How major airlines can beckon Muslim travelers for greater revenues

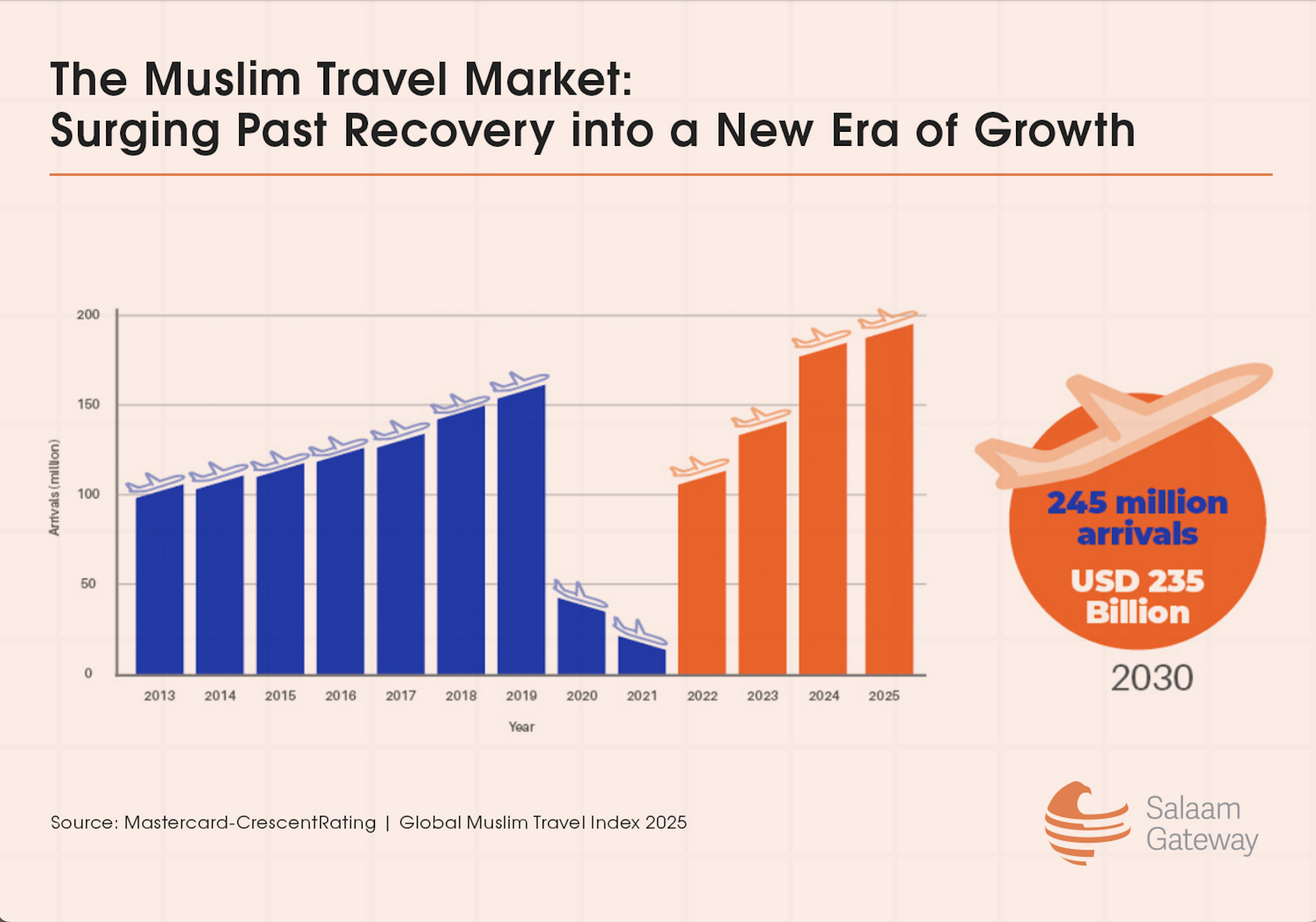

As global travelers seek experiences aligned with their values, Muslim-friendly tourism has become more mainstream in the post-pandemic travel landscape. According to the 2025 Mastercard–CrescentRating Global Muslim Travel Index (GMTI), the global Muslim travel market is one of the fastest-growing segments in the international tourism industry. The study forecasts Muslim arrivals at 176 million in 2024, representing a 25% year-over-year increase, and projects this number to reach 245 million by 2030.

