Shariah-compliant businesses shown to rate more highly in ESG than conventional firms

Shariah-compliant companies generally punch above their weight in the three central measures of environmental and societal impact, based on an analysis by asset management firm Arabesque carried out for Salaam Gateway.

The review of 7,626 publicly listed corporations based on data taken on July 22 found that the 2,407 that comply with the standards laid down by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) scored better than the overall group in 19 out of 22 environmental, social and corporate governance (ESG) categories.

Yet there is still a number of areas where there is room for them to improve.

According to Nicholas Stott of Arabesque, which carried out the analysis using its S-Ray quantitative data tool that analyses the sustainability performance of firms, the companies monitored have a head start given the paradigm of Shariah principles.

“In determining the Shariah compliance of a company, we use AAOIFI’s Shariah Standard 21. For a company to be classified as ‘compliant’, it must pass a business involvement screen in addition to three financial ratio screens,” Stott told Salaam Gateway.

“Post-screening, you are generally left with a universe of companies with low leverage, outside of non-halal industries such as conventional finance, alcohol, tobacco, gambling etc.

“Given the nature of these prudent screens, it does not come as a large surprise that the AAOIFI-compliant portfolio performs better than the wider universe of companies on a large number of environmental, social and governance topics,” he added.

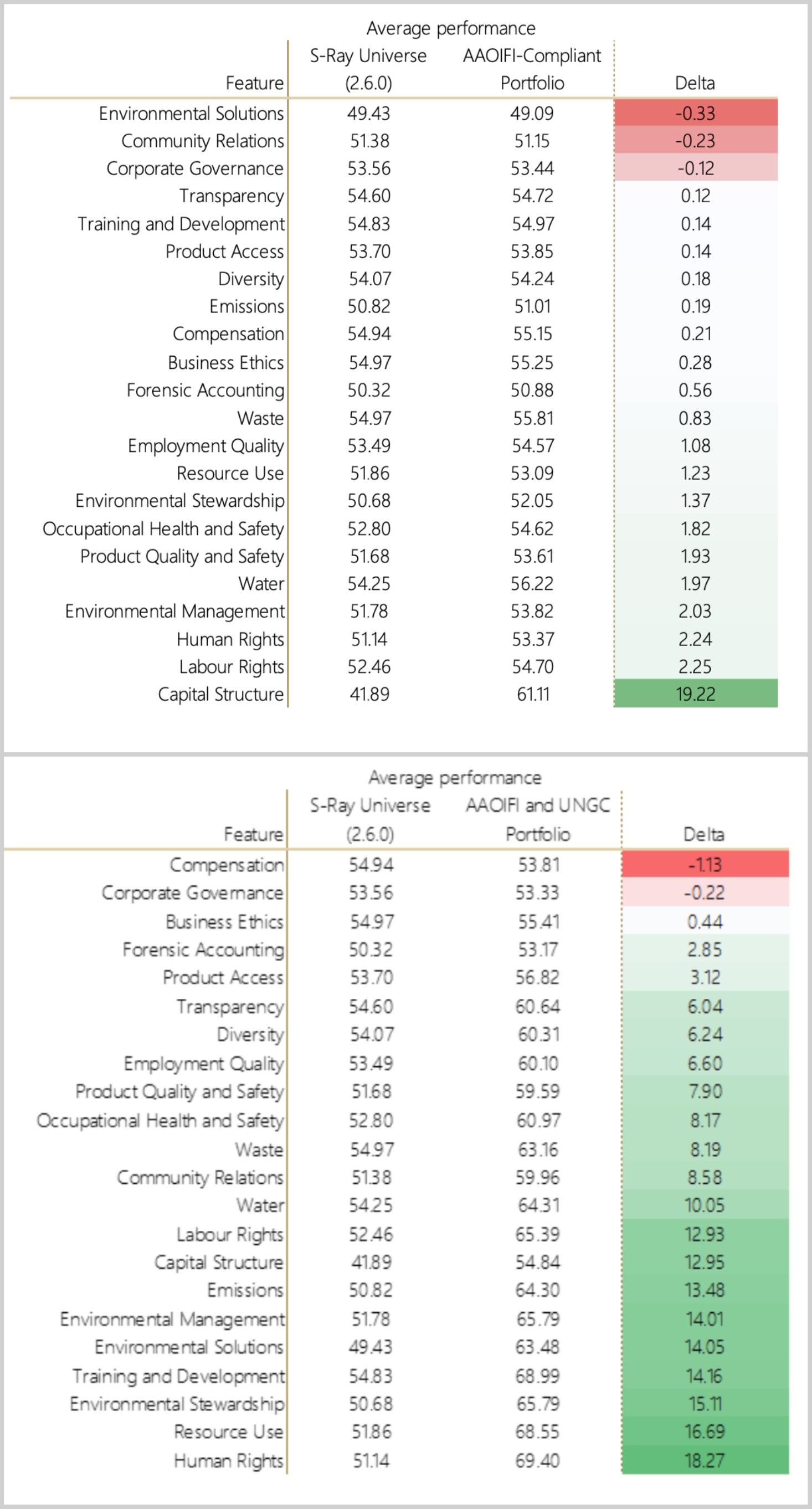

Tables generated by Arabesque showing companies' average scores against 22 business categories. Top table focuses on 2,407 AAOIFI-compliant companies and bottom table on 290 companies that are both AAOIFI-compliant and UNGC signatories.

