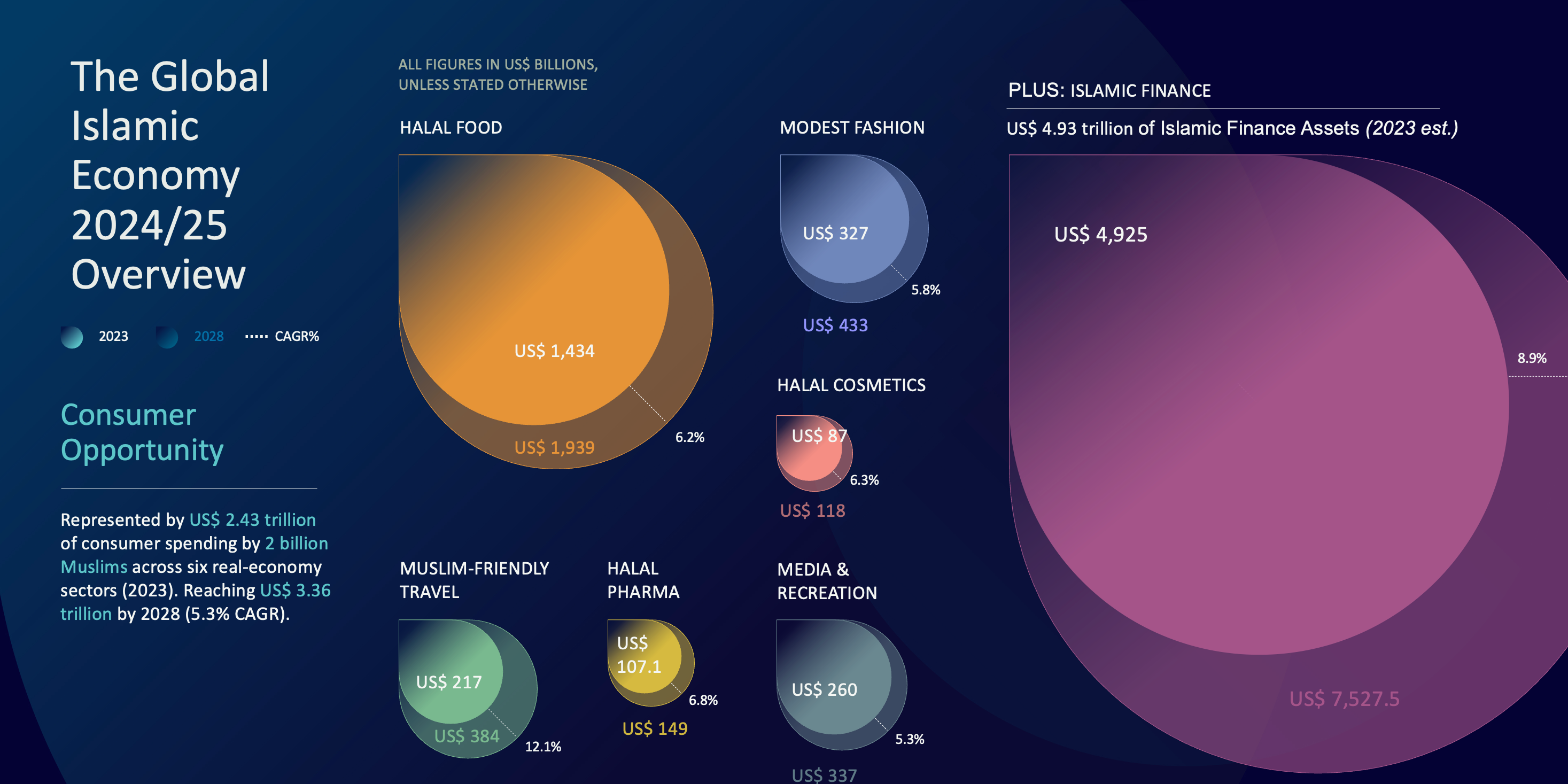

The Global Islamic Economy 2024/25 Overview: Muslim consumer market size and trajectory

Largest and fastest-growing sectors

Halal food retains pride of place, accounting for almost three-fifths of total spend with US $1.434 trillion in 2023 and on track for US $1.939 trillion by 2028. Yet the most dramatic expansion is earmarked for Muslim-friendly travel, whose post-pandemic rebound is tipped to deliver a 12.1% CAGR, taking the market from US $217 billion to US $384 billion in just five years. Halal pharmaceuticals (6.8% CAGR) and halal cosmetics (6.3% CAGR) also outpace the headline growth rate as Muslim consumers pivot toward health, wellness and ethical beauty solutions.

|

Sector |

2023 spend |

2028 forecast |

5-yr CAGR |

|

Halal Food |

US $1.434 tn |

US $1.939 tn |

6.2 % |

|

Muslim-friendly Travel |

US $217 bn |

US $384 bn |

12.1 % (fastest) |

|

Modest Fashion |

US $327 bn |

US $433 bn |

5.8 % |

|

Halal Media & Recreation |

US $260 bn |

US $337 bn |

5.3 % |

|

Halal Pharmaceuticals |

US $107 bn |

US $149 bn |

6.8 % |

|

Halal Cosmetics |

US $ 87 bn |

US $118 bn |

6.3 % |

Islamic finance asset size

- US $4.93 trillion in global Islamic-finance assets (2023).

- Expected to reach US $7.53 trillion by 2028 (8.9 % CAGR), underscoring capital depth that underwrites the wider halal economy.

Best-performing national ecosystems (GIEI 2024)

-

- Malaysia

- Saudi Arabia

- Indonesia

- UAE

- Bahrain

Trade, investment and consumer signals highlighted

- US $407.8 bn worth of halal-related goods imported into OIC states in 2023, forecast to rebound sharply to US $608 bn by 2028 (8.3 % CAGR).

- OIC member countries remain heavily reliant on imports, posting a US$ 76.37 billion trade deficit in halal related products.

- Only 3 OIC nations in the top 10 exporters to OIC countries for halal related products.

- US $5.8 bn invested across 225 Islamic-economy deals (Aug 2023–Jul 2024); Media & Recreation largest by count, Islamic Finance largest by value.

- Key signals mapped include AI-powered halal certification, blockchain traceability, localisation of supply chains and the rise of halal-oriented VC/PE funds.