Malaysia lowers growth forecast on worsening virus outbreak

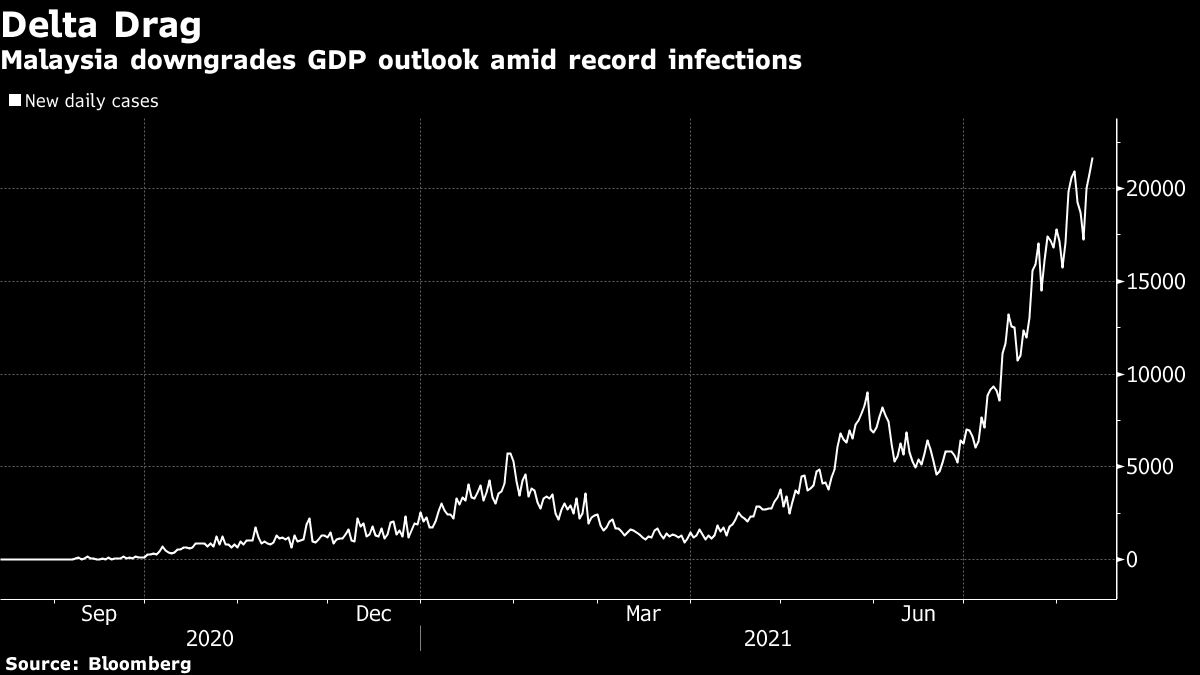

Published 13 Aug,2021 via Bloomberg News Service (Global Editions) - Malaysia lowered its 2021 economic growth forecast for a second time, as renewed movement restrictions and rising infections hamper the recovery.

Gross domestic product is expected to expand 3%-4% this year, Bank Negara Malaysia Governor Nor Shamsiah Yunus said Friday. That compares to an earlier estimate of 6%-7.5% growth.

Malaysia’s economy shrank 2% in the second quarter compared to the previous three months on a seasonally adjusted basis, according to data from the central bank. That cut short a brief uptick, and compared with the median estimate of a 1.9% contraction in a Bloomberg survey of seven economists.

“Malaysia’s growth recovery is expected to broadly resume in the later part of the second half of 2021 and improve going into 2022,” Shamsiah said in a statement. “A key catalyst for economic reopening and a driver of positive sentiment will be the continued progress and effectiveness of the national vaccination program,” she said, adding that growth will also be supported by higher commodity output, pent-up demand and large-scale infrastructure projects.

Compared to a year earlier, when the country imposed its strictest containment measures against the pandemic, the economy grew 16.1%. The median estimate in a Bloomberg survey of 19 economists was for 14.1% growth.

The ringgit was little changed after the data, at 4.235 to the dollar as of 12:08 p.m. The country’s benchmark stock index was also largely unchanged.

Reality Check

“All in all, a sober reality check of how the ongoing Covid-19 resurgence and the resulting protracted restriction measures are dealing body blows to the Malaysian economy,” said Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore. “While BNM still strikes an optimistic tone, pointing out a fourth-quarter gradual recovery and an acceleration into 2022, that is the future. Now is now. And the Malaysian economy as of now is hurting -- leading us to maintain our call” that BNM will cut the overnight policy rate next month.

The government placed the entire country under lockdown in June, a move that cost 40,000 people their jobs and sent industrial growth to a five-month low. The restrictions cost the economy an estimated 1.1 billion ringgit ($260 million) a day.

Most states are expected to reopen under new norms as early as October, Prime Minister Muhyiddin Yassin said last month. The government announced Saturday it will no longer use daily infections as a guideline for relaxing curbs and will focus instead on hospital admissions, a move that could expedite the reopening process.

“We observe a bottoming-out process under way, with a recovery coming as early as August,” RHB Bank Bhd economist Nazmi Idrus wrote in a note Monday. That comes after the government began loosening virus protocols for businesses in the second half of July, he said.

Record Caseload

Still, Malaysia’s virus woes are far from over. New infections topped a record 21,000 on Thursday, fueled by the delta variant in the country’s most industrialized state, Selangor, and in Kuala Lumpur. About 71% of the nation’s adult population has received the first dose of the vaccine, while 42% have completed both doses, according to the health ministry data, with the government aiming to fully vaccinate the entire adult population by October.

The virus remains the key source of uncertainty for the economy, BIMB Securities Sdn analyst Imran Nurginias Ibrahim said.

“The best hope now is for the existing plan to work in curbing the ongoing spread,” so that by the middle of the third quarter “Malaysia can be on the road to recovery more forcefully once again,” he wrote in a note Wednesday.

Other points from the briefing:

- Headline inflation is expected to average 2%-3% this year

- The country ran a current-account surplus of 14.4 billion ringgit in the second quarter

(Updates with more details throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info)

DISCLAIMER: This content is provided to us “as is” and unedited by an external third party provider. We cannot attest to or guarantee the accuracy of information provided in this article from the external third party provider. We do not endorse any views or opinions included in this article.

Anisah Shukry