HIGHER ESG SCORES

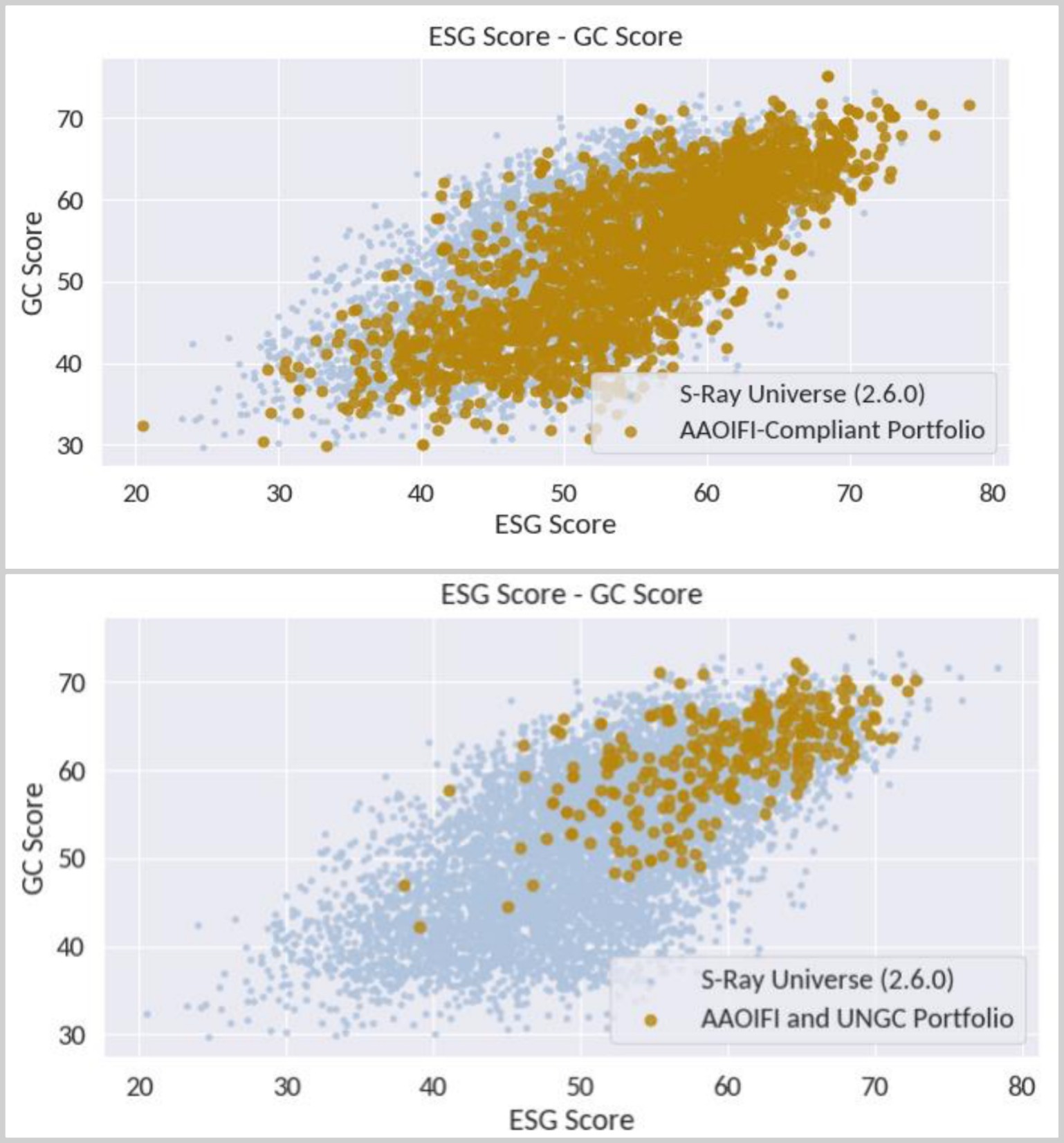

In general, the Shariah-compliant companies were awarded mean ESG scores 7.8% higher than those of the wider dataset. The difference was especially prominent in terms of governance but much less noticeable in environmental and social factors.

In addition, Shariah-compliant firms also tended to perform a fraction better when assessed against the principles of the United Nations Global Compact (GC), a non-binding pact to encourage businesses to adopt sustainable and socially responsible policies, and to report on their implementation. Here, Shariah-compliant companies performed an average of 1.7% better.

In terms of the performance of specific business elements which contribute to the United Nations Global Compact and ESG scores, it is clear that Shariah companies perform a little less favourably in their approach to environmental solutions, community relations, and corporate governance.

These metrics refer to the environmental impact of products and services and their contribution towards sustainable consumerism, their level of community involvement and public trust, and procedures and mechanisms in place that ensure proper long-term control and management of their corporations.

However, for the vast majority of 22 business topics, Shariah-compliant companies outperform the wider dataset, and most strongly in the areas of labour rights, human rights, environmental management and water use.

Although the results suggest these companies substantially improve on capital structure, which S-Ray defines as the relative level of leverage and how it might take away from a long-term focus in decision making, typically based on debt-to-equity ratio and targets for this, this is likely a function of Shariah-compliant portfolios excluding the conventional finance sector, which is typically highly leveraged.

Charts generated by Arabesque showing ESG - GC Score of whole universe of 7,626 companies versus AAOIFI-compliant firms (top) and AAOIFI and UNGC portfolio (bottom).

