Indonesian’s first listed e-commerce unicorn Bukalapak to expand Shariah features after $1.5 billion IPO

JAKARTA – Following its $1.5 billion initial public offering (IPO) on Friday (August 6), Indonesian e-commerce unicorn Bukalapak plans to expand its Shariah features in the medium-term, Yenny Wahid, its commissioner told Salaam Gateway.

The online marketplace currently has several Shariah features, including BukaZakat (zakat payment), BelanjaBerkah (halal industry virtual stores), an Islamic payment gateway, Islamic financing and BukaReksa Syariah (Islamic mutual fund investments).

The company plans to bring more of its 6 million merchants and 6.9 million online sellers into the halal value chain.

“In general, the buying and selling or transactions of all product categories in our marketplace are Shariah-compliant. But we will definitely facilitate and encourage our sellers to participate in the halal value chain, especially the creation of halal industry products,” said Yenny.

Bukalapak’s share transactions on the Indonesia Stock Exchange are Shariah-compliant and supervised by its Shariah supervisory board.

Less than 11% of Bukalapak’s revenue is non-halal and interest-based debt accounts for less than 46% of its total assets. The company does not participate in non-Shariah-compliant businesses such as producing, distributing, trading, or providing illicit goods or services, or other haram goods and services.

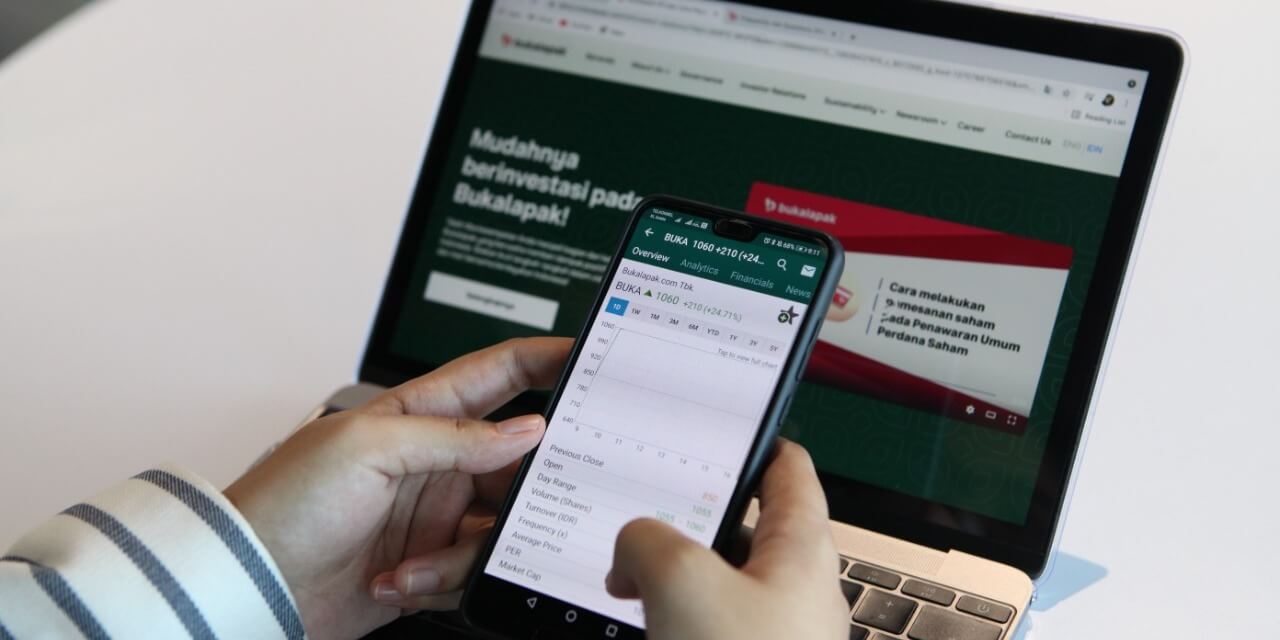

Bukalapak offered 25.76 billion shares at an offering price of 850 rupiah ($0.06) per share, the largest IPO in the history of Indonesian capital markets and the first-ever listing of a technology unicorn on a Southeast Asian stock exchange, according to the company’s President Director Rachmat Kaimuddin.

The proceeds of the IPO, which is approximately around 21.9 trillion rupiah ($1.5 billion), will be used for the working capital of Bukalapak and its subsidiaries.

Bukalapak appointed UBS AG Singapore Branch and Merrill Lynch (Singapore) Pte Ltd as Joint Global Coordinators and International Selling Agents to market the IPO to international investors. PT Mandiri Sekuritas and PT Buana Capital Sekuritas were appointed as Joint Lead Managing Underwriters.

The company received orders from around 100,000 domestic and international investors and was 8.7 times oversubscribed. Of the total proceeds, 5%, or around 1.1 trillion rupiah, came from retail investors.

"We are truly grateful that interest in our shares remains high even in the middle of the COVID-19 pandemic. This reflects the trust in us, a company that focuses on empowering MSMEs, which are primary drivers of the Indonesian economy and key to our country's economic potential,” Rachmat told Salaam Gateway.

“Regarding our support for the halal value chain, I am sure that all of our transactions are indeed already Shariah-compliant,” said Rachmat.

“I feel that Bukalapak, as with other Indonesian unicorns, is undervalued and worth a decent punt. I am also planning to bid for GoTo shares when the company is listed and I hope that they list in Indonesia,” Nicholas Jayabuana, one of BukaLapak’s retail investors told Salaam Gateway, referring to the tech giant formed in May after a merger between Gojek and Tokopedia.

© SalaamGateway.com 2021 All Rights Reserved