Anyone who reads the 2007 award-winning comedy novel “Salmon Fishing in the Yemen”, or saw the film adaptation starring Ewan McGregor and Emily Blunt, knows that even the most bizarre dreams can come true. At least in fiction. In the UAE, salmon fishing in the deserts has indeed become a reality.

As part of the UAE’s long-term strategy, Minister of State for Food Security Mariam bint Mohammed Saeed Hareb Almheiri announced on June 24 the government commitment to design a national aquaculture roadmap.

The Minister also launched the UAE Aquaculture Pulse 2020 report, which aims to attract private sector investment to strengthen the industry.

“Aquaculture is, without a doubt, one of the most important and efficient food growing sectors in the UAE,” Almheiri said. “It represents an efficient way to grow high-value protein without using huge amounts of our most precious resource — fresh water.”

The United Nations expects the world’s population to grow to 9.7 billion by 2050, which requires food production to increase by up to 70% to fill the supply and demand gap.

The broader aquaculture development – the commercial finfish, shellfish, and seaweed production under controlled conditions – promises to partially meet the growing protein demand and protect stressed marine ecosystems at once.

FISH CONSUMPTION VERSUS AQUACULTURE DEVELOPMENT

By 2027, the global per capita fish consumption is estimated to be 21.3 kg, compared to 9.0 kg in 1961 and 20.3 kg in 2017, according to the Food and Agriculture Organization of the United Nations (FAO).

Residents in the UAE today eat around 25.3 kg of fish annually per capita, according to Almheiri. This equals a 20% higher seafood consumption than the global average. Imports cover 75% of the seafood demand, aquaculture only 2%.

In 2017, the UAE’s total aquaculture production came to a modest 3.2 tons of various finfish and shellfish species, with seabream being the most produced kind.

This, however, is a significant increase from five years ago when the total production was below 500 tons, an FAO representative mentioned at the June 24 virtual meeting.

INVESTMENT NEEDED TO SUPPORT GROWTH

A lot of money is needed to grow the UAE’s aquaculture industry.

“The government has already invested more than 200 million dirhams in the last two years to develop hatcheries and fish farms,” Almheiri said.

“The private sector is the crucial backbone for the UAE’s aquaculture blueprint,” she added, pointing out that it’s imperative to attract more investment.

However, private capital markets have historically been hesitant to finance aquaculture production systems, highlights the “Towards a Blue Revolution – Capitalizing private investment in sustainable aquaculture production systems” report by The Nature Conservancy and Encourage Capital. The key reasons for this include the high capital expenditures and the risk misperception associated with fish farming.

Yet, globally aquaculture requires an additional $150 to $300 billion in capital investment by 2030 to finance infrastructure expansion to meet the projected demand growth. Today, the sector is already a $243.5 billion industry.

