Media & Recreation Sector Snapshot 2024/25

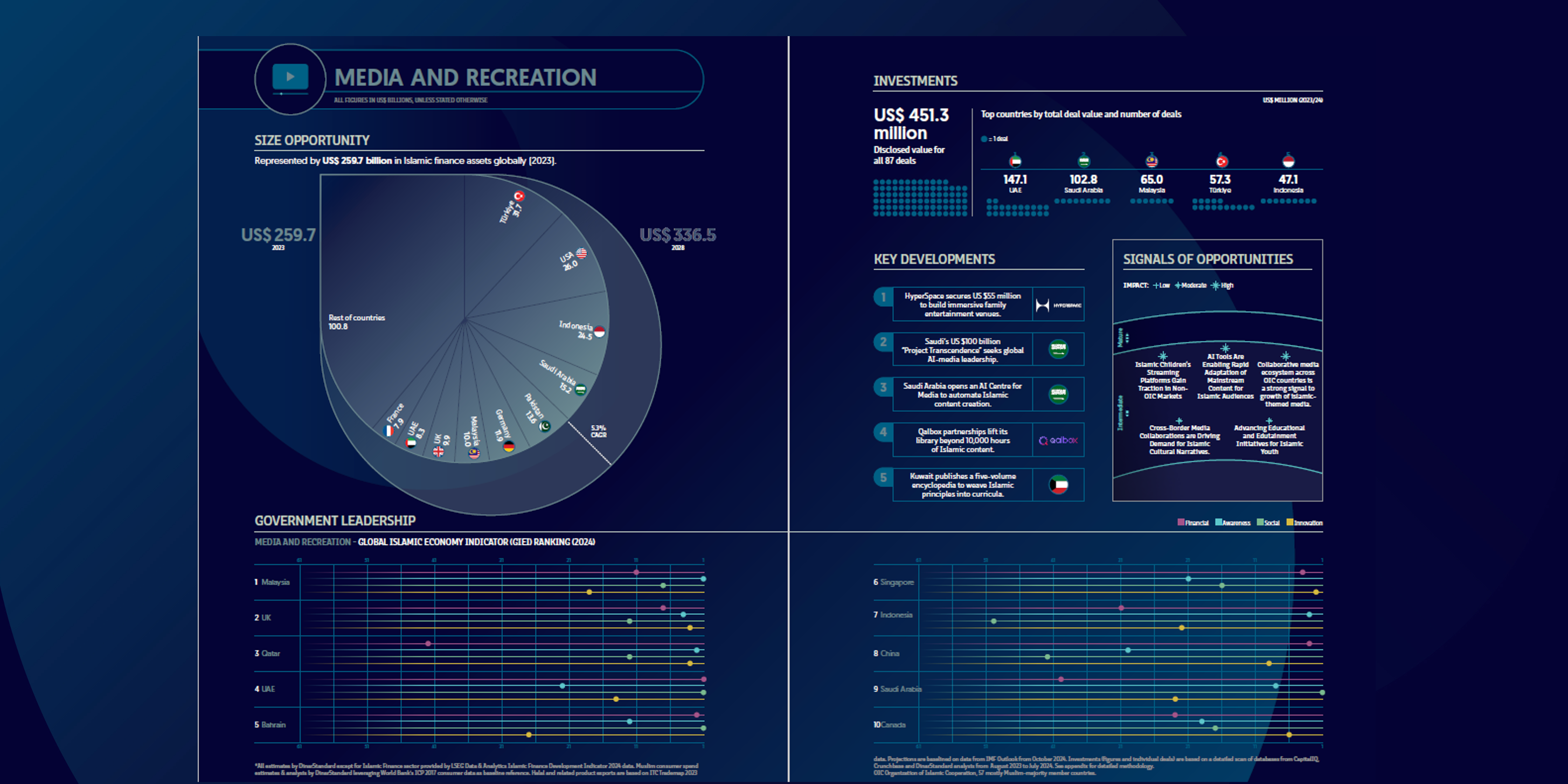

Muslim audiences spent US $259.7 billion on media and recreation in 2023; as digital-content consumption accelerates, that figure is expected to rise to US $336.5 billion by 2028, a 5.3 % CAGR. The largest single markets are Türkiye (≈ US $31.7 bn), the United States (US $26 bn) and Indonesia (US $24.5 bn), while Saudi Arabia, Pakistan and Germany form the next tier; a long “rest-of-world” tail still accounts for more than US $100 bn, signalling room for new entrants.

Investment pulse

From August 2023 to July 2024 the sector recorded 87 disclosed deals worth US $451 million—quadruple last year’s volume and equivalent to almost 39 % of all Islamic-economy transactions. The UAE led by value (US $147 m across 22 deals), followed by Saudi Arabia (US $103 m), Malaysia (US $65 m), Türkiye (US $57 m) and Indonesia (US $47 m). Capital is flowing into immersive entertainment, streaming platforms and AI-driven content tools that localise mainstream IP for Muslim viewers.

Five headline developments (2023 – mid-2024)

- HyperSpace secured US $55 million to roll out immersive family-entertainment venues.

- Saudi Arabia launched the US $100 billion “Project Transcendence” to claim global AI-media leadership.

- Riyadh also opened an AI Centre for Media to automate Islamic-content creation.

- Qalbox, part of Muslim Pro, struck new partnerships that pushed its library beyond 10 000 hours of Islamic content.

- Kuwait published a five-volume encyclopedia embedding Islamic principles into school curricula.

Policy ecosystem

The Media & Recreation pillar of the Global Islamic Economy Indicator (GIEI) ranks Malaysia #1, reflecting its export incentives and censorship clarity, followed by the UK, Qatar, the UAE and Bahrain. Singapore (#6) and Indonesia (#7) are fast risers thanks to creative-industry grants and streaming-platform growth .

Signals of opportunity

Analysts flag five maturing themes:

- AI tools that rapidly adapt mainstream film, gaming and advertising content for Islamic audiences.

- Islamic children’s streaming platforms gaining traction in non-OIC markets.

- Collaborative cross-OIC media ecosystems, pooling creators, studios and OTT distributors.

- Cross-border co-productions tapping Islamic cultural narratives for global viewers.

- EdTech-infused edutainment tailored to Muslim youth.