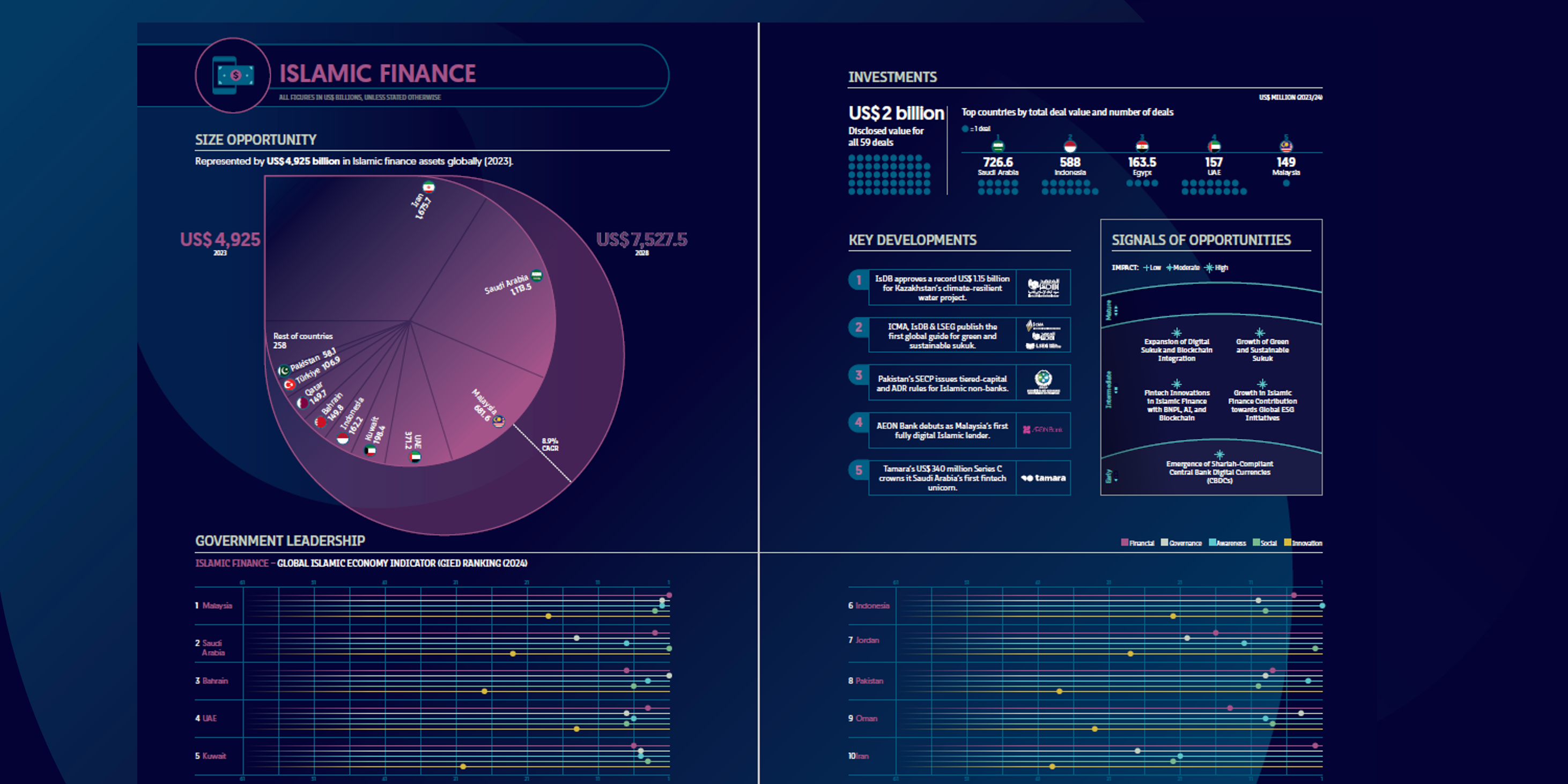

Islamic Finance Sector Snapshot 2024/25

Islamic finance remains the chief engine of capital for the broader halal-economy ecosystem. Total Shariah-compliant assets reached US $4.93 trillion in 2023; on current trajectories they are forecast to expand to US $7.53 trillion by 2028, implying a robust 8.9 % compound annual growth rate. Saudi Arabia anchors the industry with just over US $1 trillion in assets, followed by Iran, Malaysia, the UAE and Qatar, which together account for well over two-thirds of global market share.

Investment Pulse

Deal activity stayed lively over the past year. Fifty-nine disclosed M&A, private-equity and venture-capital transactions totalled about US $2 billion. Saudi Arabia led by ticket size (≈ US $727 million), while the UAE, Egypt, Jordan and Malaysia rounded out the top five destinations. Fintech and digital-lending plays attracted the lion’s share of funding, underscoring investors’ appetite for technology that lowers customer-acquisition costs and broadens financial inclusion.

Five Stand-out Developments (2023 – mid-2024)

- IsDB’s record US $1.15 billion financing package for Kazakhstan’s climate-resilient water project illustrates how large, syndicated Islamic facilities are being channelled into adaptation infrastructure.

- ICMA, IsDB and LSEG jointly released the first global handbook for green and sustainable sukuk, setting a common language for ESG-linked issuance.

- Pakistan’s Securities & Exchange Commission introduced tier-2 capital and additional director-responsibility rules for Islamic non-bank finance companies, bringing prudential oversight closer to international best practice.

- AEON Bank launched as Malaysia’s first fully digital Islamic bank, signalling the sector’s migration to app-first, branch-light models.

- Saudi buy-now-pay-later champion Tamara raised US $340 million in Series C funding, becoming the Kingdom’s first Shariah-compliant fintech unicorn and highlighting the depth of regional VC pipelines.

Government Leadership

For the Islamic-finance pillar of the Global Islamic Economy Indicator (GIEI), Malaysia retains the top spot, thanks to a mature regulatory framework, vibrant sukuk market and growing roster of digital banks. Saudi Arabia holds second place, buoyed by asset scale and fintech momentum, while Bahrain, the UAE and Kuwait complete the top five with strong ecosystems that pair innovation sandboxes with international gateways.

Signals of Opportunity

The report flags several forces that could redefine the landscape over the next five years:

- Digital sukuk and tokenised assets that integrate seamlessly with blockchain settlement rails;

- A surge in green and sustainability-linked sukuk, widening the pool of values-aligned investors;

- Fintech innovations—open banking APIs, AI-driven credit scoring and embedded finance—that push inclusion deeper into underserved markets;

- Shariah-compliant central-bank digital currencies (CBDCs) under exploration in multiple OIC jurisdictions;

- Growing alignment between Islamic-finance principles and climate-positive SDG initiatives, encouraging blended-finance structures that crowd in global capital.