What are the parts of the global Islamic fintech framework?

The world's Islamic fintech framework comprises five areas that work together to make the industry tick, according to the Global Islamic Fintech Report 2021 from DinarStandard and Ellipses.

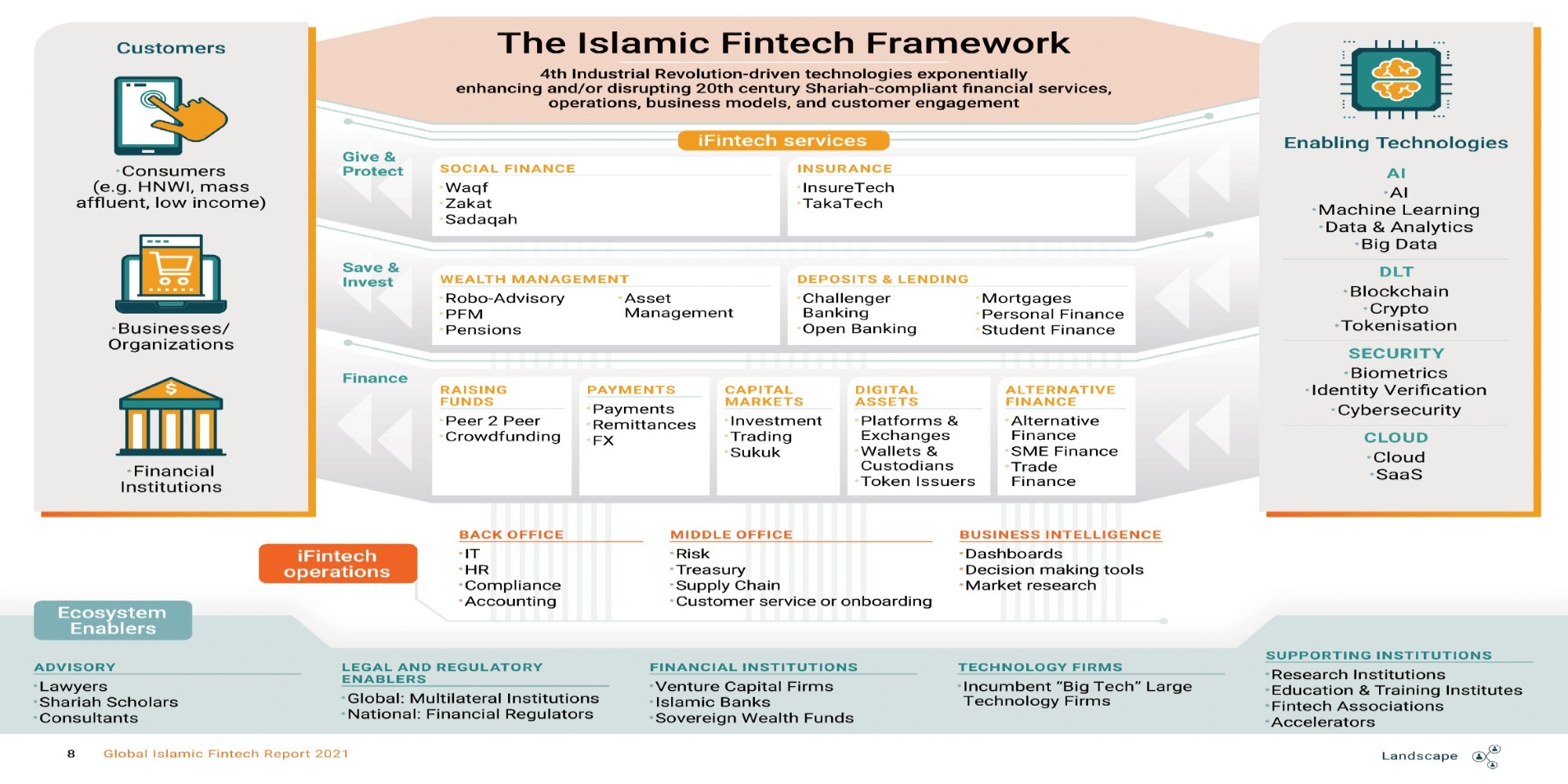

Services are probably the best-known as they're the ones facing end-consumers. These services include those in social finance, insurance, wealth management, deposits and lending, raising funds, payments, capital markets, digital assets, and alternative finance.

These services make use of enabling technologies like Artificial Intelligence, Distributed Ledger Technology, Security, and Cloud.

Using these technologies, services face their customers who include consumers, business organisations and financial institutions.

The operations that make all this happen include back office, middle office, and business intelligence.

What the end-customers don't often see for themselves is how all of these are impacted by the ecosystem's enablers that include advisory, legal and regulatory players, financial institutions, tech firms, and supporting institutions.

These different parts of the framework rely on each other to make Islamic fintech work.

The Global Islamic Fintech Report 2021 produced by DinarStandard and Ellipses can be downloaded in full from here.

© SalaamGateway.com 2021 All Rights Reserved