Dana Syariah meltdown renews governance calls for Indonesia's Islamic fintech space

The Dana Syariah case is emerging as one of the largest Islamic fintech crises globally, casting doubt over regulatory oversight and consumer protection across the country's Shariah-compliant digital finance ecosystem.

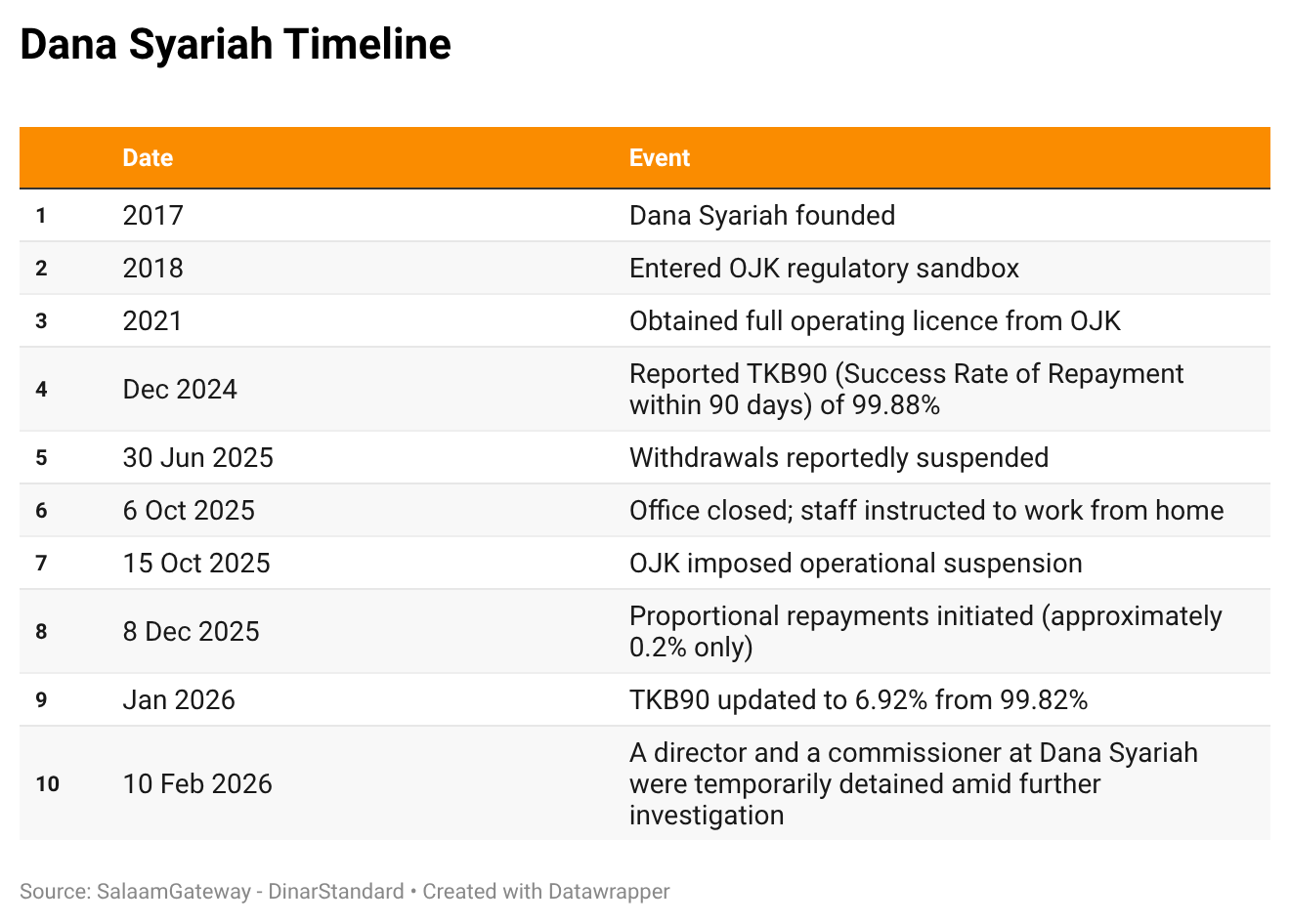

Founded in 2017, Dana Syariah Indonesia grew into a prominent, Sharia-compliant peer-to-peer (P2P) lending platform, connecting investors with nation-wide real estate projects. The company helped channel approximately $250 million from more than 41,500 investors, offering 15–20% in annual returns.

According to public disclosures, Dana Syariah focuses on projects with pre-secured buyers, offering monthly profit distributions and structured investments with a 125% collateral coverage. The company also promoted flexible withdrawal features, which it said helped enhance investor confidence.

The license issued and the oversight maintained by Otoritas Jasa Keuangan (OJK), Indonesia's financial services regulator, inspired hope and proved decisive, according to a Dana Syariah investor forum representative. Several investors ploughed significant funds because the platform was officially licensed and monitored.

