Is Iran teetering on the economic brink?

Iran’s government may be under stress, but it retains coercive stability, according to analysts.

“The regime is under very strong pressure, certainly. The most problematic is the leadership succession, which has no obvious answer. We may therefore yet see some changes, but I think we’re far away from a collapse in the government’s ability to provide basic services and maintain a monopoly on the use of force within the territory,” Vladimir Gorshkov, macro policy strategist at State Street Investment Management tells Salaam Gateway.

Conflict sparked in Iran on December 28 when protests broke out in two major markets in the country’s capital, Tehran, after a spike in inflation pushed food prices higher. The head of Iran’s central bank resigned the following day as demonstrations spilled over to other cities.

“Iran is experiencing administrative failure (collapse of services and currency) but retains coercive stability. The security apparatus remains cohesive and loyal,” Khaled Al Terkawi, an economist advisor at Etunum tells Salaam Gateway.

Iran has been contending with challenges emanating from economic sanctions, political turmoil and fiscal deficits for years. US President Donald Trump reimposed sanctions during his first term in 2018 while the United Nations reimposed its sanctions last September. The country’s social and economic plight was exacerbated with Israeli and American airstrikes targeting its military brass and nuclear sites last June.

The country’s economic woes continue - the International Monetary Fund forecasts Iran’s economy to grow 1.1% this year and 1.6% in 2027, in its January report. The figures remain unchanged from the fund’s October 2025 projections.

In its last October regional economic outlook report for the Middle East and Central Asia, the fund projected Iran’s government debt to increase to 36.4% of its GDP in 2026, and 39.3% by 2030. Meanwhile, inflation has more than doubled in the last five decades, from 20.6% in 1980 to 42.4% in 2025.

“The sanctions imposed on Iran, coupled with the scale of its military spending have all contributed significantly to the weakening of the currency,” adds Terkawi.

“Consequently, the currency is currently in its worst state, and this decline is perhaps the root cause of most of the problems. Therefore, addressing inflation will primarily involve tackling the currency collapse and, on the other hand, reducing the government's excessive spending on unproductive matters.”

Iran’s 2026 draft budget presented to its parliament days before the protests began, proposed a 2% rise in value-added tax from 10% to 12%, with Iranian consumers and employees expected to assume the maximum weight of the tax rise. The proposal suggested a 20% increase in salaries for government employees and retirees, against an inflation rate of more than 40%.

