Islamic Economy sectors contribute AED41.8 billion to Dubai’s GDP in 2018, registering 2.2% growth

Hamdan bin Mohammed:

- Mohammed bin Rashid’s vision led to increasing the Islamic economy’s contribution to Dubai’s GDP – an outcome supported by the emirate’s expertise, advanced infrastructure, and strategic geographical location

- Islamic Economy sector is a key player in our national economy

Government of Dubai Media Office - 13 June 2020: His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Chairman of The Executive Council of Dubai and General Supervisor of the Dubai: Capital of Islamic Economy Initiative, said that as the global hub of the Islamic Economy, Dubai is well placed to lead the sector’s contributions to revitalising the regional and international economy in the post-COVID-19 phase.

His Highness noted that the rising role of Islamic Economy in the broader national commercial and financial system is the result of the vision of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, who laid the foundation for the solid growth of the sector. Anticipating its potential early on, he called for the development of an innovative economic system that aligns with the ethics and principles of Islam, and actively contributes to Dubai’s GDP, while strengthening the emirate’s position as a global economic hub.

With its focus on protecting social and human wellbeing, the Islamic Economy can contribute significantly to mitigating the economic repercussions of the COVID-19 pandemic and the revival of the global marketplace. The Islamic Economy ecosystem based out of Dubai can help the sector play an important part in the economic response to the COVID-19 crisis, he further said.

HH Sheikh Hamdan said Islamic Economy sectors contributed AED41.8 billion to Dubai’s GDP in 2018, registering a growth of 2.2 per cent over the previous year. He noted that these results are testament to Dubai’s position as the global capital of Islamic economy, in line with the wider objectives of the Dubai: Capital of Islamic Economy initiative.

He added that the increased contribution of the Islamic economy to Dubai’s GDP is an organic outcome of Dubai’s expertise, advanced infrastructure, strategic geographical location, and its commitment to becoming the preferred investment destination for various Islamic economy sectors.

Furthermore, HH Sheikh Hamdan pointed out that the recent accomplishments of the Dubai: Capital of Islamic Economy initiative will encourage all the stakeholders of the Islamic economy to keep up their exemplary efforts. He called on the strategic partners of the initiative to enhance awareness of the pivotal role that Dubai and the wider UAE are playing in innovative policy making to accelerate the performance of Islamic economic sectors, and of the practical solutions Islamic economy offers to global financial and economic challenges.

Transforming Challenges into Opportunities

For his part, His Excellency Sultan bin Saeed Al Mansouri, Minister of Economy and Chairman of the Dubai Islamic Economy Development Centre (DIEDC), noted that despite the unprecedented circumstances the world finds itself in today as it combats the impact of the COVID-19 pandemic, the UAE’s ability to control the spread has come in for praise. He noted this is an example of the vision and ability of His Highness Sheikh Mohammed bin Rashid Al Maktoum in dealing with crises, mitigating their economic repercussions, and transforming challenges into opportunities.

Pillar of the diversified national economy

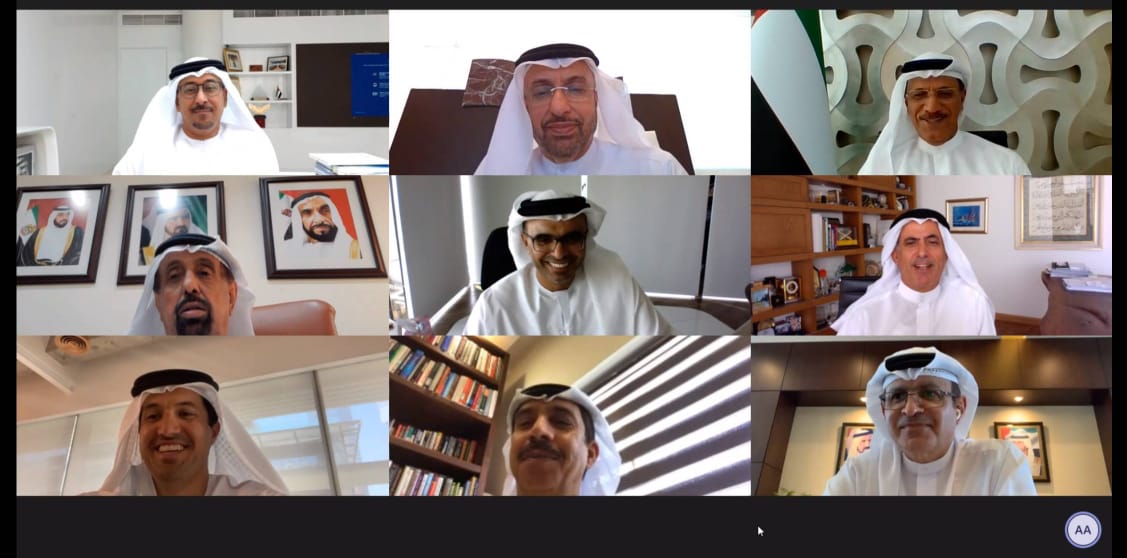

Chairing the DIEDC board meeting that was recently held virtually, His Excellency Sultan bin Saeed Al Mansouri said: “The Islamic economy is a pillar of the diversified national economy. Being a more just and transparent economic system, it strikes the required balance between wealth accumulation and distribution, while supporting comprehensive long-term growth. It’s ethics and principles play a crucial role in its high uptake and enable the nations of the world to achieve sustainable development even during challenging times.”

Remarkable Growth

His Excellency Sultan Al Mansouri added: “Since 2013, when His Highness Sheikh Mohammed bin Rashid Al Maktoum announced the Dubai: Capital of Islamic Economy initiative, we have been taking significant strides in positioning Dubai as the global capital of Islamic economy, and as a destination for diverse industry stakeholders. It is encouraging to note that the executive plans of the initiative are witnessing incredible progress due to the close collaboration and team spirit between DIEDC and its strategic partners spanning the public and private sectors.”

The Minister said: “The increase in the contribution of the Islamic Economy to Dubai’s GDP reinforces the confidence of international investors in the UAE’s flexible and enabling business environment. These factors, combined with its strong legislative framework, and advanced technological infrastructure have helped the UAE to maintain its status as a preferred investment hub on the global landscape.”

Dubai’s Position

During the board meeting, Abdulla Mohammed Al Awar, CEO of DIEDC, outlined the planned phases in developing a unified global legal and legislative framework for the Islamic finance sector, within the context of a strategic partnership between DIEDC and the Islamic Development Bank (IsDB). He highlighted the significance of the project that once complete, will bring much anticipated standardisation to the Islamic finance sector, reduce discrepancies in practices across the globe, and eventually translate into positive outcomes for the Islamic Economy as a whole.

2.2 Per Cent Growth in Islamic Economy Contribution

According to the Dubai Statistics Center, a strategic partner of DIEDC, the Islamic economy contributed AED41.84 billion to Dubai’s GDP in 2018, marking a 2.2 per cent increase from AED40.95 billion in 2017.

In terms of percentage growth, the Islamic economy contributed 9.9 per cent to Dubai’s GDP in 2018. Of the total amount, AED10.7 billion (26 per cent) came from the financial sector, AED7 billion (17 per cent) from the hospitality and F&B sectors, AED17.9 billion (43 per cent) from the retail and wholesale sectors, while the manufacturing sector contributed AED6.2 billion (14 per cent).

Copyright Press Releases 2020

Press Release