What’s the demand for gold in Islamic markets?

The Dubai Gold and Commodities Exchange (DGCX) plans to introduce a physically-backed Shariah-compliant spot gold contract, aiming for trading in the commodity to begin March 29.

A handful of Shariah-compliant gold products have been launched since Bahrain-based Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) released its standard on gold in November 2016 in a bid to expand the use of bullion in Islamic finance.

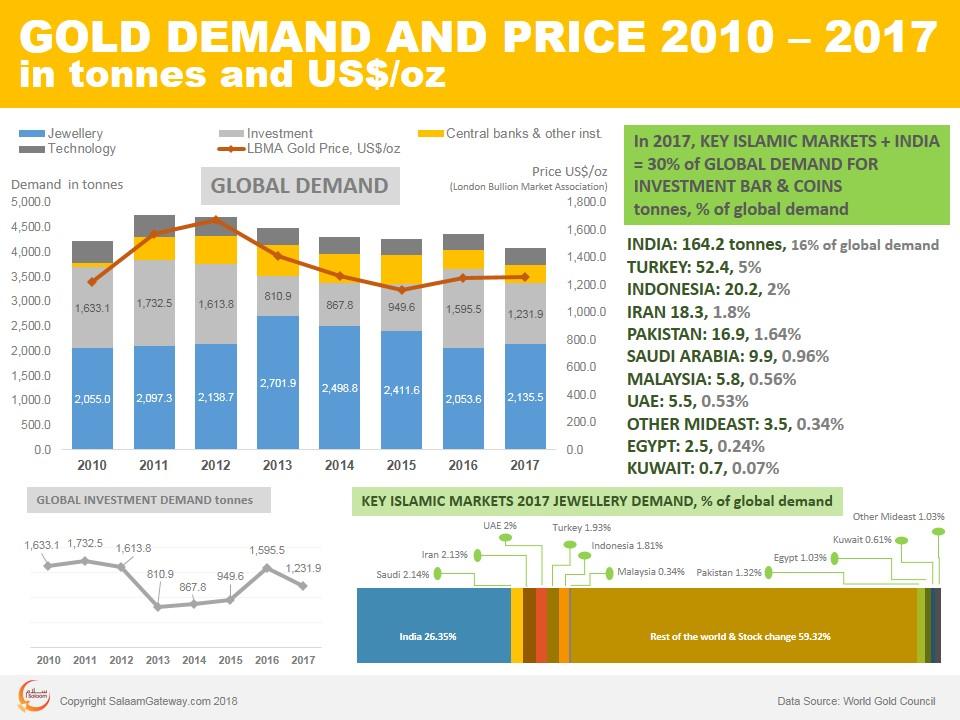

This comes at a time when the global demand for gold dropped seven percent to 4,071.7 tonnes in 2017, according to the World Gold Council.

Gold demand is measured across four main categories: 1) jewellery, 2) technology, 3) investment and 4) central banks and other institutions.

There was a four percent increase in demand for jewellery and three percent rise in gold demand for use in technology in 2017.

The demand for the precious metal by central banks and other institutions dropped five percent last year.

INVESTMENT

Total global investment demand dropped 23 percent in 2017, dragged down by a 63 percent plunge in ETFs and similar products, followed by a ten percent dip in official coins, and a two percent nudge down in demand for bars and coins.

Investment in gold comprises physical gold bars, official coins, medals/imitation coins, and Exchange Traded Funds (ETFs) and similar products.

MUSLIM-MAJORITY MARKETS INVESTMENT BARS & COINS

Among key Muslim-majority economies in 2017, Turkey saw the biggest demand for investment bars and coins, at 52.4 tonnes, representing five percent of global demand.

Indonesia follows with 20.2 tonnes, equivalent to around two percent of global demand for investment bars and coins.

Saudi Arabia leads Gulf Cooperation Council (GCC) countries, with 9.9 tonnes, representing around 0.96 percent of global demand.

The United Arab Emirates (UAE) saw a demand of 5.5 tonnes, equal to around 0.53 percent of global demand.

Globally, Greater China--comprising China, Hong Kong and Taiwan--and India were the biggest markets for investment bars and coins, at 313.8 tonnes and 164.2 tonnes, respectively. China made up 30.5 percent of global demand and India 16 percent.