Saudi Arabia emerges as prime Islamic fintech hub

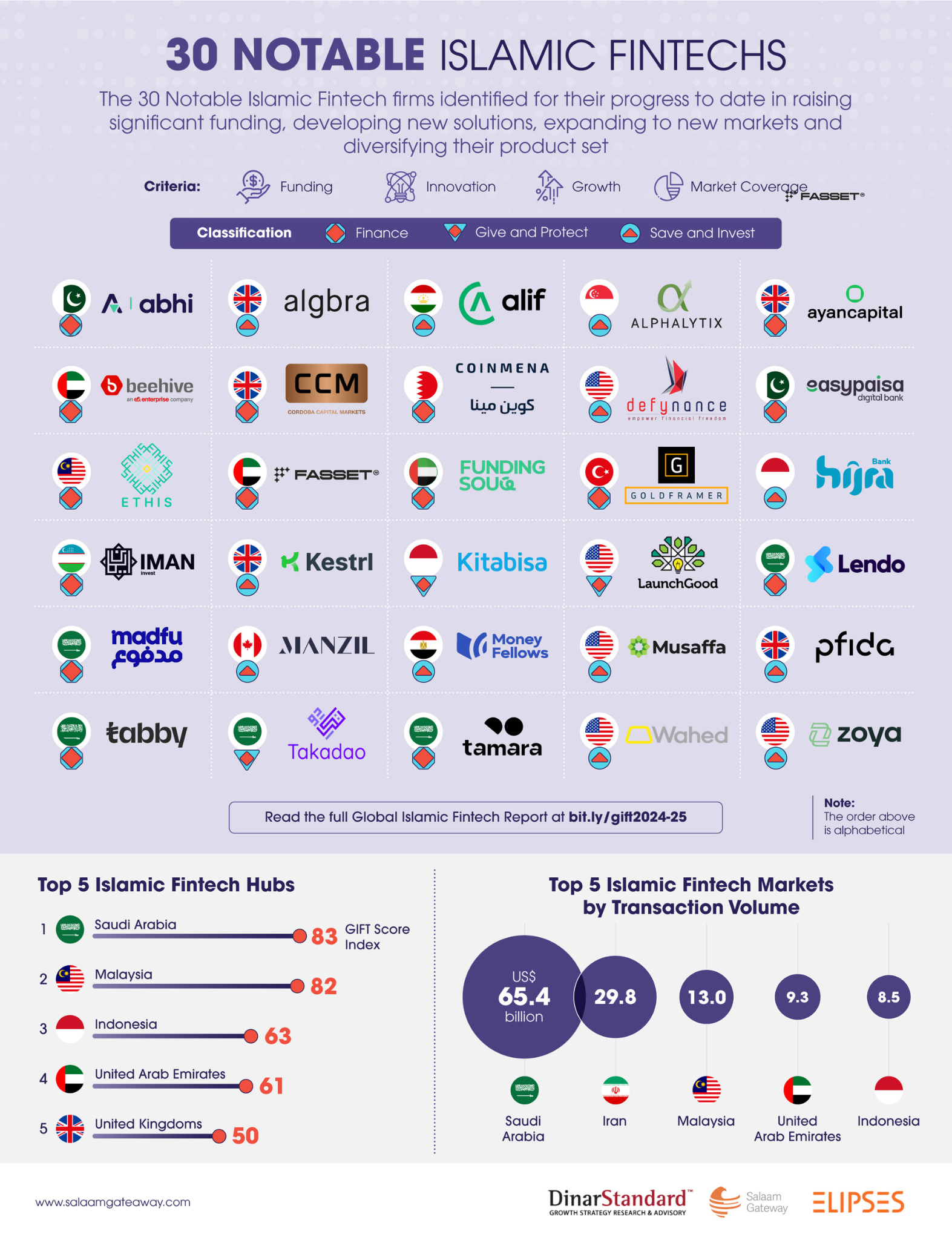

The recently released Global Islamic Fintech Report (GIFT) 2024/25, has identified 30 notable fintech startups for their pioneering efforts across the $161 billion Islamic fintech industry.

The trailblazers were recognized for achieving growth contingent on factors such as raising significant funding, developing new solutions, expanding into new markets, and diversifying their products, the GIFT report, produced by DinarStandard and Elipses, revealed.

Notable growth in non-OIC countries

Islamic fintech has gained ground worldwide, on the back of growing Shariah awareness, regulatory reforms and technological innovations.

A total of 12 startups of the notable 30 are headquartered in non-OIC (Organisation of Islamic Cooperation) countries, with five based in the UK and US each.

These countries benefit from a strong Muslim diaspora talent pool, robust digital infrastructure, high digital financial literacy, and a strong entrepreneurial culture.

The wealth management vertical in developed markets has witnessed astounding growth, particularly in North America, where investment literacy rates are high. Startups such as Wahed, Musaffa, Zoya, and Manzil are among those leveraging this opportunity.

“The 30 notable Islamic fintechs represent the pioneers in this industry paving the way for others to follow, from fundraising and new products to expanding to new markets and product diversification," said Abdul Haseeb Basit, co-founder and principal at Elipses and co-author of the report.

"Most strikingly, as Islamic fintech continues as a global phenomenon, the notable 30 are from varied markets and in varied sectors.”

Saudi Arabia leads with strong presence

Saudi Arabia has emerged as the leading Islamic fintech hub, surpassing Malaysia for the first time, in the Islamic fintech index.

The Kingdom hosts five of the nine notable fintechs from the GCC. The ecosystem is growing rapidly, driven by a massive market size and substantial funding sources, particularly from Saudi VCs and sovereign wealth funds.

Financing, especially the buy-now-pay-later (BNPL) business model, has been identified as a growing sector in Saudi Arabia and the UAE, driven by demographic shifts and increasing e-commerce adoption.

Notable players include Tamara, a Shariah-compliant BNPL provider, that raised $340 million in Series C funding, led by Sanabil Investments and SNB Capital.

However, the funding and valuation drive of Saudi fintech startups may face challenges in the long term. Typically, the early growth phase is followed by normalization, as seen across fintech industries in other regions, transitioning toward ‘"sustainable growth’ with a focus on ‘real value.’ Saudi Arabia should ensure that its growth is driven by sustainable value creation to unlock its true potential.

Southeast Asia: Market correction

Southeast Asia has become one of the major Islamic fintech hubs, with Malaysia, Indonesia, and Singapore leading the way. Growing Islamic finance literacy and regulatory support are key factors driving this growth. Notable players from the region include Ethis, Hijra, Kitabisa, and Alphalytix.

While the sector experienced significant growth during the Covid-19 pandemic, it is now experiencing a ‘normalization’ stage. Many fintech startups (both conventional and Islamic) in the region are facing challenges, including higher non-performing financing, employee layoffs, and even business closures due to their inability to demonstrate real value. However, this correction will lead to the emergence of stronger fintech companies that survive and provide concrete value for customers.

Najmul Haque Kawsar, senior consultant at DinarStandard and co-author of the report commented, “This year’s list of notable Islamic fintechs highlights real progress in areas like product innovation and market expansion across diverse geographies. At DinarStandard, we see these firms as proof that Islamic fintech can deliver more inclusive, responsible finance on a global scale, while capital constraints and financial sustainability remain critical hurdles."

"By spotlighting the notable Islamic fintechs’ achievements, we aim to encourage broader collaboration, investment, and policy support to drive the next phase of industry growth.”

To view the entire 30 notable fintech list, click here

To download our Global Islamic Fintech Report 2024/25, click here