How open banking can help advance Islamic finance

Banks are regulated businesses, designed to function as conservative institutions. But in today’s tech-driven world, where the consumer values agility and convenience, siloed operations could impact an organization’s consumer pool, and ultimately its bottom line. Regulators cognisant of the shifting sands of the world’s financial landscape are accelerating innovations such as open banking to create a more interconnected environment.

Open banking enables third-party providers to access customers’ financial data from traditional banks through application programming interfaces (APIs) in a secure format. Data can be shared with authorized parties such as fintechs, digital platforms and other banks.

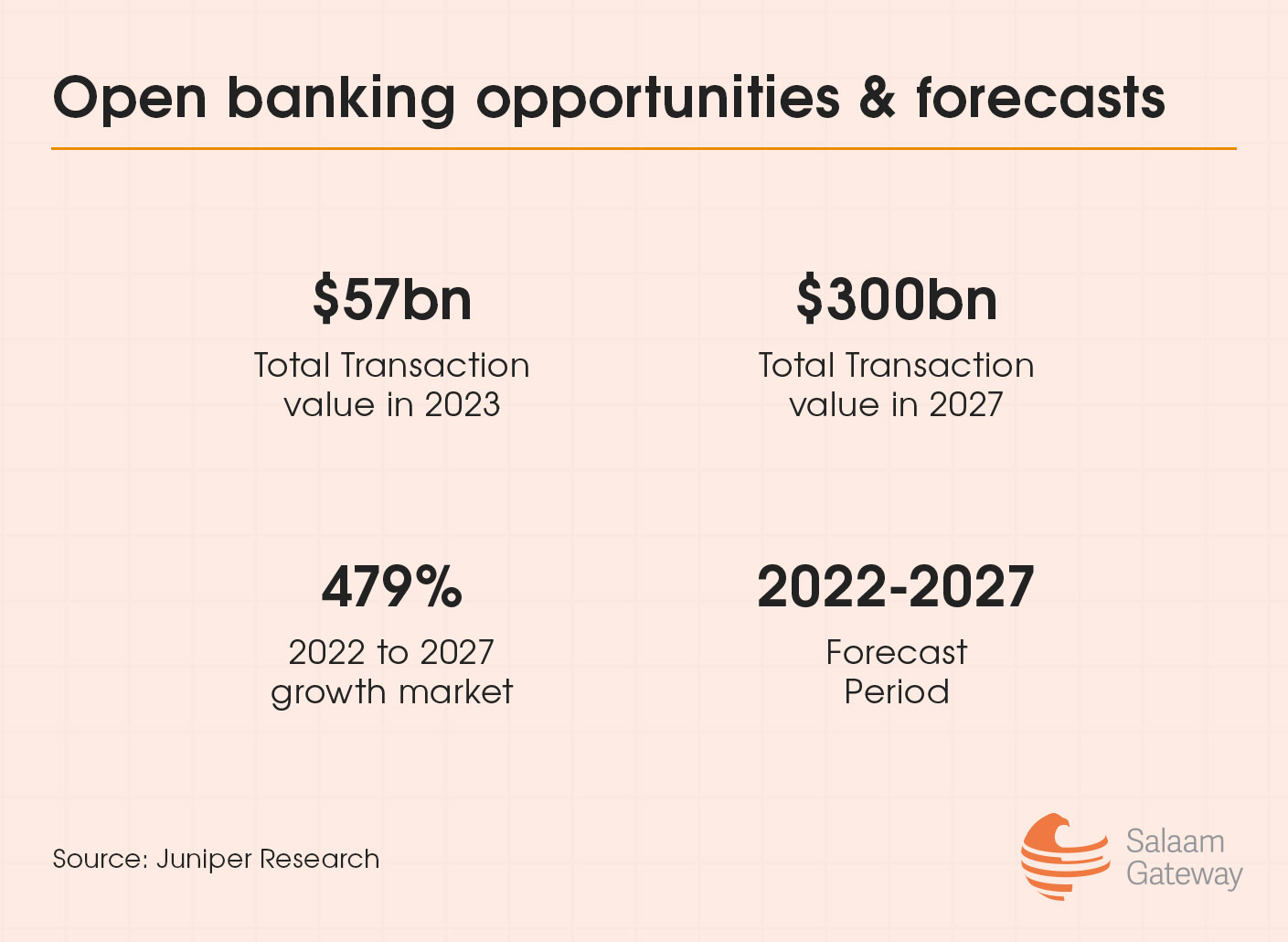

The new model introduces an open framework that looks to transform the financial services landscape, offering a string of cost-effective and innovative financial products. A Juniper Research study suggests open banking payments transaction value will grow from $57 billion in 2023 to more than $300 billion globally by 2027.

