Muslim expenditure in global Islamic economy to fall 8% in 2020 due to COVID-19 - study

The COVID-19 pandemic will result in an estimated 8% decrease in Muslim expenditure between 2019 and 2020 in the Islamic economy sectors ex-finance, according to the State of the Global Islamic Economy 2020/21 report from DinarStandard.

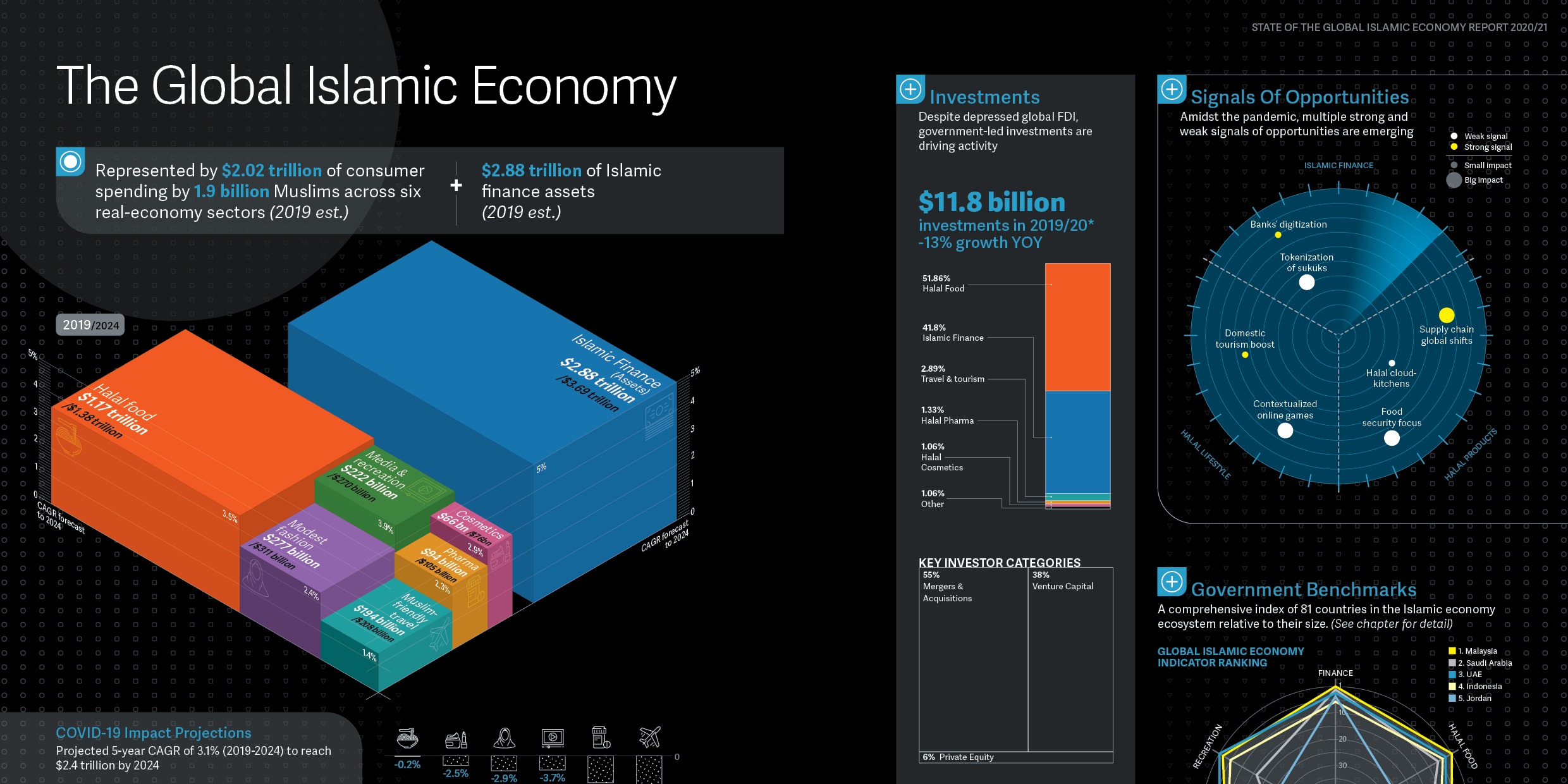

The report estimates Muslims spent $2.02 trillion in 2019 across the food, pharmaceutical, cosmetics, fashion, travel and media/recreation sectors, up 3.2% from 2018.

For 2020, the annual study estimates the steepest drop in expenditure will be in the travel sector where Muslim spend will fall from $194 billion in 2019 to $58 billion in 2020.

Muslim expenditure in other sectors -- food, apparel, cosmetics, pharmaceuticals, media and recreation -- is expected to drop slightly. All of these sectors, except travel, are expected to return to pre-pandemic spend levels by the end of 2021.

Muslim spend ex-Islamic finance is forecasted to reach $2.4 trillion by 2024 at a five-year Cumulative Annual Growth Rate (CAGR) of 3.1%.

For Islamic finance, the report estimates global assets reached $2.88 trillion in 2019, up from $2.52 trillion in 2018. DinarStandard does not expect growth in Islamic finance assets in 2020 due to the economic downturn caused by the pandemic but the firm forecasts a rebound from next year, with the industry reaching $3.69 trillion in assets by 2024.

|

KEY DEVELOPMENTS, INVESTMENTS

Despite the challenges brought on by the COVID-19 pandemic, the past year saw "notable developments" in the Islamic economy, said DinarStandard, which is Salaam Gateway's parent company.

These developments were led by an acceleration in digital transformation, disruption in global supply chains, and increased government focus on food security-related investments.

Investments, however, fell drastically. "Investments in Islamic economy-relevant sectors across Organization of Islamic Cooperation (OIC) and select non-OIC markets fell by 13% to $11.8 billion in 2019/20 from $13.6 billion in 2018/19," said the report.

"Indonesia, Malaysia, and the UAE saw the highest number of investments, with Indonesia bagging 25% of all deals recorded. In terms of sectors, halal food and Islamic finance comprised 52% and 42% of the total deal value, respectively."

SIGNALS OF OPPORTUNITY

The report outlines key areas of opportunity for the global Islamic economy even as the pandemic persists. They include:

-

At the end of 2019, global dry powder stood at a record $2.3 trillion, giving private equity investors a substantial runway for investment opportunities.

-

Indonesia remains a lucrative market for investors.

-

More investments in local manufacturing are taking place.

-

Technology-based pivots are a significant portion of new investments.

-

In the pharmaceuticals sector, preventive care was in the spotlight amid greater concern for health and wellbeing.

-

In media and recreation, there are now more Islamic-themed shows available, while online media consumption is at a record high.

|

WHAT IS THE GROWTH AND MARKET SIZE FOR EACH SECTOR? |

© SalaamGateway.com 2020 All Rights Reserved