Furthermore, DinarStandard’s State of the Global Islamic Economy 2024/25 Report estimates that Muslim-friendly travel spending reached $216.9 billion in 2023 and is projected to surge to $384.1 billion by 2028, representing a compound annual growth rate of 12.1%, outpacing nearly every other lifestyle segment.

For airlines, this market represents both scale and loyalty with a clear underlying message: serve it well, and the revenue will follow.

Building a faith-aware travel experience

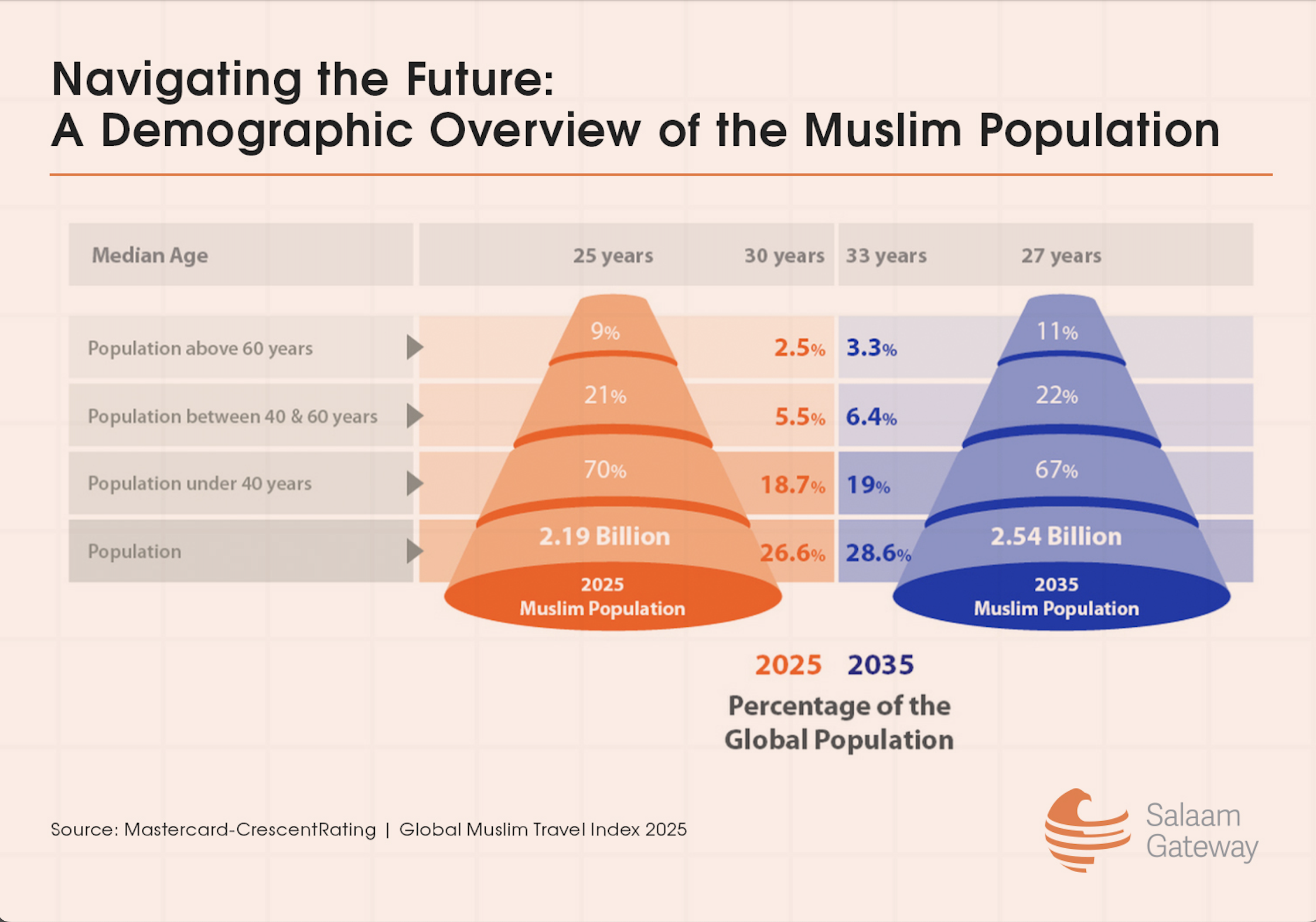

Muslim travelers are among the youngest and fastest-growing consumer bases in the world. The global Muslim population, currently around 2.19 billion, is projected to increase to 2.54 billion by 2035. Much of that growth comes from Gen Z and Millennials, digital natives entering their prime earning and travel years.

