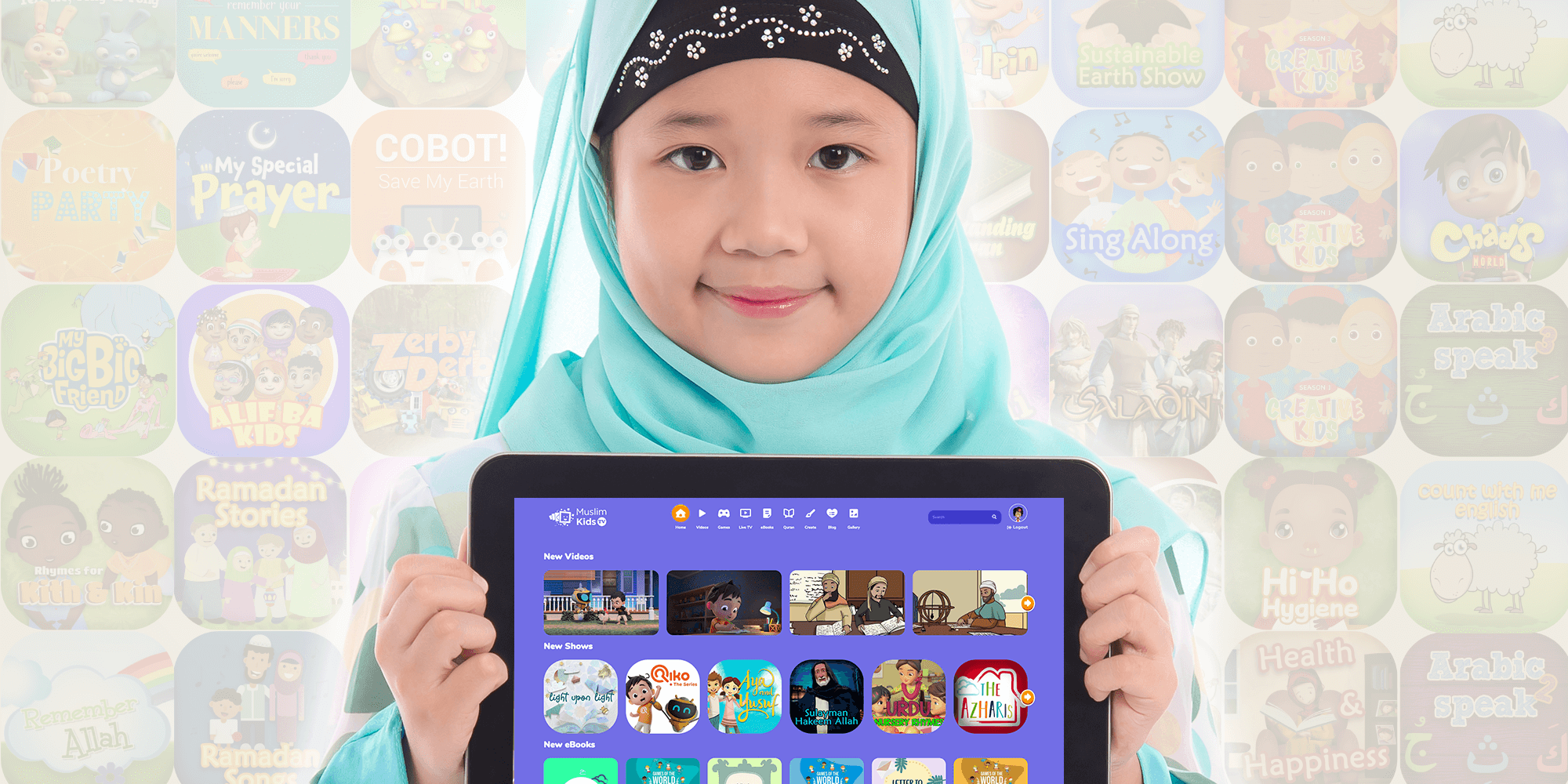

‘We want to be the Disney of the Muslim world’: Now seen in over 60 countries, Muslim Kids TV seeks funding for growth

Muslim Kids TV has managed to expand viewership in over 60 countries with just $1.2 million in pre-seed funding since it started in 2014. In the past two years alone, it hit triple percent growth in its core subscriber market and quadruple percent growth in emerging markets.

The streaming platform is now seeking venture funding for a seed round in the third quarter to fund even more growth.

“We will be putting together a consortium of investors with expertise in the consumer media space,” CEO and founder of Muslim Kids TV (MKTV), Michael Milo, told Salaam Gateway.

“Ideally, one or two investors will be from Muslim countries that can provide market entry access and connections. In the past we were forced to be very capital-efficient given the intricacies of the market, but we’re now ready for that growth funding.”

The Canada-based specialty streaming platform has been steadily expanding its viewership in English-speaking Western countries before entering Muslim-majority markets. It made inroads into Indonesia earlier this year through strategic partnerships and is seeking new funding to expand in other Muslim-majority markets.

|

MUSLIM KIDS TV IN NUMBERS

|

MKTV launched as a start-up at the University of Alberta’s TEC Edmonton technology accelerator, utilizing crowdfunding as well as federal and government support to develop the platform by producing its own, and acquiring, content. The platform currently has over 10,000, videos, games, e-books, and DIY content as well as offering three linear streaming channels for pre-school, school-age and tweens.

It has had to continuously innovate its content and marketing strategies to reach scalability. “One-offs don’t sustain the industry,” said Milo.

