What were the biggest developments in the global halal cosmetics industry in 2019-2020? The State of the Global Islamic Economy 2020/21 report from DinarStandard gives a detailed breakdown of the movements in the industry.

MARKET SIZE

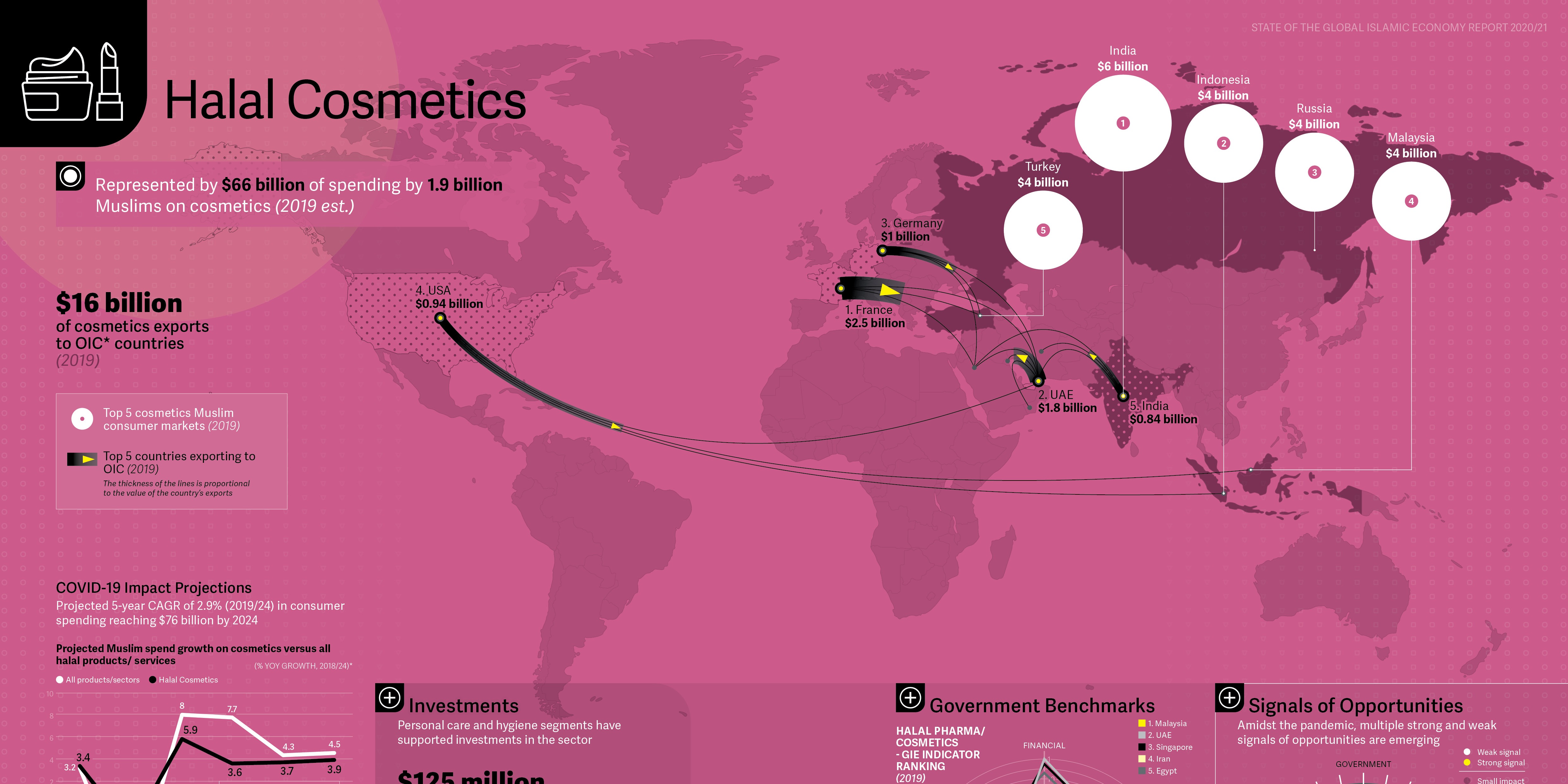

- Muslims spent $66 billion on cosmetics (note: cosmetics in general, and not halal cosmetics only) in 2019, up 3.4% from 2018.

- India, Indonesia, Russia and Malaysia are the top countries by expenditure.

- Muslim expenditure on cosmetics is set to drop by 2.5% in 2020 to $64 billion due to the COVID-19 crisis.

- Muslim expenditure on cosmetics is forecasted to reach $76 billion by 2024.

|

COVID-19 IMPACT

The global cosmetics industry experienced its best sales year in the lead up to the COVID-19 pandemic. New independent brands were hitting the shelves, and there was a growing trend for natural, organic, cruelty-free and halal-certified cosmetics. When the pandemic reached its height, sales dropped, particularly at retail outlets, while consumer behavior changed due to social distancing and the wearing of face masks.

However, as consumers adapted to the ‘new normal,’ sales started to recover, with e-commerce a major driver of sales. Brands without a strong online presence scrambled to improve their e-commerce and digital marketing to better connect with consumers.

Halal cosmetics brands have similarly adapted, in part by tapping into consumer demand to support independent brands and by marketing in local languages, especially in Southeast Asia. Brands also responded to the pandemic by launching product ranges that reflected new consumer trends. Special Ramadan ranges were also released during the holy month—typically a strong sales period— amid the pandemic.

SIGNALS OF OPPORTUNITY

Indonesia’s mandatory halal law, the push towards inclusivity and ethical products as well as local sourcing of raw ingredients have given rise to new opportunities in the cosmetics industry.

Some of the signals of opportunity in the industry are:

- Established and emerging halal cosmetics brands are emphasizing local ownership and production.

-

Halal cosmetics brands are adopting and emphasizing inclusivity in response to the beauty needs of women of different ethnicities.

-

Independent cosmetics brands are emerging that are not only halal-certified but also cruelty-free, vegan, and organic.

-

There is a growing synergy between halal cosmetics and modest fashion brands.

|

WHAT IS THE GROWTH AND MARKET SIZE OF EACH SECTOR? |

© SalaamGateway.com 2020 All Rights Reserved