Ikhlas plans to take off with Umrah travel services

Ikhlas, a platform supporting Muslim communities worldwide by providing digital access to faith-based practices, is turning two. Salaam Gateway spoke to the platform’s head, Ikhlas Kamarudin.

COVID-19 restrictions may have interrupted their initial launch plan, but Malaysia-based Ikhlas is now getting ready to take off with Umrah packages as travel restrictions are lifted and Saudi Arabia begins opening up.

Founded by Malaysia’s largest airline by fleet size, AirAisa, and named after Al-Ikhlas, the 112th chapter of the Quran, Ikhlas launched in Malaysia in March 2020.

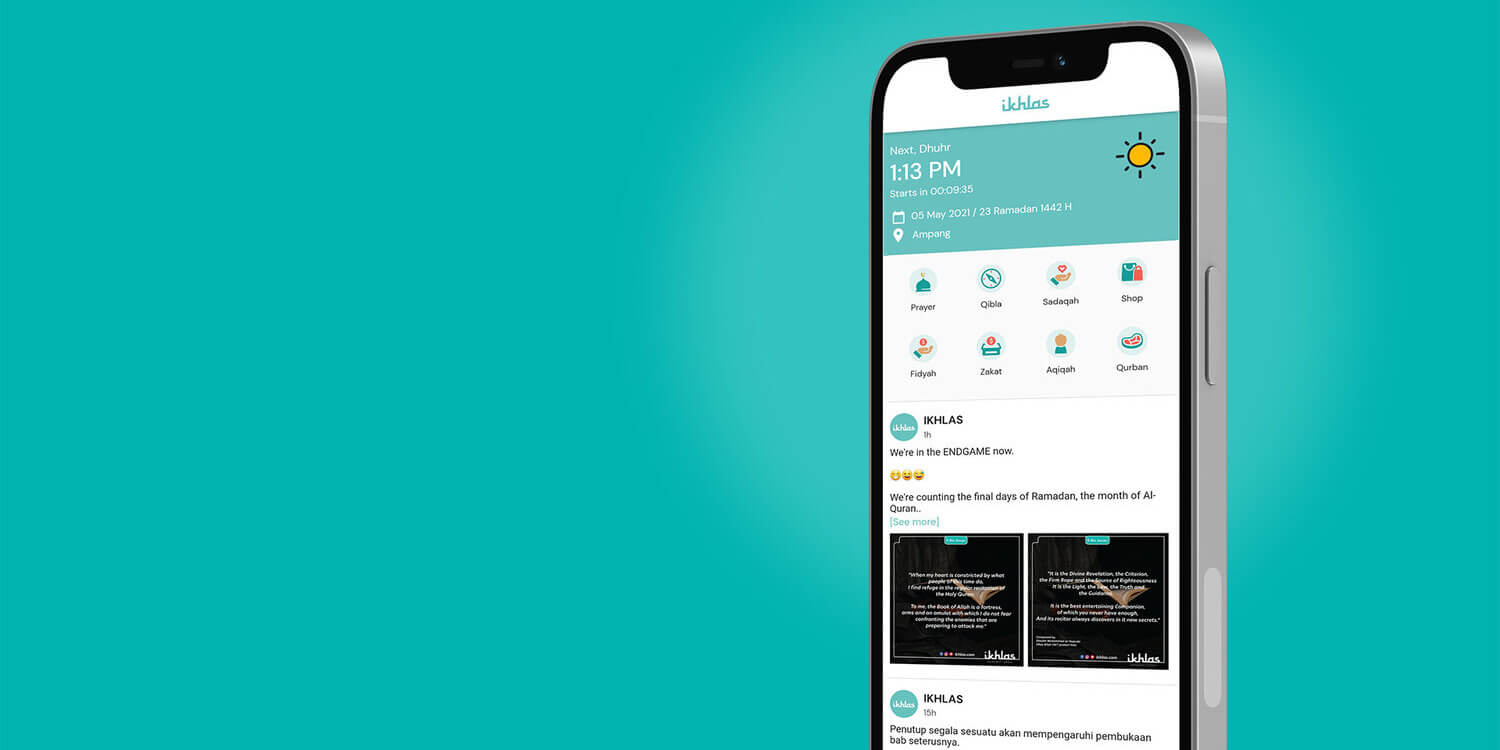

Reflecting on the company’s beginnings in the middle of a pandemic, Ikhlas Kamarudin, Head of Ikhlas, told Salaam Gateway that “it’s been a bit challenging.” Adapting to the changed market conditions, the team focused on bringing out Qurban, Zakat and other Shariah-compliant lifestyle services, including Aqiqah, Fidyah and Sadaqah.

The platform experienced success with the “Give with Ikhlas” campaign, an online-based donation initiative to feed the underprivileged in Malaysia: “We collected around 1.3 million Malaysian Ringgit ($300,000) and got to help 20,000 families,” Kamarudin said. Adjusting to the market conditions, the company implemented a diversification strategy and launched ‘Shop with Ikhlas’ in March 2021. “We’re trying to stay relevant in a very challenging time,” Kamarudin said.

In the past eleven months, the number of merchants selling via the ‘Shop with Ikhlas’ platform increased from 15 to over 100. They offer a range of more than 1,000 products such as prayer items, groceries, fashion, books, jewellery and household items.

The Ikhlas team, which has grown from four to 25 people over the past two years, developed technologies and services, such as calculating and paying Fidyah and performing Qurban online, in-house. For Zakat, the company works with an external partner as Malaysia has developed a system for collecting and redistributing zakat through state institutions.

As movement restrictions are easing, Kamarudin hopes to finally go ahead with the launch of the Umrah travel service. An internal survey carried out by the company confirms the interest. Of the about 4,000 participants, 60% to 70% said they are interested in going to Saudi Arabia for Umrah towards the end of the year.

