UAE approves strategy to bolster halal industry, Islamic finance

The UAE has approved a strategy to develop a globally competitive national Islamic financial sector, facilitate its activities and drive leadership in sustainable finance.

The strategy, which also seeks to boost exports by increasing local halal production and reach global Islamic markets, was approved during a cabinet meeting chaired by Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE.

“We aim to increase the assets of our Islamic banks from 986 billion Emirati dirhams to 2.56 trillion Emirati dirhams within six years and raise the value of listed Islamic sukuk in the UAE to over 660 billion Emirati dirhams by 2031,” said Sheikh Mohammed.

The UAE Strategy for Islamic Finance and Halal Industry aims to strengthen international sukuk listed in the UAE to 395 billion Emirati dirhams.

The global Islamic finance industry was on a tear last year, propelled by strong growth in banking assets and sukuk. Total Islamic finance assets rose 10.6% in 2024, with Islamic banking assets contributing 60% to sector growth, according to S&P Global Ratings. The GCC accounted for 81% of this surge.

“We expect economic growth in Saudi Arabia and the UAE will continue supporting Islamic banking asset expansion in 2025, barring any significant disruptions from global trade tensions or a further decline in oil prices. In the UAE, the non-oil economy's performance, along with capital expenditure needs across various sectors will further support financing requirements and sukuk issuances in 2025,” S&P said in a report last month.

“We expect economic growth in Saudi Arabia and the UAE will continue supporting Islamic banking asset expansion in 2025, barring any significant disruptions from global trade tensions or a further decline in oil prices. In the UAE, the non-oil economy's performance, along with capital expenditure needs across various sectors will further support financing requirements and sukuk issuances in 2025,” S&P said in a report last month.

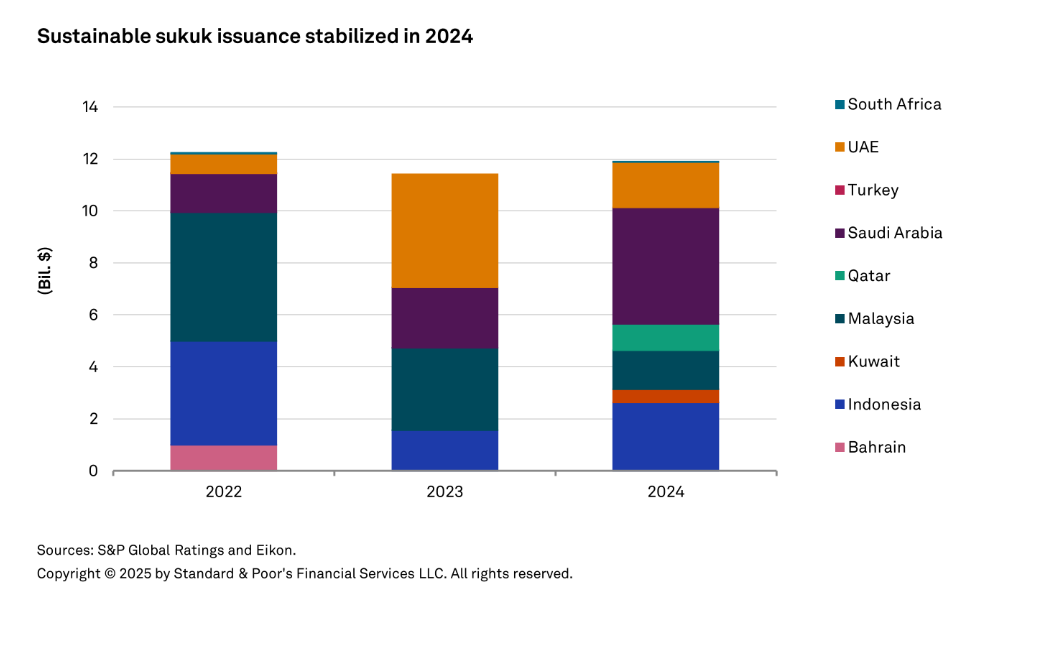

The UAE contributed 15% of the overall sustainable sukuk issuance in 2024, despite deteriorating 60% on the previous year.