Islamic finance roundup: Emirates Islamic partners with Swiss firm to unveil Shariah-compliant products

Here's a roundup of key developments across the Islamic finance ecosystem during June

Editor's Note: The Islamic finance space is humming, with lenders either launching innovative Shariah-compliant products or transitioning into full-fledged Islamic lenders. Bank Muamalat went a step ahead to launch Malaysia's first digital-only Islamic bank.

Company News

UAE / Switzerland

Emirates Islamic partners with Leonteq to unveil Shariah-compliant products

Emirates Islamic, a UAE-based Islamic financial institution, has formed a new partnership with Leonteq Securities AG, a Swiss-based structured product issuer, to distribute Shariah-compliant structured products.

This collaboration aims to enhance Emirates Islamic's offering in the wealth management sector, combining relevant solutions that are aligned with customers’ evolving needs while adhering to Islamic principles. (Zawya)

Kyrgyzstan

EcoIslamic Bank transitions to an Islamic bank

On June 3, the National Bank granted EcoIslamic Bank a license to conduct banking operations in accordance with Islamic principles for both national and foreign currencies.

This new license replaces the previously issued one as part of the conversion of EcoIslamic Bank CJSC into a fully-fledged Islamic bank.

Since its establishment, EcoIslamic Bank has been operating under Islamic principles as part of a pilot project. (Akchabar)

Image Courtesy: Fintech Futures

Malaysia

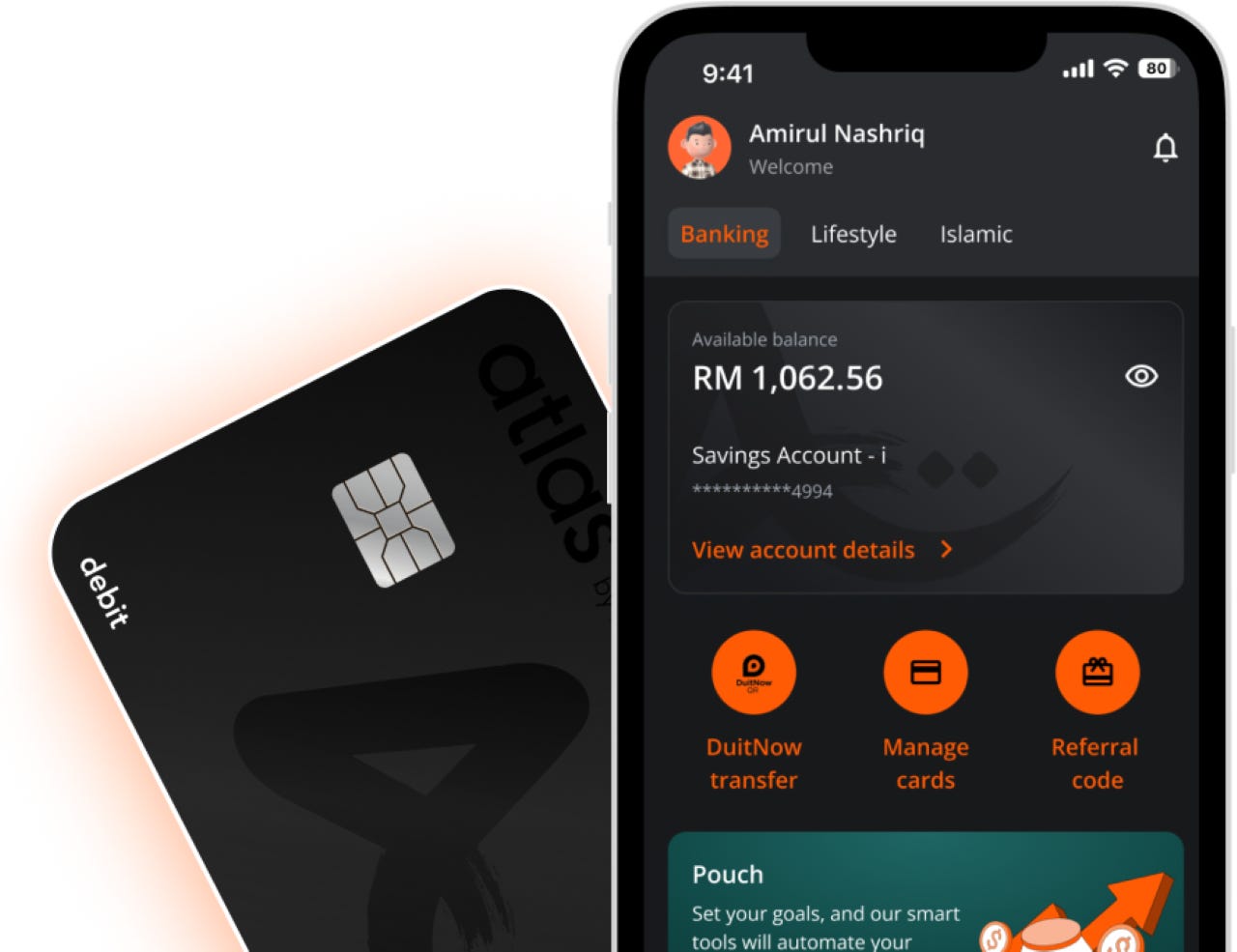

Bank Muamalat launches Malaysia’s digital-only Islamic bank

Bank Muamalat has launched Malaysia’s first Islamic digital-only bank focused on faith and lifestyle alignment.

The initiative, developed in partnership with banking technology firm Backbase, is a significant step in Bank Muamalat’s efforts to redefine Islamic banking. (Fintech Finance News)

Trade Developments

Image Courtesy: The Star

Malaysia / Guinea-Bissau

Malaysia, Guinea-Bissau extend ties with focus on Islamic finance

Malaysia and Guinea-Bissau have reaffirmed their commitment to strengthening bilateral relations, focusing on areas such as the halal industry, Islamic finance, the energy sector, and capacity building.

Prime Minister Anwar Ibrahim encouraged Malaysian corporations, including PETRONAS and FGV Holdings, to explore potential ventures in Guinea-Bissau. (The Star)

Investment

Singapore

Maybank leads in underwriting largest Islamic financing for data centres in Asia Pacific

Maybank is underwriting 2.5 billion Malaysian ringgits, which is equal to one-third of the largest syndicated Islamic financing for data centres in the Asia Pacific region.

The transaction is aimed at supporting DayOne Data Centers in the Johor-Singapore Special Economic Zone. (The Edge)