UAE's free trade agreements with OIC states – how will they impact the Islamic economy?

Globalization is not a recent topic. Agreements to foster cross-border trade of goods and services have long proven to strengthen industries, develop strong investment partnerships and catapult trade.

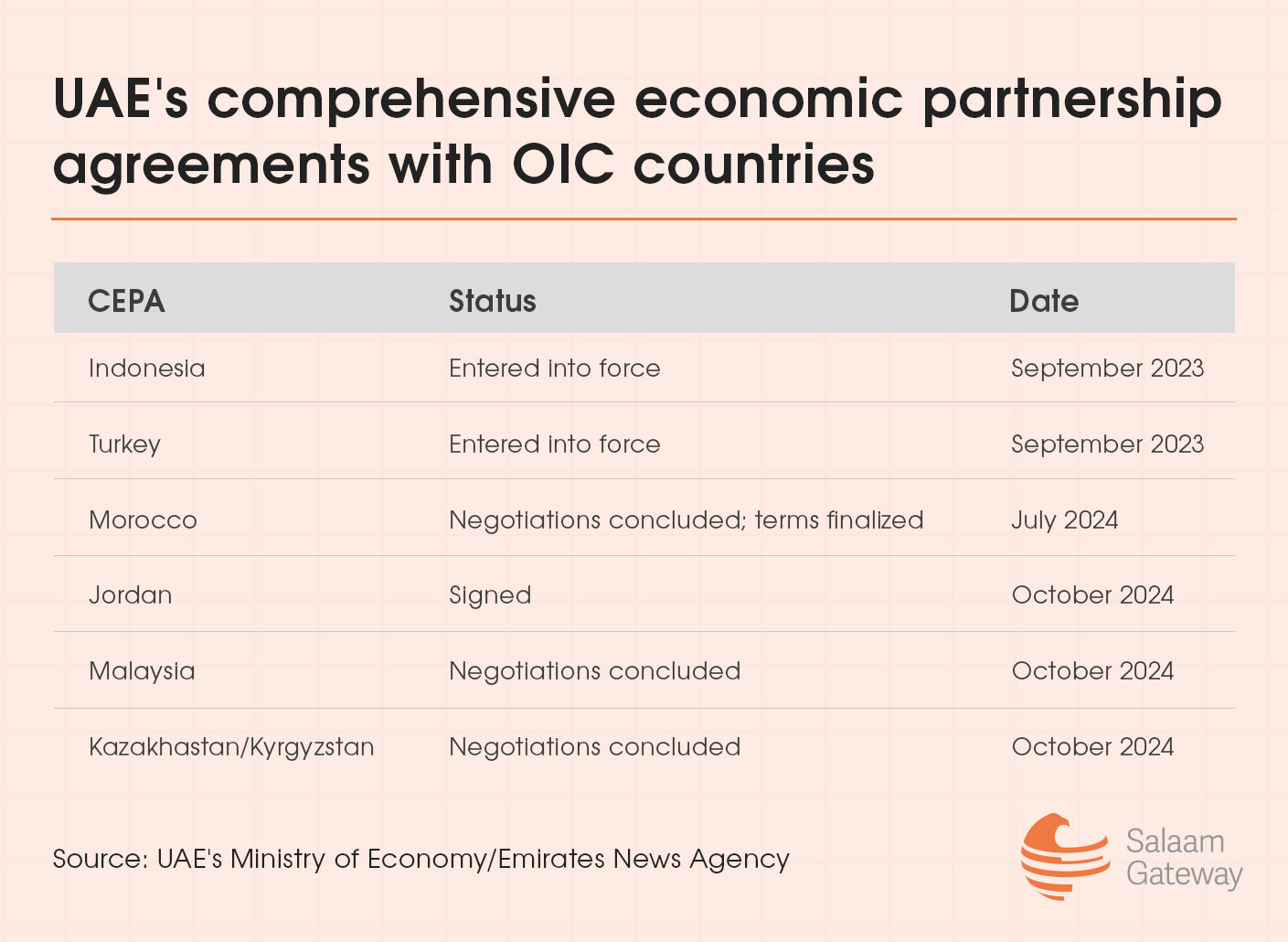

To undergird the country’s growth and increase non-oil trade, the UAE launched its comprehensive economic partnership agreements (CEPA) programme in September 2021, aiming to achieve $1 trillion in trade value by 2031. Agreements implemented as part of the initiative since encompass markets across the Middle East, Africa, South America, Asia and Europe, covering around a quarter of the world’s population.

Several of the country’s CEPAs have been with Organization of Islamic Cooperation (OIC) countries. How can these agreements promote the Islamic economies of participating nations?