U.N. GLOBAL COMPACT

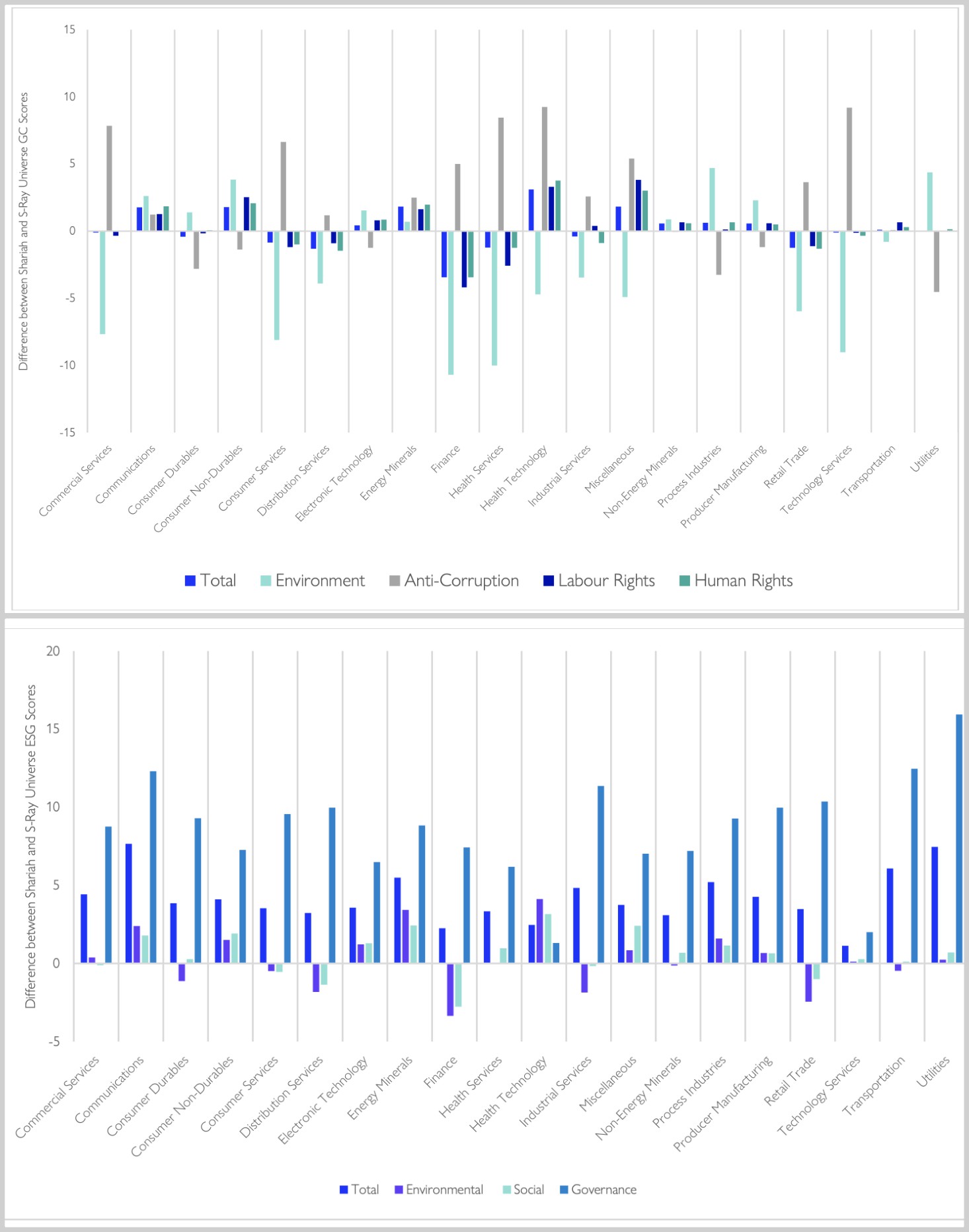

To assess how companies have been performing in 20 business sectors aligned to the U.N. Global Compact’s principles relating to human rights, labour rights, environmental responsibility, and anti-corruption measures, the Shariah portfolio consistently underperforms the wider dataset in terms of environmental scores, though it generally performs better in anti-corruption.

In a similar analysis of the three ESG measures across the same 20 business sectors, Shariah-compliant companies outperform the wider dataset throughout, with governance standing out across the board. With regard to environment and social scores, the difference is much less noticeable with much smaller and occasionally negative comparisons.

Of the 290 Shariah-compliant companies in the S-Ray database that are also recorded as being U.N. Global Compact signatories, these generally have higher average ESG scores, to the tune of 16.4%, and GC scores averaging 17.9% higher than the overall dataset.

