Muslim Friendly Travel Sector Snapshot 2024/25

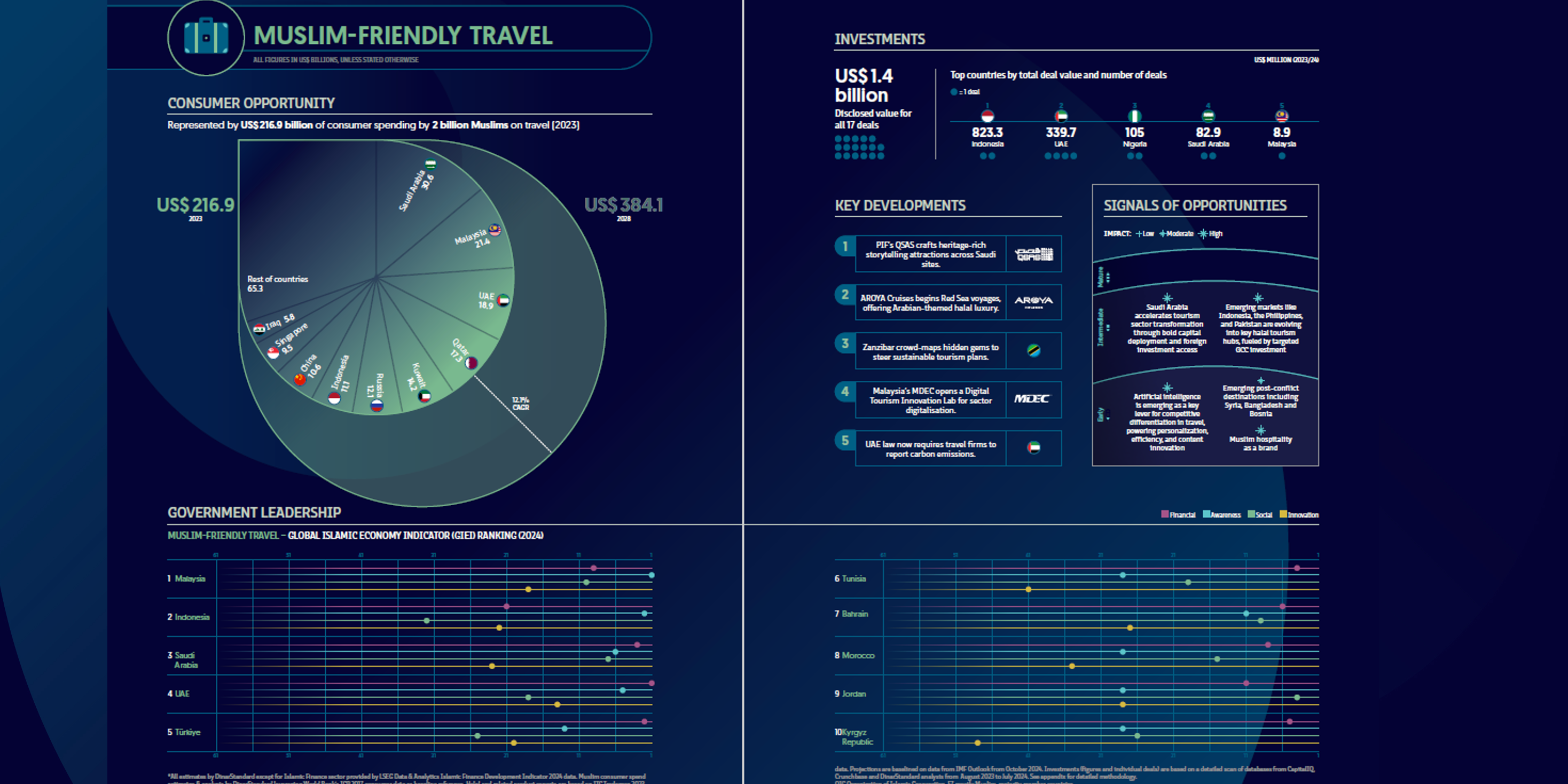

The travel segment has emerged as the fastest-expanding pillar of the halal economy. Muslim travellers spent US $216.9 billion in 2023; buoyed by pent-up post-pandemic demand, destination investment and digital booking tools, that figure is forecast to soar to US $384.1 billion by 2028, equating to a 12.1% compound annual growth rate—more than double the pace of most other halal-lifestyle categories.

Where the money flows

- Top spend countries in 2023 were Saudi Arabia (≈ US $29 bn), Malaysia (≈ US $24 bn) and the UAE (≈ US $19 bn), followed by Qatar, Egypt and Türkiye.

- A long tail of “rest-of-world” markets still accounts for almost US $65 bn, signalling room for new entrants if connectivity and halal-service readiness improve.

Capital and deal activity

Investment sentiment stayed positive, with 17 disclosed deals worth roughly US $1.4 billion:

- Indonesia dominated by value (≈ US $823 m), buoyed by large hotel-portfolio and OTA transactions.

- The UAE ranked second (≈ US $340 m), while Nigeria, Saudi Arabia and Malaysia rounded out the top five.

These flows underline a shift toward asset-light digital platforms and destination-development plays that bundle hospitality with wellness, heritage and eco-experiences.

Five headline developments in 2023/24

- Saudi Arabia’s Public Investment Fund rolled out heritage-rich, storytelling attractions across multiple sites, reinforcing the Kingdom’s Vision-led visitor push.

- AROYA Cruises began Red Sea voyages, offering a fully Arabian-themed halal luxury experience at sea.

- Zanzibar used crowd-mapping to surface “hidden-gem” villages for sustainable tourism planning.

- Malaysia’s MDEC opened a Digital Tourism Innovation Lab, aiming to fast-track sector digitalisation for SMEs.

- A new UAE decree now obliges travel firms to disclose carbon emissions, embedding ESG reporting into the visitor economy.

Government-ecosystem rankings

On the Muslim-Friendly Travel sub-index of the Global Islamic Economy Indicator, Malaysia retains first place thanks to end-to-end halal-service quality and aggressive destination marketing. Indonesia climbs to second, powered by visa-reform, super-app travel tools and airport upgrades. Saudi Arabia, the UAE and Türkiye complete the top five, each coupling infrastructure megaprojects with investor-friendly regulations.

Signals of opportunity

- Acceleration of Saudi giga-projects (e.g., NEOM, Red Sea Global) is attracting targeted cross-border equity.

- Emerging multipolar hubs—Indonesia, the Philippines, Nigeria—offer investors first-mover advantage in halal aviation, hotels and tour tech.

- AI-driven personalisation is set to redefine itinerary planning, boosting both efficiency and content creation.

- Post-conflict destinations (notably Syria and Bangladesh’s Rohingya-adjacent districts) are regaining interest as faith-based reconstruction, volunteerism and heritage travel niches mature.

- Muslim hospitality as a global brand—centre-of-excellence programmes and unified service standards—could unlock new premium price points.