Will Maldives develop offshore Islamic finance sector from growth in local services?

The archipelago seeks to become a Islamic finance hub for South Asia, but needs more legislation and the country’s half a million Muslims to adopt Islamic banking.

The Indian Ocean archipelago Maldives is developing an Islamic finance sector, although it may need to strengthen legislation and local turnover to attract sufficient international players to develop an offshore hub.

In 2016 the government established the state-owned Maldives Centre for Islamic Finance Ltd (MCIF) charged with developing the country’s capacity to be a “hub for Islamic finance” primarily in South Asia. The centre conducts research on Islamic finance, provides product structuring and consultancy services and helps float Islamic capital market instruments on the Maldives stock exchange.

The MCIF recently announced it wants to “link the Islamic finance industry in The Maldives to international markets” by operating as a regional Islamic finance centre with representatives in the South Asian Association for Regional Cooperation (SAARC) region, the Middle East and China.

The company has already assisted in issuing cross-border Islamic financial instruments for infrastructure projects and development projects, pooling funds from different countries. In a statement publically released it said: “The Maldives, with more flexible legal and financial infrastructure, makes it one of the ideal destinations to have a regional financial centre”.

The Institute of Islamic Finance Maldives director, Dr Abdullah Shiham Hassan, has said the archipelago’s Islamic financial sector must innovate better to realise its significant potential and persuade the country’s mostly Muslim population of 540,000 to “fully embrace” the industry.

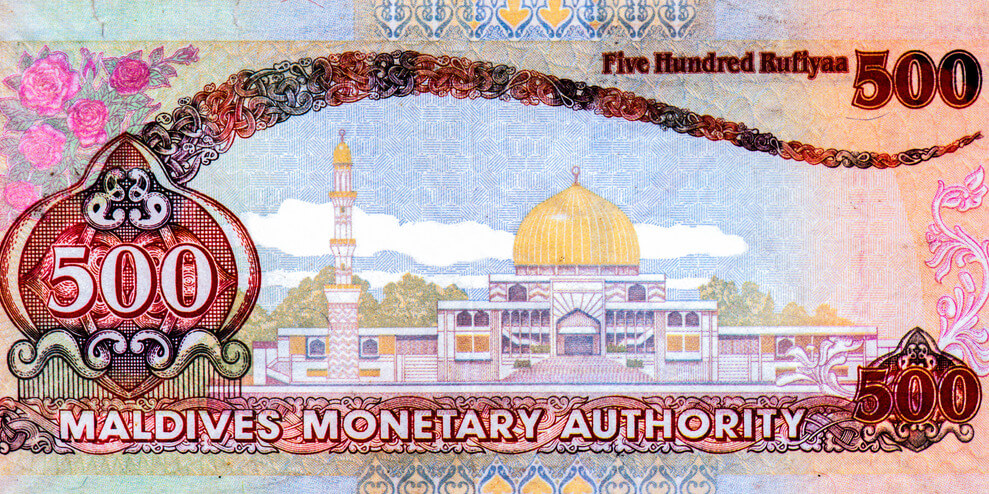

Hassan, a former advisor to the country’s central bank Maldives Monetary Authority on Islamic finance regulation and supervision and a key figure in drafting the country’s Islamic Banking Regulation (2011), told Salaam Gateway that to succeed in the Maldives, “savings and lending rates in Islamic banking need to be better than conventional banking”.

However, he said “people think, right now it's almost the same thing with a different packaging,” although on the plus side, this did indicate people are “consciously accepting” Islamic finance and should services be more abundant, they might be successful.

More significantly, Islamic finance growth is happening in the tropical island state, borne out by the success of the Maldives Islamic Bank – a collaboration between the Saudi Arabia-based Islamic Development Bank Group and the Maldives government.

Launched in 2011, the bank was the first fully Sharia-compliant bank in the country. The bank’s first quarter 2021 report said its revenue was Maldives rufiyaa (MVR) 66.9 million ($4.34 million) against MVR51.6 million ($3.35 million) in the final quarter 2020. Net profits were MVR26.6 million ($1.72 million) compared to MVR15.01 million ($975,000) over the same period.

The results also reflected the bank grew during the COVID-19 pandemic; posting posted a net profit of MVR31.5 million ($2 million) in net profit for the first quarter 2020 against MVR1.8 million ($116504) in the previous quarter.

