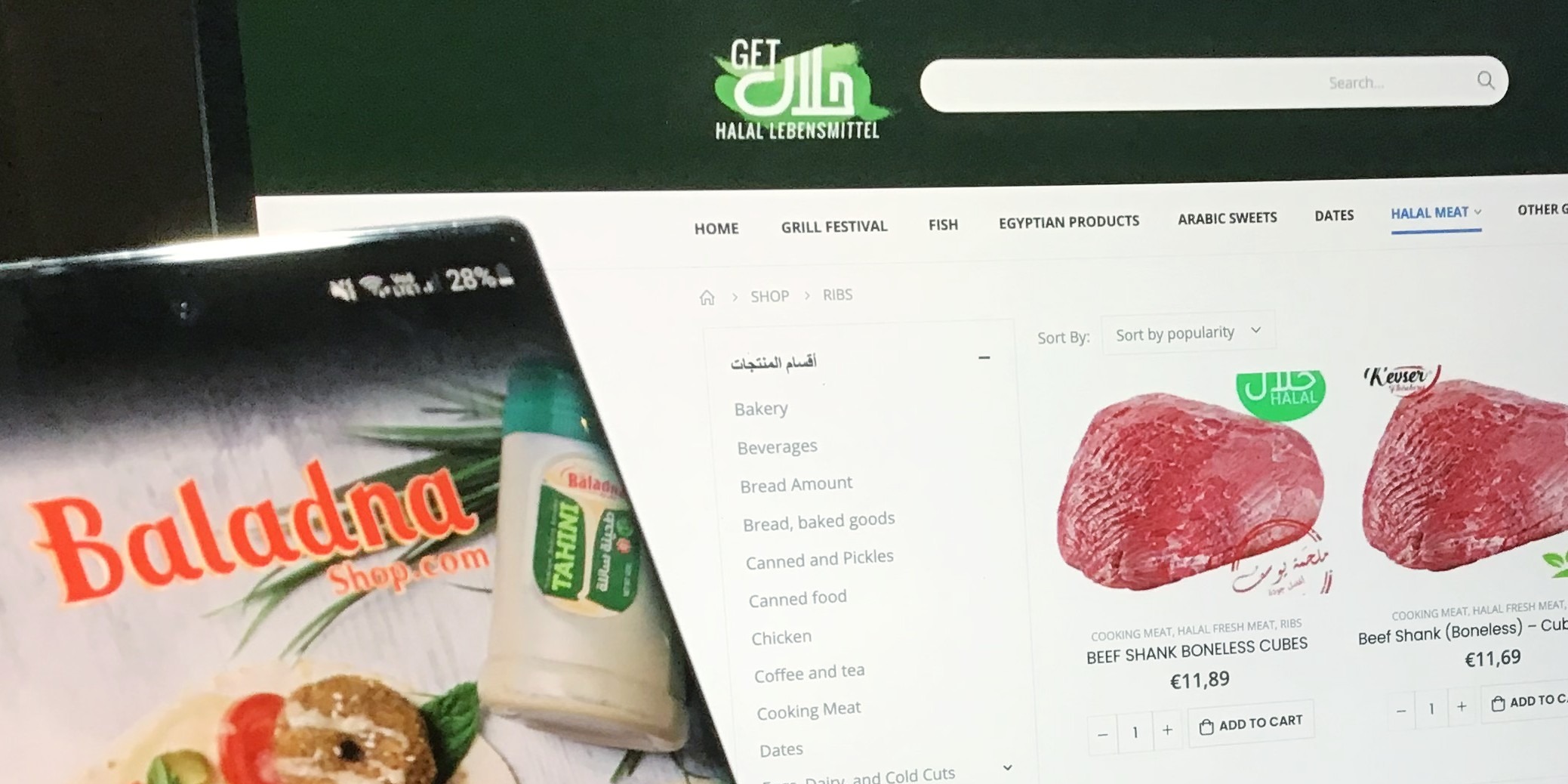

Food is a frontrunner in absolute e-commerce growth in Germany and halal suppliers joined the pack when Baladna and GetHalal launched their services late last year to positive response.

“Since the launch of our app in November 2020, we have been able to increase our orders by 600%,” Dilara Cakirhan, Head of E-commerce at Arabic halal food products manufacturer and distributor Baladna told Salaam Gateway. The company has operations in Germany, Turkey and the USA.

Baladna’s first venture into e-commerce happened earlier in 2020 when it listed some of its products on rewe.de. Now on its own app, it is selling over 400 products to businesses and end-consumers.

Unlike Baladna, Berlin-focused GetHalal doesn’t manufacture and distribute its own halal food products but works with local shops.