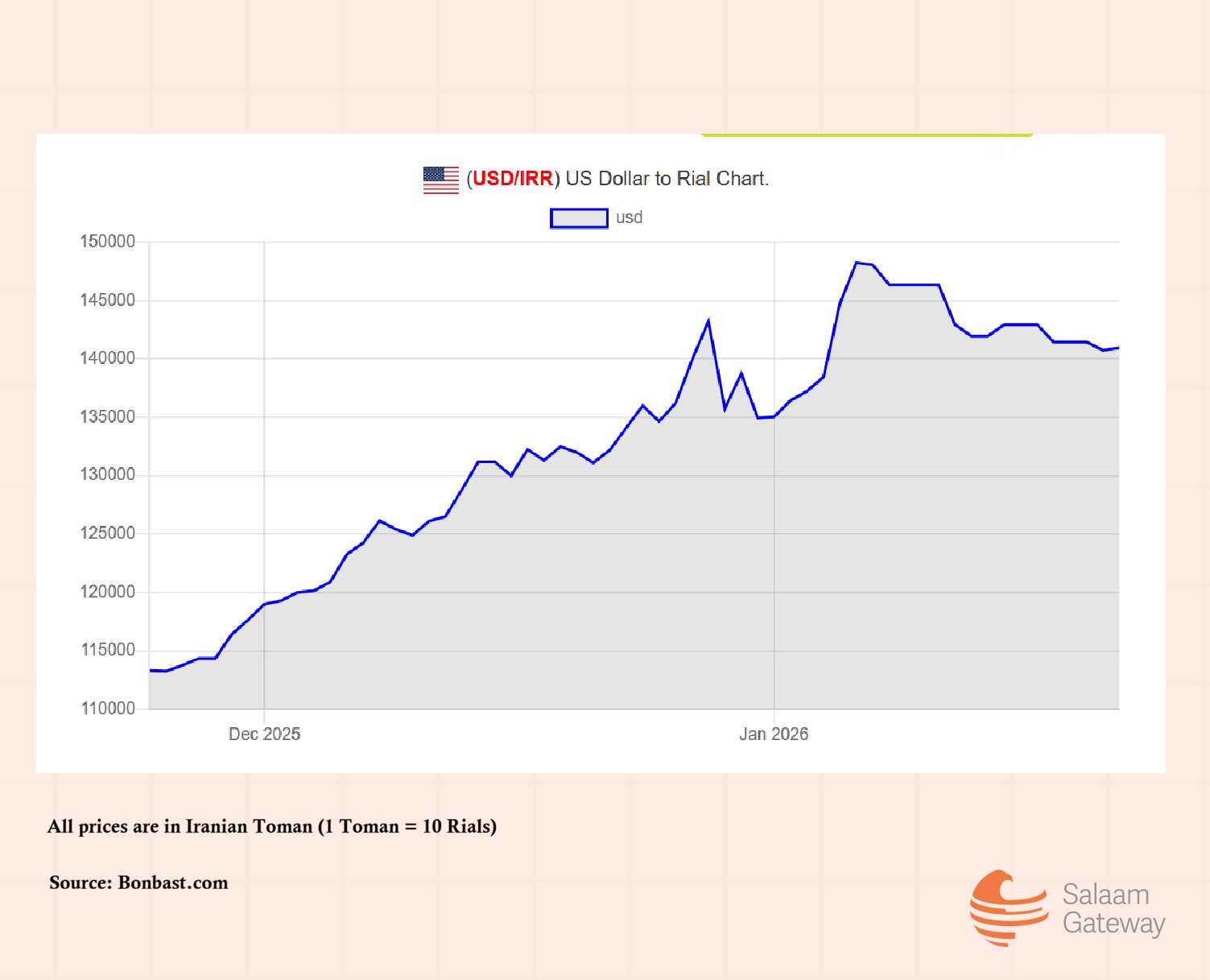

Iranian rial fell from 1.12 million to $1 on December 12 to 1.43 million to $1 on December 28. It traded at an all-time low of 1.48 million to $1 on January 6, according to Bonbast.com, a website that tracks live exchange rates in Iran’s free market.

“The sharp depreciation is a massive loss of purchasing power for the population; a sad reality that will be all too familiar. The sell-off has an element of panic. Seeing the currency slide has prompted capital flight; people buying gold, USD, stablecoin -- to preserve the value of their savings,” says Gorshkov.

Terkawi believes the rial's decline to around 1.5 million against the dollar indicates a structural, not merely technical, bottom. It reflects long-term expectations and a complete erosion of confidence, leading to rapid memory loss and the dollarization of the economy.

President Trump has threatened to impose a 25% tariff on countries that do business with Iran, complicating the country’s economic abyss. Gorshkov feels that imposing such a tax would conflict with other objectives.

“It’s not clear yet what how the administration aims to implement these, if at all, as imposing the tariff would conflict with other foreign policy objectives. For example, China is Iran’s largest export destination, but to slap a new tariff on that relationship risks upending the ongoing trade truce.”

“This suggests selective implementation at best and probably just the threat thereof. It will therefore not a game-changer. But in a world where Iran can use every marginal dollar that it can get its hands on, it matters,” adds Gorshkov.

The new tariffs, however, will act as secondary sanctions, punishing third parties for trading with Iran, notes Terkawi.

“This exacerbates the crisis by forcing deeper discounts on Iranian oil exports (slashing revenue despite volume) and severing supply chains for basic goods, further fueling inflation and panic.”

The Iranian government’s directive to sever internet services on January 8 has compounded the country’s economic plight, costing the economy tens of thousands of dollars in financial loss.

Iran’s deputy minister of communications and information technology, Ehsan Chitsaz, put the economic cost of the internet outage at $2.8 million to $4.3 million a day, according to Iran’s state-run news agency IRNA.

Actual costs may be significantly higher, with NetBlocks, a digital governance and connectivity tracker, reportedly estimating that internet shutdown could costs the country over $37 million each day.

Root and branch reform

Terkawi suggests that the currency needs to regain confidence, not just undergo a change. Moreso, a comprehensive financial audit is necessary.

“The government must immediately address the absence of financial action task force recommendations to release foreign oil reserves and their associated interest. Without foreign currency inflows, this monetary opportunity becomes ineffective.”

The government must cease deficit financing (financial printing and debt guarantees). Without these structural corrections, superficial measures like redenomination (removing zeros) become practically ineffective, he adds.

Editor