The representative added that combined with perceived Shariah oversight, extensive advertising on major media outlets, well-known brand ambassadors, multiple awards, and a reported TKB90 (90-day repayment success rate) of 99.82%, Dana Syariah appeared credible and trustworthy.

Resilience during fintech downturn

Dana Syariah was widely viewed as a relative outlier during Indonesia’s broader peer-to-peer lending downturn that started in 2023. While several conventional and Islamic fintech investors faced rising defaults, liquidity stress, or collapse, Dana Syariah continued to survive through the Covid-19 period and the subsequent fintech funding slowdown.

Although the numbers plummeted, the company deployed $56 million in 2024, down from $107 million in 2023. As of January 2026, Dana Syariah reported a TKB0 of 100% (payment rate within zero days) and a TKB90 of 99.82% - parameters used by Indonesia’s financial services regulator.

Dana Syariah also received several national and international awards, supported by extensive marketing campaigns and public endorsements.

Emerging repayment delays

Concerns began to emerge in the second quarter of 2025, amid mounting repayment delays. The deferrals intensified in the following months, despite the platform continuing to report a TKB90 of 99.82%.

Investors raised alarms on their inability to withdraw funds from their accounts. In the following months, withdrawals were fully suspended.

Dana Syariah later closed its physical office and instructed employees to work remotely, alongside slower responses from customer service channels. To date, the company has not disclosed the projects that have defaulted.

Dana Syariah’s president director reportedly stated that the company had identified multiple factors contributing to the defaults, including broader economic conditions.

Following pressure from regulators, investors, and the media, Dana Syariah updated the TKB90 indicator listed on its website to 6.92% last month, indicating a sharp plunge from previously reported levels, with only a small portion of the portfolio being repaid within 90 days.

Governance and regulatory scrutiny

Investor groups subsequently escalated their concerns to the OJK; public demonstrations calling for regulatory clarification and stronger consumer protection were simultaneously held. Investors cited Dana Syariah’s repeated public claims regarding collateralisation, pre-secured buyers, and murabaha-based transaction structures.

“We understand investment risk,” said one investor representative. “But allegations of fictitious transactions or misuse of investor funds cannot be categorised as normal risk. This points to failures in governance, transparency, and supervision.”

Questions have also been raised about regulatory oversight. Dana Syariah has operated as a licensed and supervised entity under OJK's ambit since 2021. Investor groups argue, however, that regulatory intervention came only after withdrawals had been suspended for several months.

Besides doing offline and onsite monitoring as part of its supervisory framework, OJK oversees fintech platforms through a self-regulatory organisation (SRO) model, delegating certain monitoring and governance functions to the Indonesian Fintech Lending Association (AFPI). The approach aims to strike a balance between regulatory oversight and innovation in a rapidly evolving sector.

It was further revealed that one of Dana Syariah’s founders serves as the deputy head of AFPI’s Shariah fintech funding cluster, raising questions over the effectiveness and independence of the SRO oversignt.

The company announced last December that it had begun what it described as proportional repayments to investors. Based on investor information, these repayments amounted to approximately 0.2% of outstanding obligations.

To date, Dana Syariah has not publicly disclosed a project-by-project breakdown, distinguishing performing investments from non-performing ones. It, however, claims to achieve a full resolution within one year.

In an official letter circulated to investors, Dana Syariah stated it had identified approximately $26.69 million in recoverable capacity, derived from outstanding repayments, the sale of collateral, corporate assets, and other assets subject to legal processes.

The OJK has stated that it placed Dana Syariah under supervision and initiated a special inspection, issuing a total of 15 supervisory sanctions.

After further investigation, the criminal investigation agency of the Indonesian National Police stated in an official announcement that 99 of the 100 projects were allegedly fictitious. The alleged total losses suffered by investors could potentially reach approximately $142.36 million.

Implications for the broader finance/fintech landscape

The Dana Syariah case is likely to reverberate beyond a single platform, intensifying scrutiny of governance standards, disclosure practices, and self-regulatory arrangements across Indonesia’s Islamic fintech sector - one of the largest and fastest-growing globally.

According to the Global Islamic Fintech Report 2025/26, published by DinarStandard and Elipses, Indonesia ranks as the world’s fourth most robust Islamic fintech ecosystem, down one position from the report's previous edition. In terms of market size, Indonesia is the world’s fifth-largest fintech market, valued at $10 billion in 2024/25 and projected to reach $17 billion by 2029.

The case is not just about cooked books or fictitious prospects, but a stark reminder of how weak governance can erode public trust, denting the credibility of the wider ecosystem.

Ali AlGhofiqi is a research analyst at DinarStandard, a growth strategy and execution management firm

Ali AlGhofiqi