Within this segment, religious travel remains a major engine. Saudi Arabia welcomed 1.67 million Hajj pilgrims in 2025, a lower total than pre-pandemic peaks but still a vast logistical feat. The year-round Umrah pilgrimage has become another source of travelers with 6.5 million international Umrah visitors recorded in Q1 2025 and another 1.2 million arrivals since June, according to AP News.

Within such a reliable, annual segment, the question for airlines then becomes, what are the areas through which they can attract the largest number of travelers.

Food is often the first trust signal that comes up. Gulf carriers, such as Emirates and Qatar Airways, have long set the gold standard by offering halal-certified meals on every flight, verified by recognized bodies like the Halal Food Council. However, outside the GCC, many airlines still lag.

Certifying caterers through globally recognized authorities, such as JAKIM or IFANCA, and clearly labeling halal options can make a significant difference. Pre-order systems for dietary preferences, transparent sourcing, and consistent cabin messaging reinforce confidence while streamlining operations.

Faith-aware design can also transform the passenger experience. Simple features such as Qibla direction indicators, prayer-time notifications, and content filters in in-flight entertainment signal respect and understanding.

Muslim travelers already rely on third-party tools such as the HalalTrip app for in-flight prayer guidance; embedding these utilities directly into an airline’s digital experience elevates it from convenience to care. On the ground, dedicated prayer rooms, like those at Dubai (DXB), Doha (DOH), and Jeddah (JED), complete the circle of trust from check-in to arrival.

For airlines, Ramadan and Umrah are not just cultural moments; they’re commercial seasons. Treating them as such allows carriers to unlock new revenue layers. Ramadan flight calendars that include suhoor and iftar meal options, timed date-and-water service at sunset, or pre-order suhoor boxes on overnight routes are small gestures with significant brand impact.

Similarly, Umrah travel bundles, which cover visa assistance, ground transfers, flexible return fares, and guidance on Zamzam water handling, simplify planning and build customer trust. Stopover programs in halal-ready hubs like Dubai, Doha, and Istanbul can be enhanced with prayer-friendly hotels, halal dining guides, and family-friendly packages.

Speaking to women and families

The two biggest key growth drivers in the Muslim traveler segment are famiy groups and female travelers. Airlines that cater to these demographics through tangible actions, such as guaranteed adjacent seating for families, mother-and-child amenities, modest swimwear-friendly stopover options, and privacy-oriented lounges, stand to earn lasting loyalty.

Earning loyalty through trust and value

Muslim-majority markets tend to be price-sensitive but highly brand-loyal once trust is established. This dynamic favors strategic pricing such as Ramadan sales, Umrah off-peak fares, and faith-aligned co-branded credit cards offering halal-friendly rewards, including charity redemptions, Umrah travel, or family lounge access. Airlines that tie such offers to Eid promotions or loyalty-status accelerators will not only drive bookings but also build year-round engagement.

Following the pilgrims and the diaspora

Network planning can amplify these gains. The South and Southeast Asia to Saudi Arabia corridor remains the primary pilgrim route, and airlines that coordinate capacity around Hajj and Umrah can capture spillover from both faith and leisure travel. Codeshare partnerships with carriers in Indonesia, Pakistan, India, Bangladesh, and Malaysia can turn one-stop connections into competitive differentiators.

Diaspora routes also hold promise, such as the UK–Maghreb, France–North Africa, US–MENA, and Gulf–Africa connections. Through-checked baggage for Zamzam water, shorter connection times, and prayer-friendly terminals make a measurable difference in traveler choice.

The Bottom line

The opportunity is vast and visible. A quarter-trillion-dollar market by 2030 and projected spending of $384 billion by 2028 won’t wait for carriers that treat Muslim travelers as an afterthought. The airlines that lead will integrate halal-certified catering as standard, embed faith-aware digital features, recognize Ramadan and Umrah as distinct commercial seasons, and communicate authentically with families and female travelers.

Muhammad Ali Bandial