The Gaza conflict that began last October has grown into a multi-faceted brutal dispute, with spillover effects across the region and beyond.

The crisis has not only reshaped the enclave and the realities of its residents but has drawn in companies, brands, and countries, too, as they juxtapose strategies with postures.

Türkiye announced in May that it will suspend all trade with Israel, building on earlier restrictions set out last month.

The country’s trade ministry said in a post on social media platform X that necessary efforts are being coordinated with the Palestinian ministry of national economy to ensure that "Palestinian brothers and sisters who have to live under occupation are not affected by these restrictions."

The directive was preluded by an earlier decision issued on April 9 in which Türkiye had halted the exports of 54 product categories to Israel until a cease-fire was implemented and sufficient humanitarian aid was allowed into the Gaza strip. The restricted items included several types of aluminium and steel products, paint, electric cables, construction materials, fuel, and other materials.

Potential impact

Israel is one of Turkiye's top long steel export destinations, so the restrictions could harm Turkish mills' export volumes and pricing, according to S&P Global Commodity Insights. Israel is also one of Turkiye's major steel pipe export destinations.

Capt. Cem Ercan, CEO at Ceta Logistics & Projects told Salaam Gateway that Türkiye’s decision to stop Israeli exports will directly affect both the logistics and transportation sectors.

“It is obvious that there will be a decline, especially in the iron and steel sector and transportation. This will indirectly affect the economy and logistics activities of both countries.”

Bilateral trade between the two countries stood at $7.06 billion in 2023, according to data released by the Turkish Statistical Institute.

“Turkiye serves as the largest supplier of raw iron bars to Israel, accounting for approximately 63% of Israel's total imports in this category. This cessation of trade is expected to have a substantial impact on Israel's construction sector,” Iman Ali Liaqat, consultant at DinarStandard told Salaam Gateway.

Last December, Malaysia also barred all Israeli-flagged and Israel-bound ships from docking at its ports. The country’s prime minister Anwar Ibrahim announced in a statement that the decision will not affect Malaysia’s trade activities.

Regional landscape

Türkiye’s decision to restrict trade is expected to impact its economy, but it raises a bigger question: Will other MENA countries follow suit?

“At the start of the Israel-Hamas war, there were calls to actually reduce or just not export to Israel from Arab countries or impose some sort of a blockade, but all of these calls were generally refused by most of the Arab countries,” said Samer Talhouk, senior analyst, MENA country risk at BMI last month. “I don’t think we would see any such restrictions unless things escalate significantly or there is some sort of a miscalculation."

Rafi-uddin Shikoh, CEO at DinarStandard said Türkiye’s decision is reflective of a direction that MENA countries could potentially pursue.

“Which country will follow suit and to what degree remains to be seen but for now, there is at least a momentum for such decisions to be taken,” adds Shikoh.

Several countries across the MENA region have forged ties with Israel in recent years. The UAE, Bahrain and Morocco established full diplomatic ties with Israel in 2020 as part of the Abraham Accords. This was preceded by Egypt forming diplomatic relations in 1979, followed by Jordan in the 1990s.

The UAE also became the first Arab country to ratify a comprehensive economic partnership agreement with Israel, reducing or eliminating tariffs on more than 96% product lines, with the aim to bolster non-oil bilateral trade to $10 billion by the end of the decade.