“We’re planning something pretty big after the Hajj season,” Kamarudin added without divulging further details.

Although Ikhlas is part of the Capital A Group, formerly known as AirAsia Group, the company intends to work with other airlines to offer a variety of Umrah packages. Kamarudin sees the affiliation with AirAsia as a unique selling point, emphasising inventory control, the process of allocating seats among fare classes on a flight leg. He, however, acknowledges that customers want choice and the opportunity to personalise packages.

“Having more airlines to work with and having more suppliers assists our best-service and best-price practises,” Kamarudin said. “It also democratises Umrah,” he added. “Umrah has always been dominated by travel agents. It's somewhat like a union here controlled by the agents.”

AirAsia Group Berhad announced a name change for the group holding company to become Capital A Berhad in January 2022. The name change reflects the group’s new core business strategy as an investment holding company with a portfolio of synergistic travel and lifestyle businesses across the aviation, digital engineering and ventures verticals.

“We are not just an airline anymore,” CEO of Capital A, Tony Fernandes, said at the announcement event held in Kuala Lumpur.

According to Fernandes, the airline business will continue to underpin the AirAsia brand. However, non-airline businesses are expected to bring in up to 50% of the group’s revenues by 2026, leveraging data and technology.

Struggling financially since the COVID-19 pandemic, the group’s third-quarter 2021 revenue has been further declining by 37% year-on-year to 296 million Malaysian Ringgits ($70.7 million), resulting in a loss before tax of 895 million Malaysian Ringgits ($214 million). The digital businesses such as bigpay, a money app for which Capital A is currently seeking a digital bank licence in Malaysia, contributed 60% to the revenue.

Listed on Bursa Malaysia, the company informed the stock exchange on 3 February that it “is in the midst of formulating a regularisation plan to address its financial condition.” Like the broader group, Ikhlas welcomes funding.

“We are looking for external parties to come into the business to let us grow aggressively, not only in Malaysia, but also in Indonesia and other Asian countries,” Kamarudin said.

© SalaamGateway.com 2021 All Rights Reserved