

The initiative aims to boost the average length of stay from five to nine nights and lift per capita spending beyond $1,000 by integrating culture, heritage, and leisure with religion.

Meanwhile, Saudi Arabia's stopover program offers 96-hour transit visas with complimentary hotel stays, further supporting extended visits.

This approach helps reduce seasonality, distributing traffic beyond peak Hajj and Ramadan periods, and creates year-round demand for transportation, accommodation, and local services.

Muhammad Ali Bandial