Notwithstanding, the report noted that despite the “unprecedented setback in global economy” caused by COVID-19, the bank has maintained its headquarters and six branches in five atolls across the island country. These offer Islamic personal, business and investment deposit accounts and financing for personal and business needs.

Sharia-compliant products and takaful

The commercial Bank of Maldives (BML) established BML Islamic in January 2015 and offers a range of Sharia-compliant compliant products including investment services and children’s saver accounts. In 2020 the division introduced green financing for environment-friendly projects and education loans for customers paying higher education costs.

The Maldives also offers Islamic insurance (takaful) with Ayady Takaful, established in 2014, being the Islamic window of Allied Insurance Maldives. Its Sharia-compliant products include Cargo Takaful, Contractors Takaful, Fire Takaful, Home Takaful, Hull Takaful, Money Takaful, Motor Takaful and Travel Takaful.

The country’s former vice-president, ex-legal affairs minister and lawyer Mohamed Jameel Ahmed said the growth in Islamic businesses was benefitting from the increasing number of Maldivian students who had studied Islamic finance abroad and were returning home with much-needed skills.

“I am sure the country will have the numbers of trained financial professionals to meet the demand for Islamic banking skills,” he told Salaam Gateway.

Home-grown higher education is also helping. The Islamic University of Maldives offers a master’s course in Islamic finance practice and a post-graduate course aimed at “producing industry practitioners with global insight”. The course has been accredited by the Malaysian Qualifications Agency (MQA), meaning it is recognised in that country’s global Islamic finance hub, and covers a wide range of critical topics from wealth management, banking and investment to financial services, ethics and governance.

Legislative changes

Can this kind of growth see Maldives become an offshore and international centre for Islamic finance?

Hassan said this is “possible in the future”, but the government must solidify its Islamic finance regulation first. Ahmed said he hoped Maldives would pass a separate banking act for Islamic finance – something he believes will make a “big difference” by boosting the confidence of foreign Islamic financial players to invest in the country.

Backed by such a law, he predicted “an overwhelming majority” of Maldives consumers would save and purchase Islamic investment vehicles. He hoped the current government would not be deterred that an attempt to introduce in an Islamic Banking Act during former president Abdulla Yameen’s term (2013-2018) was unsuccessful.

He says that unsuccessful attempt evolved because of “a lack of political will” to push through this complex legislation in parliament. Consequently, the Maldives Banking Act 24/2010 still regulates the sector – the basis of a secondary Islamic banking regulation (2011).

While this is a legitimate law, Islamic finance specialists requesting anonymity said stand-alone primary legislation for Islamic finance in the Maldives would boost the sector’s international reputation. One issue with which effective regulation may have to grapple going forward is offering Islamic finance for tourism-related investments to service a sector that accounted for 28% of the country’s $7.26 billion GDP in 2020.

Ahmed said some goods and services offered by this sector, such as alcohol consumption and serving pork, could be considered haram. Hassan said tourism businesses drawing on Islamic finance investment would have to “eliminate haram elements”, but believed the real challenge in creating a significant Islamic finance industry was a “lack of political will to meaningfully embrace” Islamic finance.

He said the country’s leaders “really don't want Islamic Sharia ruling in our country, otherwise government bodies will not be able to charge compound interest.”

However, the government is keen on promoting halal tourism. As well as the Maldives Marketing & Public Relations Corporation’s ‘Have Halal, Will Travel’ promotion of Maldives as a growing hub for halal tourism, the Asian Development Bank (ADB) has also played its part in boosting the sector.

An ADB spokesperson said its inclusive micro, small, and medium-sized enterprise (MSME) development project that ended 2019 had provided business counselling and mentoring for more than 500 entrepreneurs and 55 new MSMEs.

The ADB worked with the Maldives Islamic Bank in rolling out this project, combining its $10.02 million with $10.3 million from the Islamic Development Bank and $700,000 from the Maldives government.

Ahmed is hopeful Maldives will have a sustainable Islamic finance sector in the future, saying it is “a progressive democracy but with a resilient economy”.

© SalaamGateway.com 2022. All Rights Reserved

Read - Maldives push for halal tourism may boost halal food imports

Poorna Rodrigo