Islamic fintech Wahed adds investment app to UK portfolio, readying digital bank and takaful

LONDON - Wahed Inc is moving full-steam ahead in the UK following the hiring of ex-HSBC exec Umer Suleman in June as its country general manager.

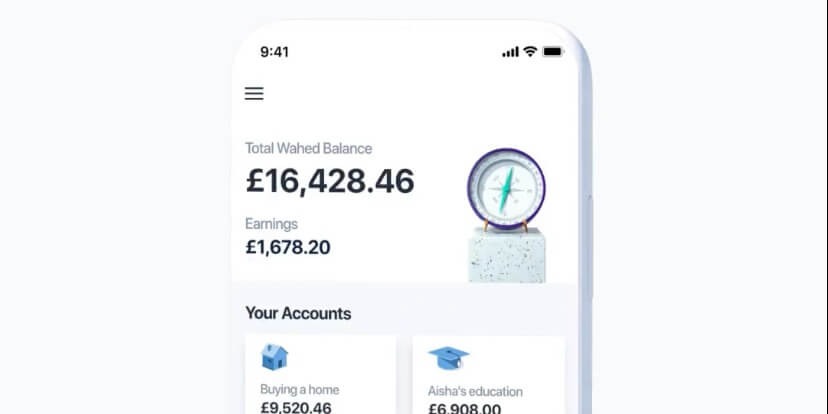

The U.S.-headquartered Islamic fintech company on July 27 released its investment app that allows users to directly deposit funds into their accounts, and more products are in the pipeline, including a digital bank and takaful.

Wahed launched its first product in the UK in September when it teamed up with Options UK to offer a Shariah-compliant workplace pension product.

The Islamic fintech's expansion in the UK comes after the company received $25 million in a funding round in June last year.

New GM Suleman told Salaam Gateway Wahed is finalising its online banking platform, which it hopes to launch by the end of the year.

Wahed acquired fintech start-up Niyah at the end of last year and is transforming that tech to become its digital bank. The plan is to launch it first in the UK and then in the markets where it is already present, including Malaysia, USA and the countries of the Commonwealth of Independent States.

“With Niyah, we are working with full integration--integrated services, investment accounts, current accounts--moving into economies of scale and client needs,” said Suleman.

Wahed's digital bank will join an increasingly crowded Islamic neobank market including Rizq, Kestrl and newest platform Nomo that was launched by the Bank of London and the Middle East in mid-July.

Similar to the other UK-based Islamic neobanks Wahed's digital bank will not be getting involved in retail lending.

The platform will also not be entering the corporate financing space, despite the needs of businesses.

“We’re not getting involved in SME financing because it is capital intensive and we need to understand the market,” explained Suleman. “We want to take people on the journey of financial inclusion and creating and preserving wealth.”

Aside from traditional Islamic banks, there are few Shariah-compliant financing solutions for British SMEs. There are less than a handful of platforms that offer Shariah-compliant corporate financing, including Qardus and Izdihar.

TAKAFUL

Suleman also revealed to Salaam Gateway that Wahed is in the research and development stage for a takaful product.

“We are just coming to the closing part of an intensive R&D phase on bringing takaful products to the UK market in a sustainable way,” he said. “We will test it with a small user base.”

The UK takaful market remains underdeveloped. Among the limited options available are Cobalt Underwriting that offers insurance and reinsurance for businesses or institutions by creating new underwriting capacity from within the established insurance community located in the London Market, including Lloyd’s of London.

Suleman did not reveal which organisation Wahed is partnering with but said it is engaging with a well-known insurance provider to help with the underwriting of the product.

He declined to give a definitive timeline of the potential product’s launch, adding that there will need to be a consumer education period.

“The overall take-up of conventional insurance products in Muslim communities is already quite low,” said Suleman.

Wahed has licenses in nine jurisdictions and 200,000 users globally, and the company is keen to increase Muslims' financial education.

“We want to help the average person in the Muslim community and those looking for an ethical alternative,” said Suleman.

As part of these efforts, Suleman said Wahed has lined up some well-known Muslim athletes who will serve as brand ambassadors.

The company recently moved into a new office in Marylebone and is expanding its workforce both in the UK and globally, Suleman noted.

*CORRECTION: Changes were made throughout to clarify that Wahed's digital bank is not Niyah and that the company is transforming the fintech Niyah that it acquired to become its own digital bank.

© SalaamGateway.com 2021 All Rights Reserved