Based on the performance of specific operational features that contribute to the S-Ray U.N. Global Compact and ESG scores, it is clear that Shariah companies which are also GC signatories perform worse in features such as compensation, which is defined as fair and equal compensation of staff and board members, and corporate governance, which refers to procedures and mechanisms that ensure proper long-term control and management of the corporation. However, for all remaining features, Shariah-compliant GC signatories companies outperform the rest.

Charts generated by Arabeque showing difference between Shariah and S-Ray universe for GC and ESG scores by sector.

NO GUARANTEE OF GREATER SUSTAINABILITY

Although the overall Shariah-compliant portfolio outperforms the wider dataset in terms of mean ESG score, Arabesque stresses that this does not necessarily imply that halal companies are more sustainable than their non-Shariah counterparts.

This becomes increasingly clear at the business sector level, where there exists both out- and under-performance of Shariah companies relative to the overall dataset across ESG sub-scores. Moreover, in terms of business operations, there is considerable variation in the difference between Shariah and overall average scores across sectors, with both positive and negative deltas.

In addition, GC scores show similar results to ESG scores. Though there is slight outperformance, this is distinctly less clear with smaller levels for the GC score and larger variation at the sub-score and sector-level.

“Interestingly, when analysing the AAOIFI-compliant companies that are also signatories of the UN Global Compact, we see considerable outperformance over the S-Ray Universe, including the majority of the feature categories,” Stott said.

“The results of this analysis demonstrate the tight coupling between Shariah and socially responsible investing. A number of the characteristics that lead a company to be Shariah-compliant may be just as important for a conventional investor looking to invest their money through a socially responsible lens.

“It is a core belief of Arabesque that Shariah investments are just as suitable for conventional investors as they are for Islamic ones,” Stott added.

SHARIAH COMPLIANCE A STEP AWAY FROM ESG

The principles of the U.N. Global compact are among the factors Shariah investment houses use to determine the suitability of a corporate target, but “we take a more engagement-based approach as we shouldn’t expect perfection”.

That is according to Gerry Ambrose, chief executive of Aberdeen Standard Islamic Investments in Kuala Lumpur, who stresses that environmental, social and good governance factors still weigh heavily in any decision to invest in a company.

“If you refuse to invest in a company that has breached the UN goals in its history, you would have a pretty small portfolio of companies from which you can select your fund. What we are trying to find out is if a company is sound and now aware of the sustainability goals, and is moving in line with meeting these requirements. Some of them are not perfect.”

Whereas companies that have signed up to the GC must commit to “implement 10 universal sustainability principles” relating to human rights, labour, environment and anti-corruption, ESG factors are more fluid and monitored largely by dedicated ratings agencies.

Since the nature of Shariah investment places a stronger emphasis on sustainability, social responsibility and governance, some investors view Shariah-compliant funds as a subset of ESG funds.

“We are quite strong on ESG and we see the trend of Shariah fund management being lumped together with ESG,” said Ambrose. “All our Shariah-compliant funds are ESG-compliant and they are all within certain tolerance goals set by the United Nations.”

One of the most recent companies to adopt the AAOIFI Code of Ethics for Islamic Finance Professionals is Ethis Global, which believes it is the first Islamic fintech to do so. The Malaysian social crowdfunding platform is also a signatory to the GC.

“We felt it was important to formally be a signatory of the global compact since we operate in emerging countries where some principles may not always be upheld such as protecting the environment and anti-corruption. As a signatory, we have more credibility as a responsible company, which assists us in forming partnerships and gaining clients,” said Umar Munshi, Ethis’s co-founder.

“We also signed up to the AAOIFI code to have a clear framework and guidelines of ethics directly linked to Islamic principles. The main difference is in the onboarding and training of our staff to understand Islamic ethics in our work at a deeper level.”

(Reporting by Richard Whitehead; Editing by Emmy Abdul Alim emmy.abdulalim@salaamgateway.com)

© SalaamGateway.com 2020 All Rights Reserved