So far, business has been brisk. According to co-founder Ali Mahmoud, GetHalal has 70% repeat customers with an average of 1.5 orders a month.

The online supermarket delivers within Berlin. It sources groceries such as rice, fruits, and tinned food from suppliers, and delivers meat, fresh fish and fresh sweets from major halal shops, Mahmoud told Salaam Gateway.

“You will find around 80 different meat products,” he added.

The online supermarket believes it has carved itself a winning niche by offering 100% unstunned halal meat and promising second-day delivery.

The three meat shops that currently supply to GetHalal— Kevser Fleischerei, Yousf Fleischerei, and Al-Mustafa Fleischerei— import from France, Belgium, and Poland as Germany only allows the unstunned slaughtering of animals in very exceptional cases.

GetHalal’s preference for selling unstunned halal meat may have to change. As Salaam Gateway reported in October, Poland’s Senate passed amendments to a new animal protection bill that includes banning the export of unstunned meat at the end of 2025. In Belgium, the European Court of Justice in December last year backed a ban on non-stun ritual slaughter, including halal.

Mahmoud told Salaam Gateway GetHalal will discuss with the butcheries it works with to make sure they don’t meet with supply problems due to these decisions in Poland and Belgium.

BOOST FOR BUSINESS

The early success of Baladna’s app and GetHalal boils down to several factors.

Pandemic lockdowns accelerated food and groceries e-commerce in Germany. In the first quarter of 2021, e-commerce growth in the food category was 84.5% compared to the previous year and generated sales of 666 million euros including VAT compared to 361 million euros including VAT in Q1 2020, according to bevh, the 500 corporate members-strong German Federal Association of E-Commerce and Mail Order.

Compared to other Western European countries, Germany’s e-food sector development lags behind its potential. In its report “Food and Drink E-commerce in Germany”, the research firm Euromonitor cites the late entrance of leading grocery retailers as the reason, brought on by the country’s dense shop network. However, supermarkets selling food products for Germany’s Muslim population aren’t widespread.

“[T]he nearest oriental supermarket is not always nearby,” Baladna’s Cakirhan said. The pandemic boosted home cooking but halal-sensitive customers haven’t always been able to find all the right ingredients in the supermarket, she added.

Shopping online has made halal food and groceries a lot more accessible and Baladna found that e-commerce has increased its customer loyalty “massively”. “Customers keep ordering via the app,” said Cakirhan.

Baladna’s B2B customers appreciate the app for showing stock levels, availability of goods online and calculating free space on a pallet, according to Cakirhan. This function helps to manage the pallet’s weight, dimensions and transport costs.

Germany’s Muslim population has also increased over the last five years, by some 900,000 to reach between 5.3 and 5.6 million, according to a national study released in May. Muslims with a migration background from Turkey continue to form the largest group of origin with 2.5 million, but a growing number are from Arabic-speaking countries of the Middle East, with the largest group of around 730,000 counting Syria as their country of origin.

Catering to this growing population, GetHalal’s platform offers Arabic as one of its three languages, the other two being German and English.

Baladna also offers Turkish in addition to German, Arabic, and English.

LOGISTICS

The success of e-commerce rests heavily on fast and efficient delivery.

According to consulting firm Oliver Wyman, e-food in Germany has mainly reached households via retailers at fixed or selected delivery windows and via classic parcel deliveries.

“The race for the best delivery service is still open. Those who find the right balance between high service quality and reasonable effort will gain a decisive competitive advantage,” Partner and Head of the Retail and Consumer Goods practice group Rainer Münch said.

Germany has seen rapid e-commerce growth in Berlin-based delivery service start-up Gorillas that was founded in May 2020 and reached unicorn status just after a mere nine months.

Gorillas promises to deliver over 1,000 groceries products, including fresh meat and vegetables ordered via a smartphone app, within 10 minutes by bicycle courier.

This is a level of service GetHalal can’t compete with as a bootstrapped company due to cost and scalability issues. “The second-day delivery model was the best choice,” Mahmoud said about the nine people-strong organisation with a car fleet equipped with cooler boxes to serve its clientele.

Baladna faces different challenges. “Since our products don’t have to be refrigerated and have a very long shelf life, we have no problems with shipping,” Cakirhan said.

But the company gets special delivery requests and is challenged to comply with customer-requested delivery times as it can only deliver at certain times.

Both Baladna and GetHalal face an e-food landscape in Germany that Oliver Wyman forecast to increase at least fivefold by 2030. They have reason to be optimistic as the assessment was made in February 2020 before COVID-19 started to accelerate the pace of e-commerce customer adoption.

© SalaamGateway.com 2021 All Rights Reserved