“The significance of CEPA agreements with OIC countries is multi-dimensional. The Islamic economy is embedded within the DNA of these pacts, which could support bilateral growth,” Bashar Al-Natoor, Islamic finance head at Fitch Ratings told Salaam Gateway.

OIC agreements

The UAE signed a comprehensive economic partnership agreement with Indonesia in 2022, its first with an OIC country and third overall. The agreement included a specific chapter on the Islamic economy (IE), committing both parties to promote IE's current and future sectors. Bilateral non-oil trade grew 12% to $4.6 billion last year, with the deal aiming to raise it to $10 billion annually.

“The UAE's CEPA with OIC countries like Indonesia represent a transformative opportunity for the Islamic economy,” Ahmad Soffian, CEO and co-founder of Sa’adah Global, an Indonesia-based halal business consultancy told Salaam Gateway.

“For Indonesia, a global leader in halal products and services, this partnership can amplify exports of halal-certified goods to the UAE and other OIC countries, facilitating the growth of SMEs and startups in the halal ecosystem. Moreover, by integrating expertise and resources, these agreements encourage innovation, investment, and the establishment of unified halal standards, boosting the global competitiveness of the Islamic economy.”

The UAE-Indonesia pact was followed by a free trade agreement with Türkiye signed last March, eliminating or reducing custom duties on 82% of product lines.

The UAE-Indonesia pact was followed by a free trade agreement with Türkiye signed last March, eliminating or reducing custom duties on 82% of product lines.

The agreement, which is expected to increase non-oil bilateral trade to $40 billion annually within five years, includes a halal cooperation article that encourages both countries to negotiate and finalize a memorandum of understanding related to halal quality infrastructure and mutual recognition on halal certification. This includes standards and accreditation of halal products.

“CEPAs could impact the broader Islamic economy, helping address issues such as halal certification and halal labelling. Türkiye could build on its cachet of being a significant destination for Muslim-friendly tourism and halal food, while developing other IE verticals too,” said Al-Natoor.

Both agreements came into force in August 2023. Dr. Thani bin Ahmed Al Zeyoudi, the UAE’s minister of state for foreign trade, said at the time that these agreements would act as catalysts for channelling investments into promising sectors including energy, logistics, tourism, the Islamic economy, agriculture, and more.

“The UAE’s Islamic finance industry is in a relatively advanced stage, where almost 29% of bank financing and deposits are Shariah-compliant. Moreover, UAE Islamic banks are significant investors, arrangers and issuers of international sukuk, while countries such as Indonesia and Türkiye are major sukuk issuers. CEPA agreements with these countries could help further mature the Islamic finance industry and support existing collaborations,” added Al-Natoor.

The UAE and Morocco finalised the terms of a CEPA agreement in July. Bilateral non-oil trade stood at $1.3 billion in 2023 with the UAE being Morocco’s largest Arab investor. The following agreement with Jordan inked in October this year became the first free trade pact signed between an GCC and an Arab state.

While the text of both the above agreements has not been published, the pact with Morocco is expected to establish platforms for investment and private sector collaboration across renewable energy, tourism, infrastructure, mining, food security, transport, and logistics. The partnership with Jordan is also expected to foster opportunities across renewable energy, industrial projects, manufacturing, transport, pharmaceuticals, and food processing verticals.

The UAE and Malaysia concluded negotiations towards a trade deal this October. The Malaysian Investment Development Authority said earlier in the year that the pact would introduce Malaysia’s first chapter on the Islamic economy in a CEPA, facilitating collaboration with the UAE in areas of halal certification and Islamic finance.

“The CEPA is a strategic lever for UAE-based companies to optimise Malaysia as a gateway into the ASEAN market, which in turn, will provide tremendous opportunities for our businesses – particularly the SMEs – through integration into regional supply chains, capacity-building and knowledge sharing,” said Zafrul Aziz, Malaysia’s minister of investment, trade and industry.

The UAE concluded negotiations for an economic agreement with the Eurasian Economic Union this month in a sign of deepening ties between the GCC state and the bloc. The agreement will encompass five members of the EAEU bloc, comprising Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia, two of which are OIC states.

The UAE’s push into trade deals has resulted in non-oil trade of 1.4 trillion dirhams ($381.2 billion) in the first six months of 2024, up 11.2% on the previous year. Trade pacts with global partners has also propelled the flow of foreign direct investment into the country.

"The results of our partnerships with key allies around the world are clear, with the sharp increase in trade flows supporting our status as a dynamic hub for global commerce and a gateway to high-growth markets worldwide,” Al Zeyoudi said on LinkedIn.