Global Islamic finance industry assets to reach $3.69 trln by 2024 from $2.88 trln in 2019 - study

What were the biggest developments in the global Islamic finance industry in 2019-2020? The State of the Global Islamic Economy 2020/21 report from DinarStandard gives a detailed breakdown of the movements in the industry, with the headline being the impact of the COVID-19 pandemic on the growth of the industry.

MARKET SIZE

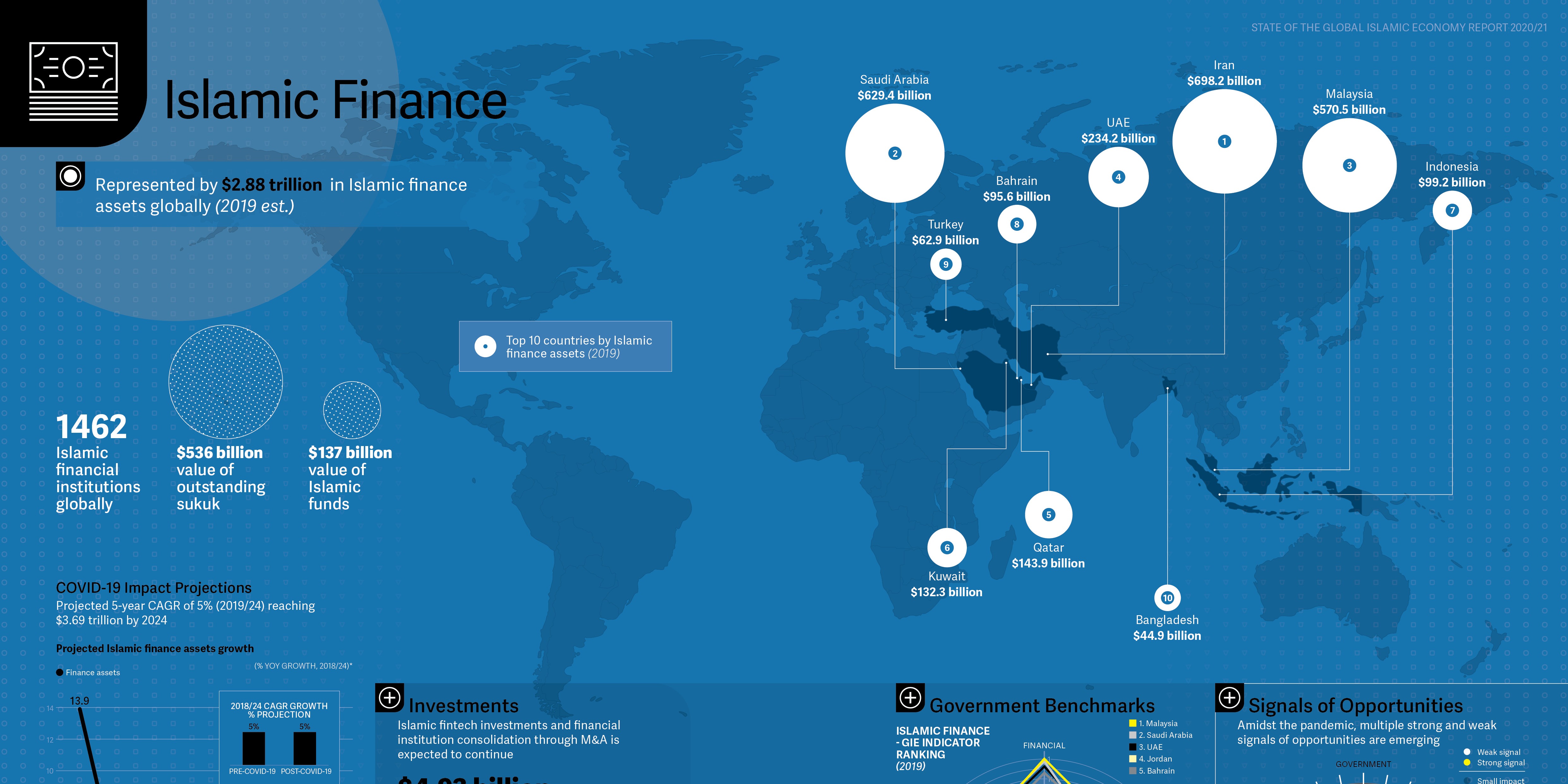

- Global Islamic finance industry assets increased by 13.9% in 2019 to reach $2.88 trillion from $2.52 trillion in 2018.

- 3 biggest countries in 2019: Iran ($698.2 billion), Saudi Arabia ($629.4 billion), Malaysia ($570.5 billion)

- No asset growth is expected for 2020.

- The industry is expected to reach $3.69 trillion by 2024.

| DOWNLOAD THE STATE OF THE GLOBAL ISLAMIC ECONOMY 2020/21 REPORT |

COVID-19 IMPACT

The impacts of the COVID-19 pandemic on the global Islamic finance industry include:

- Growth of the Islamic finance sector in 2020 halted

- The pandemic stimulated the development of more inclusive and socially-driven finance, whether through crowdfunding, public-private partnerships, or support for SMEs, according to the report.

- Throughout 2020, Islamic financial and multilateral institutions stepped up to provide financial support in the wake of COVID-19.

- Weaker economies this year also saw the consolidation of the banking and takaful sectors, especially in the Gulf Cooperation Council (GCC). As this was a key development among banks and insurers, fintech continued to grow and evolve, with new players such as challenger banks and blockchain-based sukuk platforms.

- The digitalization of the industry continued apace as well, with new business models and customer experience improvements driving this development.

NATIONAL, ECOSYSTEM DEVELOPMENTS

Several important national and ecosystem strategies and initiatives emerged across 2019 and 2020, including:

-

The UAE launched a new initiative to create a unified global legal and legislative framework for the Islamic finance sector to expand its reach in response to calls for greater standardization.

-

Kuwait's parliament announced the formation of a Shariah board for the banking sector.

-

Malaysia’s central bank issued a guidance document for the Value-based Intermediation Financing and Investment Assessment Framework (VBIAF) to facilitate the implementation of a risk management system for assessing the financing and investment activities of Islamic financial institutions.

-

The Saudi Arabian Monetary Authority (SAMA) announced the issuance of rules governing microfinance companies, including Shariah-compliant ones, to regulate licensing provisions and further organize their activities.

SIGNALS OF OPPORTUNITY

It may have been a challenging year but there were signals of opportunities regardless, including:

- Fintech implementation continued to grow, with more investment avenues available for investors.

- Robo-advisory sector developing at pace.

- Collaboration between key players is on the rise.

- Social impact initiatives gained even more importance during the pandemic.

- The establishment of new Islamic finance regulations and guidelines has helped the industry stay attractive.

|

WHAT IS THE GROWTH AND MARKET SIZE FOR EACH SECTOR? |

© SalaamGateway.com 2020 All Rights Reserved