Pakistan’s Islamic bank market share of deposits gain 0.5 pct, assets up 0.2 pct Jun 2016 to Jun 2017

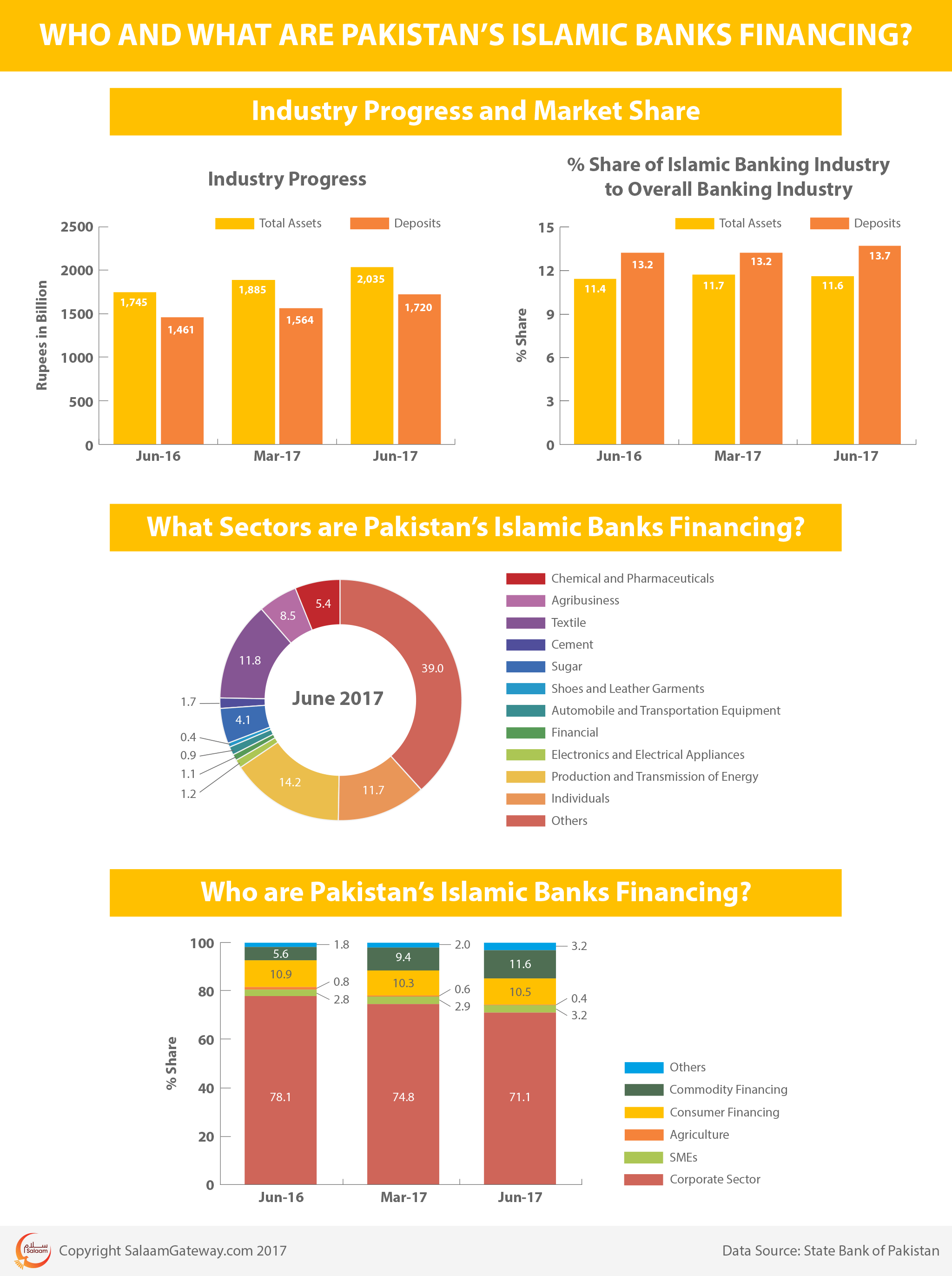

The market share of Pakistan’s Islamic banking assets and deposits in the country’s overall banking sector gained 0.2 percent and 0.5 percent, respectively, from June 2016 to June 2017, according to data from the State Bank of Pakistan (SBP).

Pakistan is home to 21 Islamic banks: five full-fledged and 16 Islamic branches of conventional banks.

DEPOSITS

Deposits in all Islamic banks surged 17.78 percent to reach 1,720 billion Pakistani rupees at the end of June 2017 from the same month a year ago. 59.71 percent were held in full-fledged Islamic banks.

Full-fledged Islamic banks: Deposits of full-fledged Islamic banks increased by 7.4 percent from April to June 2017 to reach 1,027 billion rupees compared to 957 billion rupees in the previous quarter.

Islamic windows: Deposits of Islamic banking branches of conventional banks increased by 14.2 percent, compared to 7.4 percent for full-fledged Islamic banks, to reach 693 billion rupees by the end of June compared to 607 billion rupees in the previous quarter.

ASSETS

Islamic banks held 2,035 billion rupees in assets at the end of June this year, an increase of 16.6 percent from June 2016. 59.5 percent of all Shariah-compliant banking assets were held in full-fledged Islamic banks, which is roughly the same proportion for deposits.

Full-fledged Islamic banks: According to the SBP, assets of full-fledged Islamic banks grew by 4.1 percent from April to June 2017 to reach 1,210 billion Pakistani rupees compared to 1,162 billion rupees in the previous quarter.

Islamic windows: The assets of Islamic banking branches of conventional banks rose 14.2 percent to reach 825 billion rupees compared to 723 billion rupees in the previous quarter.

Composition: According to the SBP, the major flow of funds in the Islamic banking industry was focused on financing as opposed to investment. The share of Islamic banks’ net financing and investments to total assets stood at 48 percent and 26 percent, respectively, by the end of June 2017.

FINANCING

Corporates: Pakistan’s Islamic banks predominantly finance corporates although this dropped 7 percent, from 78.1 percent of their portfolio in June 2016 to 71.1 percent in June 2017.

SMEs: Financing extended to small- and medium-sized enterprises (SMEs) nudged up 0.4 percent, from 2.8 percent in June 2016 to 3.2 percent in June 2017.

SMEs account for around 90 percent of all businesses and contribute around 40 percent to GDP, according to the Pakistan government’s Small and Medium Enterprises Development Authority (SMEDA).

BIGGEST JUMP: The biggest jump in percentage share of financing portfolio was in commodity financing, which grew 107 percent from June 2016 to June 2017. This was primarily due to a seasonal jump around harvest season. Wheat was the biggest commodity financed by the banking sector overall.

($1 = 105.1 Pakistani rupees)

© SalaamGateway.com 2017 All Rights Reserved