Islamic banks can look to capitalize on this rising tide to ensure continuous integration with Shariah-compliant entities to cater to a young and growing Muslim consumer base.

Islamic banks can look to capitalize on this rising tide to ensure continuous integration with Shariah-compliant entities to cater to a young and growing Muslim consumer base.

“Islamic banks and fintechs have the potential to unlock a treasure trove of innovative solutions through open banking and APIs. Imagine a scenario where personalised financial planning becomes the norm rather than the exception. For example, a major Islamic bank could use APIs to gather a customer’s financial data from multiple accounts and institutions,” said Najmul Haque Kawsar, senior consultant at DinarStandard.

“By analysing this aggregated data, the bank could offer personalised investment portfolios that comply with Shariah principles, such as Sukuk (Islamic bonds) and equity funds free from haram activities like gambling or alcohol. It’s akin to having a personal financial advisor who understands your unique values and needs.”

A 2022 study conducted by IslamicMarkets.com revealed Islamic finance professionals believe open banking will mean greater use of fintech innovations in Islamic finance such as Waqf, Zakat and Sadaqah. Among the 346 professionals surveyed in August that year, 90% confirmed the adoption of open banking by financial institutions, governments, fintechs and other stakeholders would increase by 2025.

Growth of open banking in Islamic finance will be driven - in part - by more and better regulations, the study found.

“Imagine an Islamic fintech developing a Zakat app integrated with users’ bank accounts via open banking APIs. This app could automatically calculate Zakat based on real-time financial data, including cash, savings, investments, and gold holdings,” said Kawsar.

Faysal A. Ghauri, founder and CEO of Halal Payments Network adds that open banking has significantly eased the process of managing Zakat and inheritance, ensuring compliance with Shariah law.

“Managing inheritance in line with Shariah law can be complex. Open banking simplifies this by integrating with digital wills and inheritance platforms. Also, with open banking APIs, charitable giving becomes seamless. Fintech platforms allow users to automate donations and track contributions, aligning with religious commitments,” Ghauri explained.

Navigating challenges

Muslim-majority countries are at varied stages of open banking development.

Regulators in the GCC have been quick to recognize the potential of open banking to transform traditional banking services within the region, an Infomineo report suggested. It identified Bahrain as a regional leader, having adopted open banking rules in 2018, while Qatar Central Bank is prepping a framework for release by 2026.

While Bahrain launched its open banking framework in 2020, followed by Saudi Arabia two years later, the UAE has issued its open finance regulation this year. Oman’s Sohar International has introduced what is claimed to be the sultanate’s first API banking portal this year, potentially paving the way for other institutions, too.

Across Southeast Asian countries, Bank Negara Malaysia issued a policy document on the development of Open API for open data by financial institutions in 2019. Indonesia's central bank has developed a blueprint as a policy to promote the integration of the national digital economy and finance. The Indonesia Payment System Blueprint 2025 lists open banking as one of its five key initiatives.

However, varied stages of open banking development and adoption across markets can create barriers for cross-border integration and growth. Global adoption can also be crippled by different interpretations of Shariah compliance.

“Each country has unique regulatory frameworks, complicating global expansion. The differing interpretations of Shariah compliance between Malaysia and GCC countries are a notable example. Navigating these variations requires substantial resources,” said Ghauri.

“[Also], different jurisdictions interpret Shariah law differently, necessitating customized compliance strategies. The Islamic Financial Services Board (IFSB) identifies standardization of Shariah rulings as a critical challenge. Compliance with varying data protection laws, such as the EU’s GDPR [General Data Protection Regulation] and Middle Eastern regulations, adds another layer of complexity. Ensuring data security across borders is paramount.”

DinarStandard’s Kawser believes navigating the complex regulatory [framework] warrants a careful balancing act between financial regulations and Shariah law.

“Ensuring new technologies and services adhere to Shariah principles requires continuous consultation with Shariah scholars and robust governance frameworks. Consider the meticulous vetting needed to ensure a new product, like an Islamic robo-advisor, avoids interest and speculative elements.”