Oman is finding way out of its budget distress without a bailout

Published 10 Mar,2021 via Bloomberg Politics & Policy - Cash-strapped Oman is getting a shot at redemption with investors without recourse to a bailout from wealthier neighbors.

A year after the sultanate’s bonds approached distressed territory and its government discussed the possibility of financial aid from other members of the Gulf Cooperation Council, it’s following through on a turnaround plan that enables it to go it alone, according to JPMorgan Chase & Co.

“This time around it’s not about GCC support,” Hani Deaibes, the U.S. bank’s head of debt capital markets for the Middle East and North Africa, said in a phone interview from Dubai. “It’s about Oman’s own strategy and the implementation” of its fiscal adjustment plan known as Tawazun, he said.

The sultanate has signaled a resolve to improve fiscal discipline with plans to start taxing incomes of wealthy individuals in 2022 -- breaking a regional taboo -- introducing a delayed value-added tax in April and paring state subsidies on water and electricity.

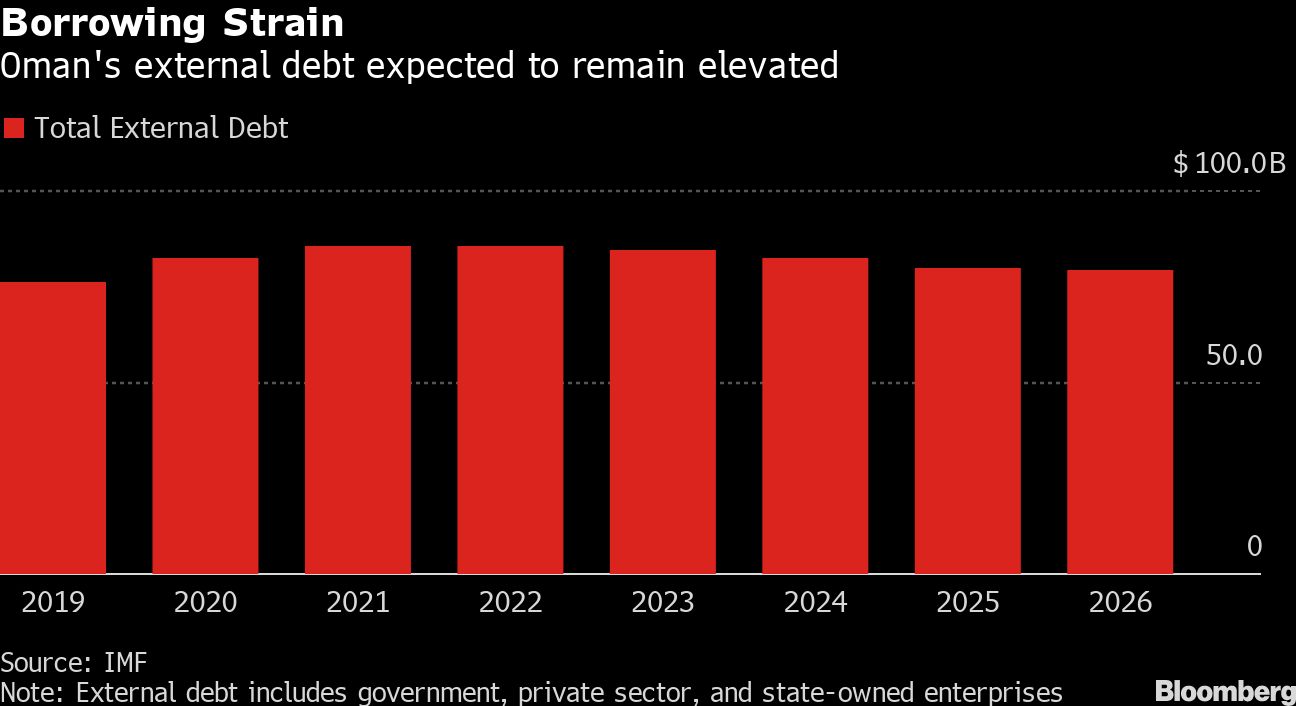

The International Monetary Fund now expects authorities to run a budget deficit of only 5.4% of gross domestic product this year, less than a third its shortfall in 2020. The IMF’s outlook, published last month, pencils in a deficit near zero already in 2024, a view more optimistic than even the government’s own projections.

For JPMorgan, which has advised and worked with the government on its fiscal measures, the key difference in Oman -- long a laggard in overhauling its public finances to adapt to lower oil prices -- is that it’s now “committed to implementing its reform plan.”

“The strong performance of its debt is reflective of the turnaround plan,” Deaibes said.

Since the sultan’s approval of fiscal consolidation measures in late October, and with oil prices on the rise, Oman’s debt has returned an average of about 12%, ranking in the top tier of 80 emerging markets tracked by Bloomberg. Prior to the decision, the nation’s bonds had a negative return of around 3.5% last year.

The largest oil exporter outside of OPEC may need to borrow about $4.2 billion to cover its fiscal shortfall this year under a plan based on a crude price of $45 per barrel. Oman sold $3.25 billion in a three-part debt offering in January.

Less Debt

JPMorgan, one of the biggest arrangers of Middle East and North Africa bond deals, expects sales across the region to slip in 2021 from last year’s record of near $140 billion.

“2020 was an exceptional year and people were happy to over-fund because of the uncertainty in the market,” Deaibes said. “We have higher oil prices, better growth prospects, an improved geopolitical backdrop and rates are volatile but still low and spreads are tight.”

The year kicked off with bond sales that included Saudi Arabia raising funds in dollars and euros, alongside deals by other Middle Eastern governments including lower-rated Bahrain.

But the momentum has eased as emerging-market assets fell out of favor on expectations of tighter global monetary policy and as a revival of inflation reduced the relative appeal for risky assets.

“So rates volatility aside, we are in a goldilocks situation where it is conductive for issuers to take advantage of the market,” Deaibes said. “Our focus is to leverage the situation so we can de-risk our issuers and create more optionality later in the year.”

For more articles like this, please visit us at bloomberg.com

©2021 Bloomberg L.P. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info)

DISCLAIMER: This content is provided to us “as is” and unedited by an external third party provider. We cannot attest to or guarantee the accuracy of information provided in this article from the external third party provider. We do not endorse any views or opinions included in this article.

Archana Narayanan