Governmental support for MKTV has given the platform “credibility”, said Flordeliza Dayrit, the company’s co-founder and COO. Nonetheless, it took time for the government to recognize that MKTV fitted into wider policy plans to improve multiculturalism and diversity in Canada.

“Last year the national public broadcaster (Canadian Broadcasting Corporation, CBC) contacted us to put their content on our platform. For us, we were quite surprised but it was refreshing that they see us a category leader in the space and our potential to grow and deploy in different countries,” said Dayrit.

One of MKTV’s struggles has been to sell content in Muslim-majority countries, with national broadcasters frequently asking to acquire programmes but more often than not lacking competitive international budgets.

“We have had to be strategic, going on a case-by-case basis. Our approach has been to not break-up exclusivity of the content on the platform,” said Milo.

The company turned to strategic tie-ups to enter markets. In March, the platform launched in Indonesia through partnerships with the country’s largest mobile providers and mobile wallets including XL Axiata, Indosat, Tri, Telkomsel and OVO for mobile financial services. MKTV has also partnered with media company Garis Supuluh, which was set up by Indonesian actors, and it also had the backing of the Canadian government and Indonesia’s Ministry of Tourism and Creative Economy.

Teaming up with mobile providers and mobile wallets has been key to entering new markets to enhance accessibility and ease of payments. “Some countries have not adopted credit cards to the same degree as, say, the Arabian Gulf countries, so there are a lot of logistical challenges. To enter different markets we make sure we have the infrastructure and partners in place,” said Milo.

With the payment system operational in Indonesia, MKTV is currently dubbing its content into Bahasa Indonesia and acquiring more local content, which will bolster the platform’s own offerings as well as media production on the ground.

“Our big picture vision is to actively look for content providers and co-production partners. What we’ve found in talks with culture and digital economy ministries is that they see this as a great way to stimulate the local production industry. While for us, we offer producers access to a global audience together building and sustaining a viable faith-based content industry,” said Milo.

Throughout most of the Organization of Islamic Cooperation (OIC) countries, the children’s media industry is underdeveloped. “It is taking off now all over the world. We are seeing it countries that weren’t producing Islamic-themed content, like Bangladesh and Pakistan,” said Milo.

MKTV is looking to enter the Pakistani market and to expand into key African countries like Nigeria and Sudan.

“We are doing a trial run in Pakistan. We’ve done the technical integration, and are at the testing stage right now,” said Milo.

WHERE ARE THE MUSLIM INVESTORS?

Yet while Islamic countries are interested in streaming the content, MKTV has seen more reluctance from investors in those places to back new productions and the platform itself. “We are finding more than a few Islamic content producers are actually South Korean or Chinese-owned. Many Muslim venture capitalists are not seeing the potential,” said Dayrit.

Global streaming services, however, get it. “There is quite a hot market around speciality streaming services. These big streaming companies have their eye on MKTV – ‘can you crack this nut, to open up underdeveloped markets’? If we are able to do that, it is tremendously valuable to them,” said Milo.

“We think we’d have no problem to attract a kind of merger or acquisition (from these international streaming services). Our immediate challenge is to raise some of the initial funding to properly position ourselves.”

GOING GLOBAL

Indicative of MKTV moving in the right direction is Netflix acquiring the rights to stream the UAE-made award-winning animated film Bilal, produced by Barajoun, which MKTV had originally streamed. “We marketed Bilal very well. Barajoun sees us as a good partner to capture audiences that like to watch their programmes,” said Milo.

To attract viewers around the world MKTV adopted different tactics to global streamers like Netflix and Disney+, which have removed free trials.

“We’ve kept the 14-day free trial as there’s a lot of skepticism around Muslim content, and we want to showcase that there is value in it. Our conversion rate is really quite high, at 70%,” said Dayrit.

“Parents see the engagement with their children, the quality of the product, and that the platform is massive - we offer videos, films, games, e-books and the Quran app, and also a comic creator for users to upload content.”

MKTV has however taken a leaf out of Netflix’s play book by using analytics to gauge what consumers want. “A few years ago we wanted to be broad-based, with values, but what analytics tells us is that the faith-based part of our content is some of the most popular, so that drives our programming and decisions,” said Dayrit.

“Netflix has been so successful because their analytics side is so advanced in the industry, which has given them the edge. We want to apply that to what we are doing,” she added.

Better understanding consumer demand has reaped significant dividends. MKTV’s churn rate – consumers opting out – dropped by 30% between 2019 and 2021, with the average monthly churn rate now just 4%. In the past it was as high as 35%, according to Dayrit.

The platform has also made sure it is easily accessible on many channels – it is now available as an app on all major TV brands including Apple TV, Android TV, Amazon Fire TV, Roku, Samsung and LG, and it is eyeing tie-ups with Asian Smart TV manufacturers like TCL and others, according to Dayrit.

DISNEY OF THE MUSLIM WORLD

MKTV produces 42% original content, acquiring the remaining 58%. “We hope to balance the content as we grow over the next couple of years, to produce 60% of content and acquire the rest,” Dayrit said.

It is also venturing into the interactive games industry, currently developing Time Hoppers: the Silk Road, a role play game for children aged six to nine years old.

“We received (Canadian) federal funding for the game and we’re hoping to partner with different game distributors. When we talk about Islamic media, it is even more undeveloped in the games industry. It could outperform TV and film revenue globally. It is a huge growth area,” said Milo.

As MKTV gears up for a new round of funding, it is aiming to become a global player in Muslim children’s entertainment.

“We want to be the Disney of the Muslim world, to be like the big Hollywood studios that have been around for 100 years and are billion dollar companies,” said Milo.

© SalaamGateway.com 2021 All Rights Reserved