COSTLY AQUACULTURE TECHNOLOGIES

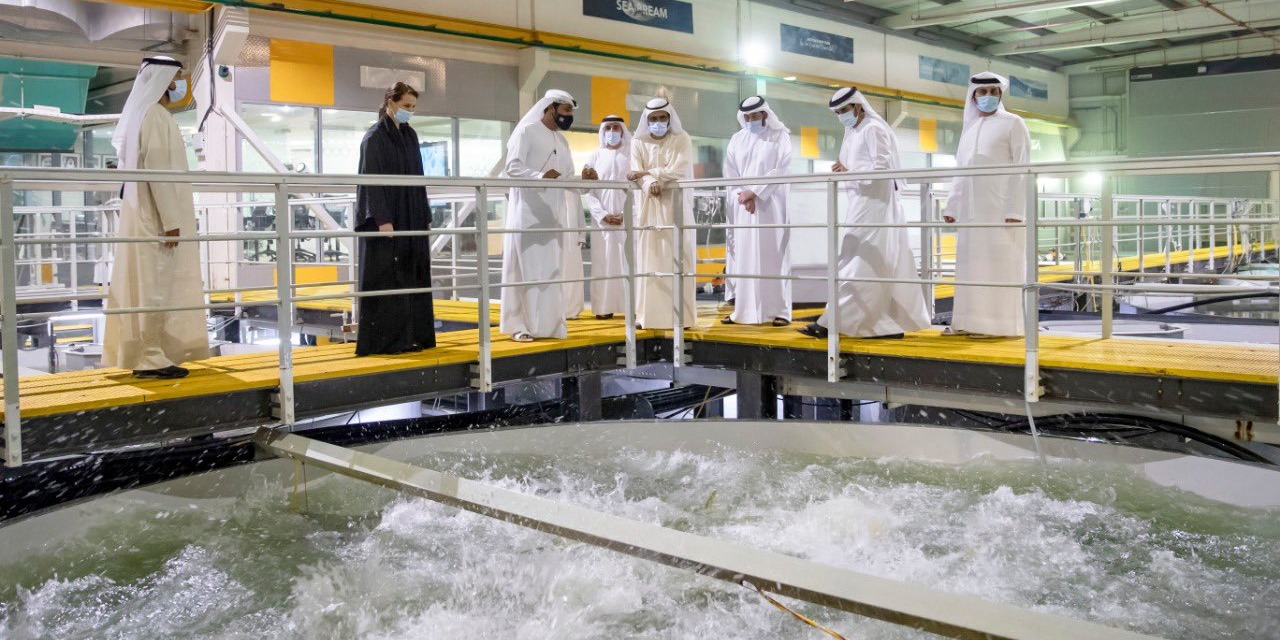

Fish Farm, a company situated just outside Dubai, operates four large salmon tanks, each about 1,000 cubic meters. The extra 24 tanks of around 100 cubic meters, grow other fish species like grouper, yellowtail kingfish, and sea bass.

“We experienced a steep learning curve, but succeeded in becoming the leader in growing cold-water species in an arid region like this,” said marine biologist Nigel Lewis who is Fish Farm’s General Manager and Aquaculture Development Manager, about the adoption of the recirculating aquaculture system (RAS).

“We recently upgraded and improved the technology to get more output,” he said about the RAS capacity increase by about 500 tons for salmon production.

“Which technology to choose depends on the species you want to produce for the local market,” Lewis explained. “For high-value fish, use RAS; for low-value fish, cage production is more appropriate.”

The farm also operates 60 offshore cages in the Indian Ocean, each with a 20-meter diameter, producing up to 2,000 tons of sea bream a year. “So far, we’ve managed about 1,700 tons,” said Lewis.

“RAS culture is much more expensive in terms of fish capital and operating costs,” Lewis said. The authors of the Blue Revolution report also warn about environmental tradeoffs, resulting in increased energy, water, and land usage.

“Our RAS system recycles 98% of the water used,” Lewis explained. “It passes through the fish tanks, then through a very specialist water treatment system taking out all the waste and solids.”

“We just bring in water to take care of evaporation and waste,” Lewis added.

In return, RAS systems offer higher production capacities per unit area, reduced mortality, and greater control over production outcomes.

Other benefits are fewer biological risks such as disease and parasite issues and typically lower environmental compliance and permitting costs relative to traditional sea farming.

“The improved survival, feed conversion and other efficiencies compensate for the additional cost,” said Lewis.

FEEDING THE FISH

For many farming operations, feed is the highest operational cost, at 30 to 50% of the cost of goods sold (COGS), according to the Blue Revolution report.

Manufacturers have been reducing their fish feed dependence on fish oil and fish meal at the source, the ocean. “But in terms of sustainability, great progress has been made substituting the traditional feed ingredients with vegetable protein,” Lewis commented.

“If aquaculture is to grow at the rate it needs to expand to keep up with demand, there will ultimately be a shortage of fish oil and fish meal,” he added.

“We are also looking for new substitutes — insect protein, for example, is another one.” The choice of this protein could potentially lead to challenges for halal as not all insects are permissible and the different schools of jurisprudence may have their own rulings with regards insects and their uses.

Lewis said all approvals will be sought, including halal, and any non-compliant ingredients would be excluded. “Insect protein being looked at is from larvae of the black soldier fly,” he explained.

Currently, Fish Farm has to import the vegetable protein feed. According to Lewis, within the next two years, the UAE can provide locally-produced alternative fish feed.

“The government supports that, and there is a company ready to go,” Lewis advised without divulging more details.

Employing around 80 people, Fish Farm LLC is the country’s largest aquaculture operation and the only one producing multiple species.

The company is ISO-certified and the firm’s organic products carry the Halal National Mark and Emirates Quality Mark label.

Fish Farm is the result of a vision by Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, to “grow salmon in the desert of Dubai”, and is now managed by its CEO, Bader bin Mubarak.

Contrary to “Salmon Fishing in the Yemen”, Fish Farm’s story isn’t fiction but a successful reality.

(Reporting by Petra Loho; Editing by Emmy Abul Alim emmy.abdulalim@salaamgateway.com)

© SalaamGateway.com 2020 All Rights Reserved