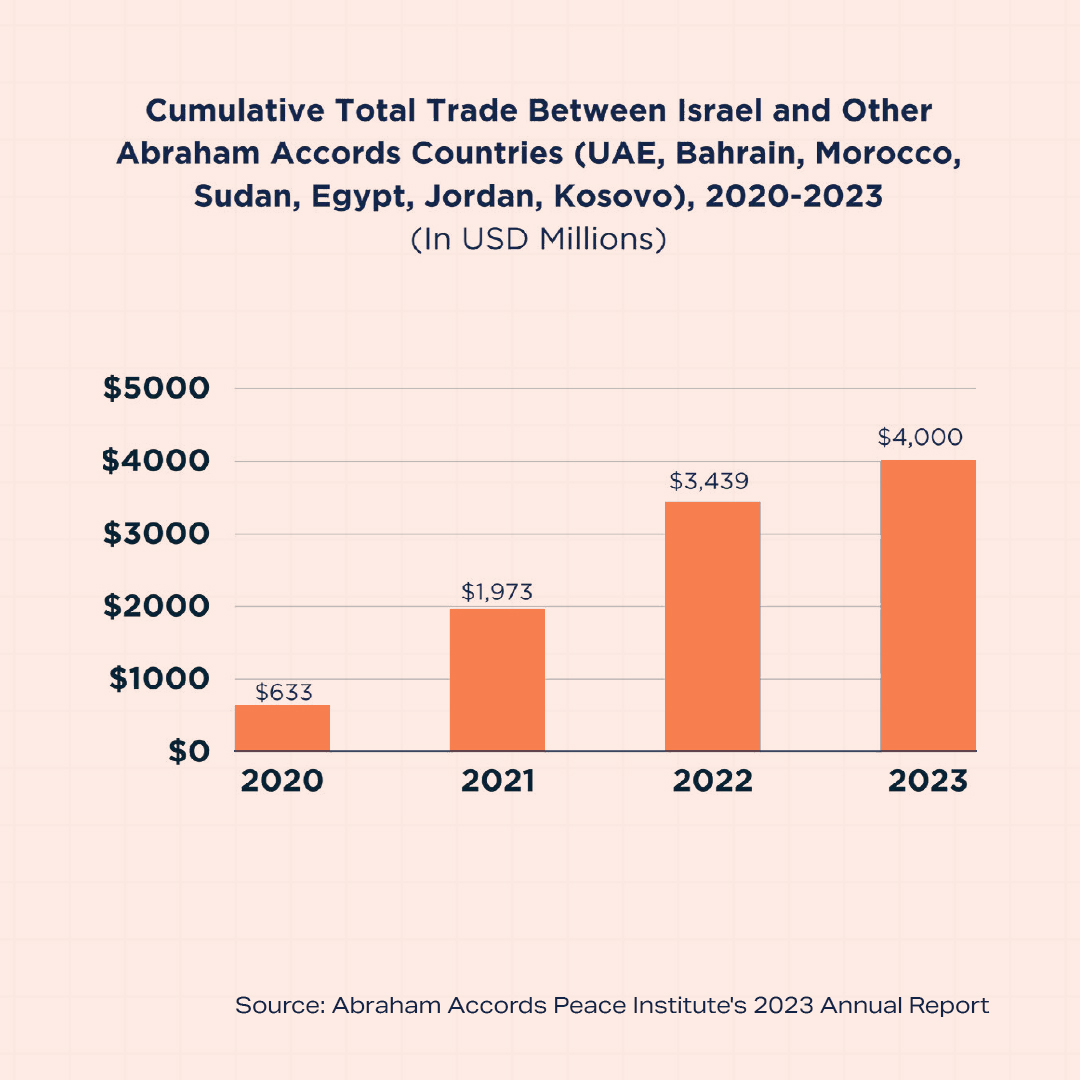

Accumulated trade between Israel and the Abraham Accords countries, including the UAE, Bahrain, Morocco, Sudan, Egypt, Jordan, and Kosovo, exceeded $4 billion in 2023, up 16% on 2022, the Abraham Accords Peace Institute (AAPI) said in its 2023 Annual Report, citing data from the Israel Central Bureau of Statistics.

“The actual volume and value of trade in goods and services between Israel and Abraham Accords countries was in fact much higher. For example, these statistics do not include the export of Israeli natural gas to Egypt and Jordan, and Israeli water to Jordan. The exports of natural gas and water from Israel to Egypt and Jordan is estimated to be valued at more than $2 billion. Similarly, most defence-related trade is not included in these official trade statistics,” the AAPI report added.

“The actual volume and value of trade in goods and services between Israel and Abraham Accords countries was in fact much higher. For example, these statistics do not include the export of Israeli natural gas to Egypt and Jordan, and Israeli water to Jordan. The exports of natural gas and water from Israel to Egypt and Jordan is estimated to be valued at more than $2 billion. Similarly, most defence-related trade is not included in these official trade statistics,” the AAPI report added.

Trade in services, including software and cyber, is not a part of the statistics either. Hence, the report estimates that the real value of trade and investments with Abraham Accords countries exceeded $10 billion last year.

The Gaza war has had a limited impact on Israel’s trade with Abraham Accords countries, ebbing 4% from $937 million to $903 million in the last three months of 2023, the AAPI report noted.

What to expect?

Turkiye's trade suspension may have garnered attention the world over, but whether it is enough to create a domino effect remains to be seen.

“The decision reflects political factors and is viewed as a symbolic gesture to resonate with public sentiment. It's expected that other OIC [Organisation of Islamic Cooperation] nations will prioritise non-economic actions like diplomatic and humanitarian endeavours, rather than opting for a complete trade boycott,” said Liaqat.