Islamic robo-advisor launches in UAE amid fintech push

Wahed, a global Shariah-compliant fintech, has launched in the UAE, as the country looks to further its ascendancy as an innovation hub.

The company said in a statement that it received its financial services permission (FSP) from Abu Dhabi Global Market’s regulatory authority.

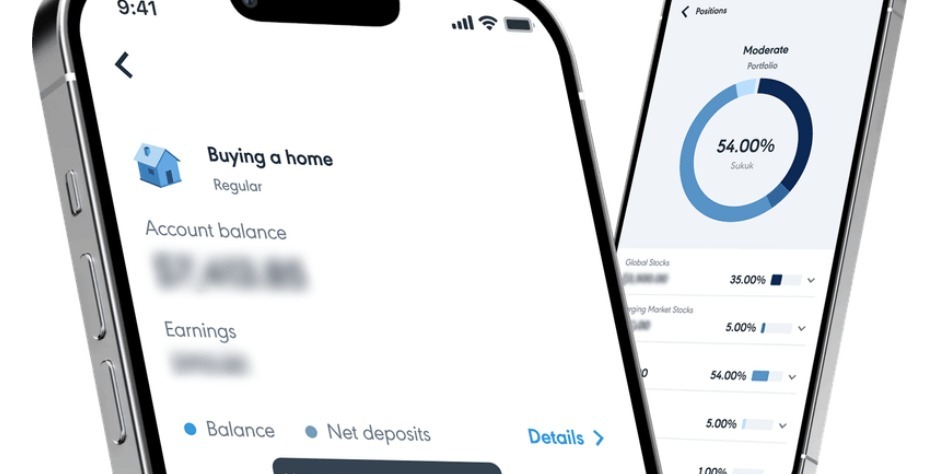

Wahed will enable UAE-based customers to plow funds in diversified Shariah-compliant portfolios via its mobile app. The company has raised more than $75 million in funding from family offices, institutions and backers, including Dubai Cultiv8, international footballer Paul Pogba and UFC champion Khabib Nurmagomedov.

Junaid Wahedna, CEO of Wahed said that the company was committed to contributing to an increase in the savings culture amongst youth and professionals in a Shariah-compliant manner.

Arvind Ramamurthy, chief of markets at ADGM, added that the launch of Wahed in the UAE brings next-gen financial services and strengthens the growing digital economy.

Wahed, since inception, has onboarded more than 300,000 customers in the UK, US, the UAE, Malaysia, and beyond.

The Arab world enjoys an advantageous demographic profile, with a third of its population under 30. According to the International Monetary Fund, fintech revenues in the Middle East, North Africa and Pakistan are expected to increase from $1.5 billion in 2022 to between $3.5-4.5 billion by 2025.