Jakarta’s return to lockdown surprises analysts, hurts economy

Published 10 Sep,2020 via Bloomberg Markets - The unexpected decision to put back Indonesia’s capital back into a tougher lockdown has surprised analysts and investors as well as threatening to prolong the recovery of the Southeast Asia’s largest economy.

With Jakarta accounting for around 20% of the country’s GDP, the decision could cause the Indonesian economy to contract for a third consecutive quarter, instead of an earlier expectation for a recovery in the tail end of the year.

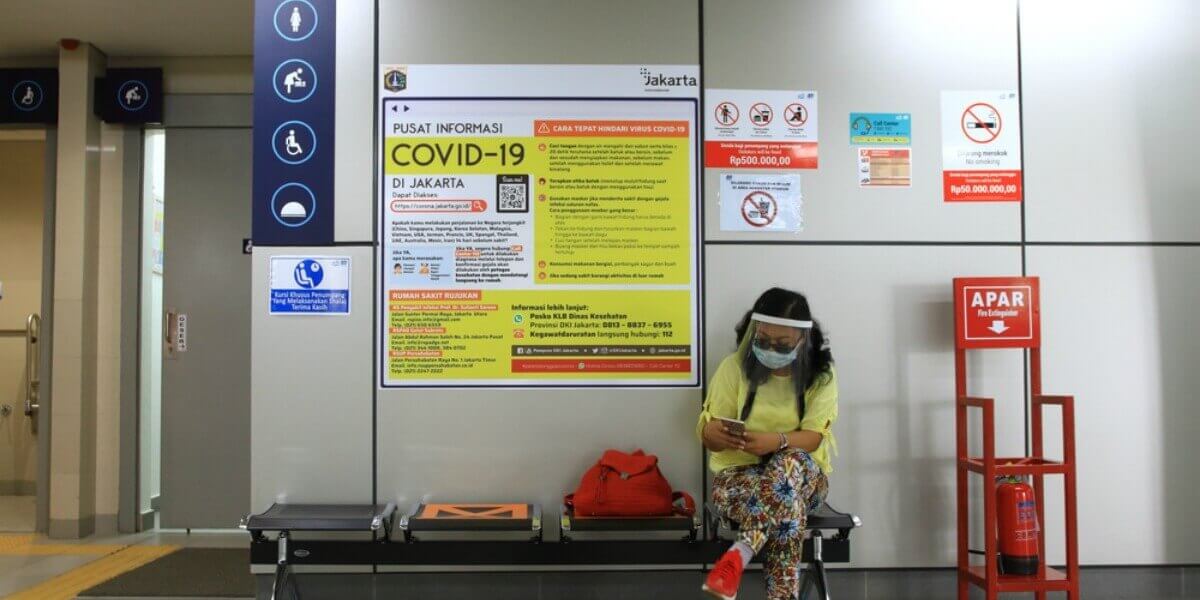

Jakarta will require non-essential industries to have employees work from home, limit use of public transportation and shut entertainment sites and places of worship starting Sept. 14. Hospital capacity in the capital will max out by Sept. 17 as coronavirus infections in the metropolitan area surged.

The Jakarta Composite Index plunged as much as 5%, triggering a circuit breaker that will be lifted at 11:06 a.m. local time. While the gauge is set for its steepest drop since March, it’s still up 24% from its March low but down 22% on the year.

Sinarmas Sekuritas (Jeffrosenberg Tan)

- “From public policy perspective, this is a dilemma between choosing science or public health over the economy.”

- The decision will be incrementally negative for equities, which generally have some dependence on future earnings. The bond market, especially sovereign issuance, will suffer only a limited impact as it has some safe haven features.

- The hope of an upcoming vaccine and possible economic recovery in developed markets will make the fallout from the current curbs less severe than what the country had seen in March.

Maybank Kim Eng (Isnaputra Iskandar)

- “I think we will see negative GDP growth in the fourth quarter instead of what many people expected earlier for a recovery in the final three months of 2020.”

- The impact on the financial market will be widespread, and at the time like this “investors should not try to catch the falling knife.”

- After the initial carnage, some investors may seek refuge in medical stocks, gold miners, tower companies or consumer related names such as tobacco, and telecom stocks

- Stocks that might be less affected by the curbs are Mitra Keluarga, Merdeka Copper Gold, Sarana Menara Nusantara, Tower Bersama, Indofood CBP, Telekomunikasi Indonesia, Unilever, Hanjaya Mandala Sampoerna, Gudang Garam, United Tractors

Samuel International (Harry Su)

- “With Jakarta accounting for around 17.5% of Indonesia’s GDP, the reimposition of semi-lockdown in the capital will undoubtedly be a drag on economic growth, stocks and rupiah. This curbs mean downside to our GDP estimates, and if Covid-19 remains unchecked as we head into 4Q20, another contraction is possible.”

- Supermarkets and health-related sectors are expected to be among those which will be resilient.

Sucorinvest Asset Management (Jemmy Paul)

- “If the new restrictions extend beyond more than one month, it’s going to hurt the economy.”

- “We are overweight equities because we don’t think the selloff will push the JCI lower than 4,000. We won’t buy more right now but we don’t want to sell our equities.”

- Likes telecommunications companies. May overweight banks on dip.

Oversea Chinese Banking Corp. (Wellian Wiranto)

- “With pockets of new clusters forming including in Bali, the damage may be broader.”

- This adds to unfavorable factors for the market including the proposal to dilute the central bank’s autonomy and concerns over debt monetization.

(Adds exchange’s circuit breaker in fourth paragraph)

For more articles like this, please visit us at bloomberg.com

©2020 Bloomberg L.P. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).

DISCLAIMER: This content is provided to us “as is” and unedited by an external third party provider. We cannot attest to or guarantee the accuracy of information provided in this article from the external third party provider. We do not endorse any views or opinions included in this article.

Harry Suhartono