Modest Fashion Sector Snapshot 2024/25

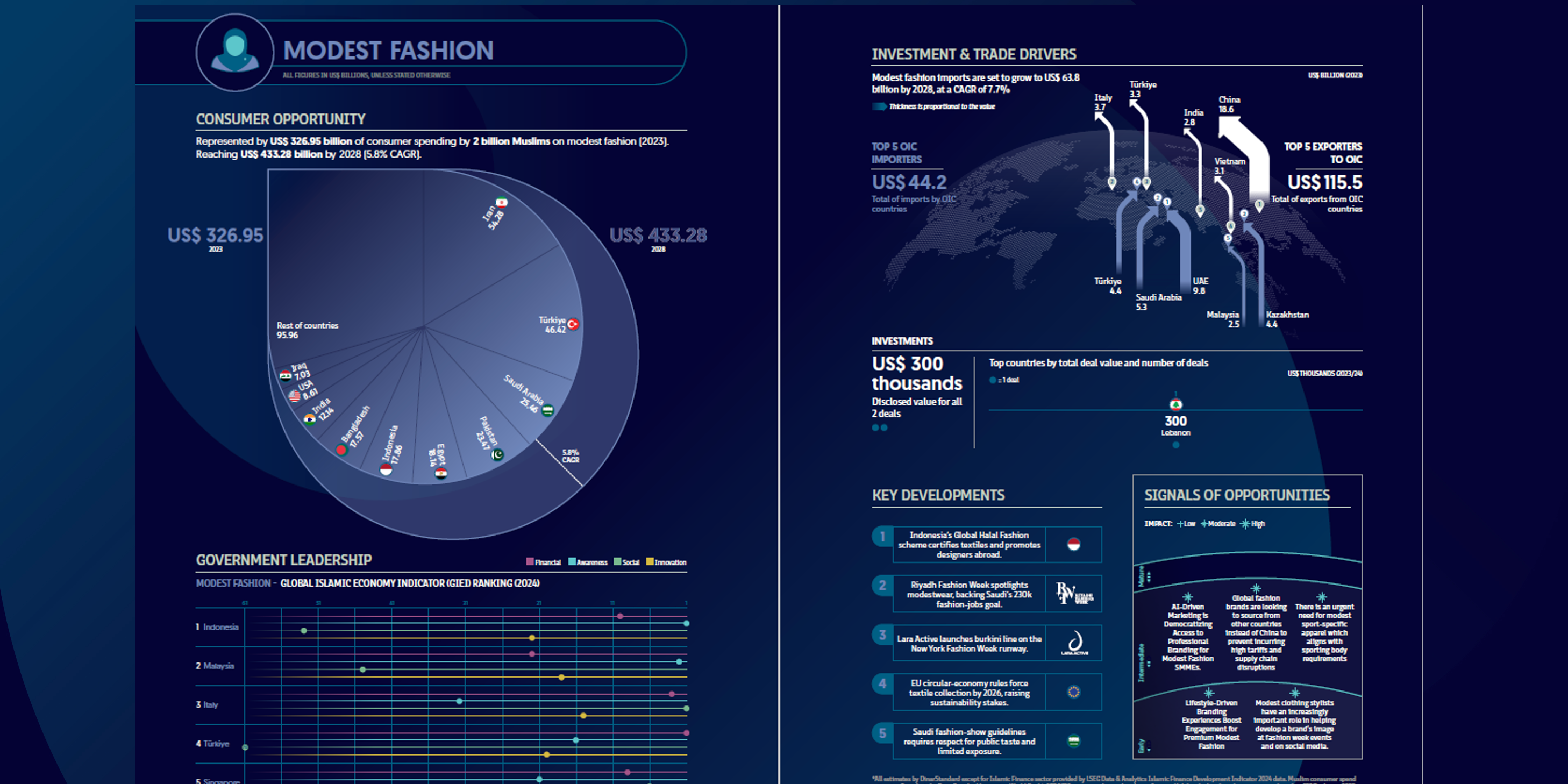

Muslim consumers spent US $326.95 billion on apparel and footwear in 2023; buoyed by social-commerce adoption, state-backed industry programmes and rising participation by mainstream labels, that figure is projected to reach US $433.28 billion by 2028, equivalent to a 5.8 % CAGR. Iran remains the single-largest spend market, followed by Türkiye and Saudi Arabia, while smaller but fast-growing Indonesia has moved into the top ten.

Government leadership

The Modest-Fashion pillar of the Global Islamic Economy Indicator sees Indonesia in first place, ahead of Malaysia, Italy, Türkiye and Singapore—a ranking that reflects Jakarta’s Global Halal Fashion certification drive, export-oriented showcases and designer incubators.

Trade dynamics

OIC member states imported US $44.2 billion of fashion goods in 2023; imports are forecast to rise to US $63.8 billion by 2028 (7.7 % CAGR). The UAE (US $9.8 bn), Saudi Arabia (US $5.3 bn) and Kazakhstan (US $4.4 bn) are the three largest buyers, while China remains the leading external supplier (US $18.6 bn), ahead of Vietnam and India. OIC exporters as a group maintain a rare trade surplus—US $71.3 billion—thanks to cost-competitive manufacturing in Türkiye, Bangladesh and Indonesia.

Investment pulse

Deal flow was muted: only two disclosed transactions worth a combined US $300 thousand were tracked during the review period, led by Lebanese circular-fashion start-up FabricAid’s seed round.

Five headline developments (2023 – mid-2024)

- Indonesia’s Global Halal Fashion Scheme began certifying textiles and promoting local designers overseas.

- Riyadh Fashion Week debuted, supporting Saudi plans to create 230,000 fashion jobs.

- Lara Active took a burkini collection onto the New York Fashion Week runway, signalling mainstream acceptance.

- The EU’s circular-economy rules mandated nationwide textile collection by 2026, raising sustainability stakes.

- New Saudi fashion-show guidelines require respect for public taste and limited exposure, formalising modest-wear norms.

Signals of opportunity

Analysts highlight six maturing opportunity zones:

- AI-driven marketing and on-demand micro-manufacturing democratise professional branding for SME labels;

- Global brands localise modest lines while Muslim designers tap virtual catwalks and digital twins;

- Urgent demand for sport-specific modest apparel aligned with federation rules;

- Lifestyle-driven experiential branding deepens customer engagement for premium players;

- Shift away from single-source (China) supply chains amid tariffs and logistics volatility;

- Rise of stylists and influencer-led curation, especially across TikTok and Instagram.